Smart Money Concepts focus on understanding institutional trading behaviors by analyzing order flow, liquidity zones, and market manipulation tactics to anticipate price movements. The Wyckoff Method emphasizes studying supply and demand dynamics through price action, volume analysis, and market phases to identify accumulation or distribution patterns. Discover how these approaches can enhance your trading strategy by exploring their unique principles and applications.

Why it is important

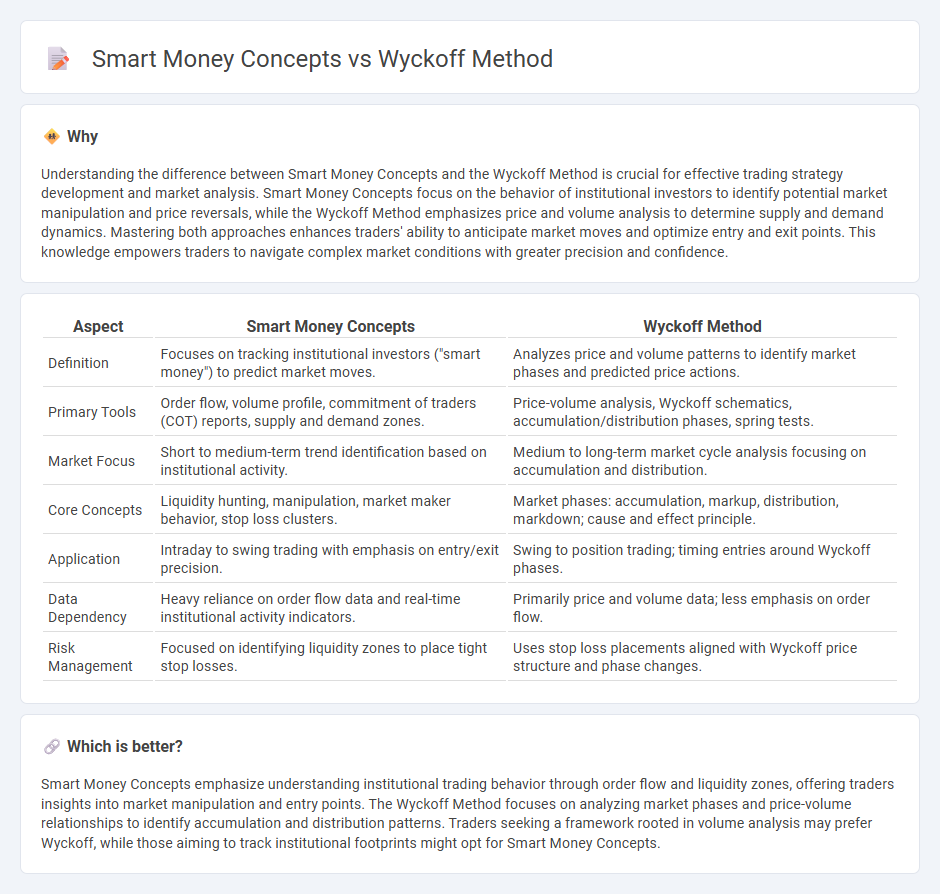

Understanding the difference between Smart Money Concepts and the Wyckoff Method is crucial for effective trading strategy development and market analysis. Smart Money Concepts focus on the behavior of institutional investors to identify potential market manipulation and price reversals, while the Wyckoff Method emphasizes price and volume analysis to determine supply and demand dynamics. Mastering both approaches enhances traders' ability to anticipate market moves and optimize entry and exit points. This knowledge empowers traders to navigate complex market conditions with greater precision and confidence.

Comparison Table

| Aspect | Smart Money Concepts | Wyckoff Method |

|---|---|---|

| Definition | Focuses on tracking institutional investors ("smart money") to predict market moves. | Analyzes price and volume patterns to identify market phases and predicted price actions. |

| Primary Tools | Order flow, volume profile, commitment of traders (COT) reports, supply and demand zones. | Price-volume analysis, Wyckoff schematics, accumulation/distribution phases, spring tests. |

| Market Focus | Short to medium-term trend identification based on institutional activity. | Medium to long-term market cycle analysis focusing on accumulation and distribution. |

| Core Concepts | Liquidity hunting, manipulation, market maker behavior, stop loss clusters. | Market phases: accumulation, markup, distribution, markdown; cause and effect principle. |

| Application | Intraday to swing trading with emphasis on entry/exit precision. | Swing to position trading; timing entries around Wyckoff phases. |

| Data Dependency | Heavy reliance on order flow data and real-time institutional activity indicators. | Primarily price and volume data; less emphasis on order flow. |

| Risk Management | Focused on identifying liquidity zones to place tight stop losses. | Uses stop loss placements aligned with Wyckoff price structure and phase changes. |

Which is better?

Smart Money Concepts emphasize understanding institutional trading behavior through order flow and liquidity zones, offering traders insights into market manipulation and entry points. The Wyckoff Method focuses on analyzing market phases and price-volume relationships to identify accumulation and distribution patterns. Traders seeking a framework rooted in volume analysis may prefer Wyckoff, while those aiming to track institutional footprints might opt for Smart Money Concepts.

Connection

The Wyckoff Method provides a structured approach to understanding market cycles and price action through accumulation, distribution, and markup phases, which align with smart money concepts focusing on institutional traders' behavior and large-volume activities. Smart money concepts emphasize identifying footprints of professional traders, such as absorption and manipulation, which the Wyckoff Method explains via its schematics and volume analysis. Combining both frameworks allows traders to anticipate market moves by reading supply and demand dynamics driven by smart money participation.

Key Terms

**Wyckoff Method:**

The Wyckoff Method specializes in analyzing market cycles through price, volume, and time to identify accumulation and distribution phases, providing traders with a structured approach to predict market trends. It emphasizes the study of supply and demand dynamics, smart money actions, and key price levels such as support and resistance to anticipate price movements. Explore the Wyckoff Method further to master market timing and improve trading decisions.

Accumulation

The Wyckoff Method emphasizes accumulation phases through price and volume analysis to identify institutional buying, using schematics like the spring and trading ranges to signal entry points. Smart Money Concepts focus on understanding order flow and liquidity pools, highlighting how large players manipulate key levels to accumulate positions stealthily. Explore these strategies deeper to enhance your market timing and trading precision in accumulation zones.

Distribution

The Wyckoff Method identifies Distribution as a phase where smart money offloads assets after accumulation, leading to price declines marked by increased volatility and volume spikes. Smart Money Concepts emphasize identifying institutional selling through order flow analysis, liquidity grabs, and market structure shifts during Distribution phases. Explore these strategies to deepen your understanding of how top traders anticipate market reversals.

Source and External Links

Wyckoff Theory For Beginners (The Definitive Guide) - The Wyckoff Method, created by Richard D. Wyckoff in the early 1900s, is a trading strategy based on analyzing price changes, volume, and market trends through three laws: supply and demand, cause and effect, and effort versus result, helping traders predict market movements and decide when to buy or sell.

The Wyckoff Method: What It Is and How You Can Trade It - This classic technical analysis approach explains market behavior through price and volume patterns, revealing how institutional traders create liquidity and use stop losses and breakouts to move prices strategically, applicable across stocks, forex, commodities, and crypto.

The Simplified Guide To Trading With The Wyckoff Method - Wyckoff's framework describes market cycles in four stages, notably accumulation (where smart money builds positions after a downtrend), markup, distribution, and markdown phases, each revealing supply and demand dynamics and market psychology to guide traders on trend development.

dowidth.com

dowidth.com