Risk reversal and seagull spread are advanced options trading strategies aimed at managing market exposure and volatility. Risk reversal involves buying a call option and selling a put option to capitalize on directional market moves, while seagull spread combines buying and selling calls and puts to define a broader risk-reward profile with limited downside. Explore detailed comparisons and use cases to enhance your strategic trading decisions.

Why it is important

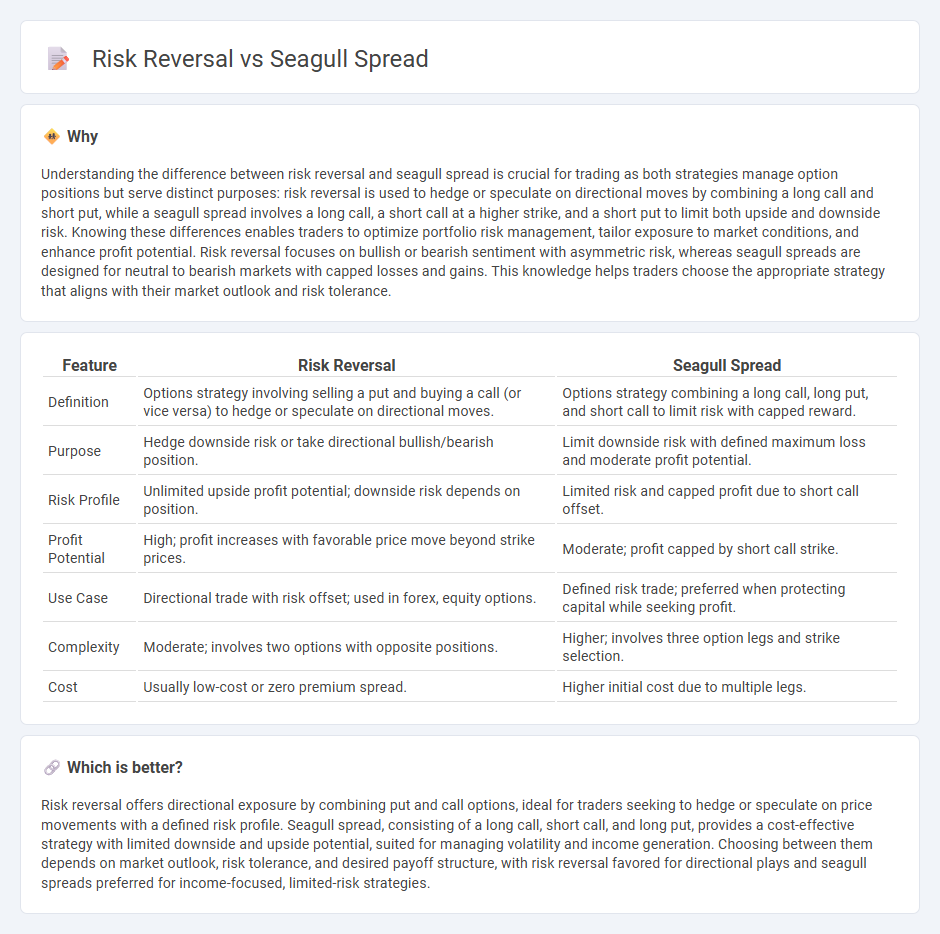

Understanding the difference between risk reversal and seagull spread is crucial for trading as both strategies manage option positions but serve distinct purposes: risk reversal is used to hedge or speculate on directional moves by combining a long call and short put, while a seagull spread involves a long call, a short call at a higher strike, and a short put to limit both upside and downside risk. Knowing these differences enables traders to optimize portfolio risk management, tailor exposure to market conditions, and enhance profit potential. Risk reversal focuses on bullish or bearish sentiment with asymmetric risk, whereas seagull spreads are designed for neutral to bearish markets with capped losses and gains. This knowledge helps traders choose the appropriate strategy that aligns with their market outlook and risk tolerance.

Comparison Table

| Feature | Risk Reversal | Seagull Spread |

|---|---|---|

| Definition | Options strategy involving selling a put and buying a call (or vice versa) to hedge or speculate on directional moves. | Options strategy combining a long call, long put, and short call to limit risk with capped reward. |

| Purpose | Hedge downside risk or take directional bullish/bearish position. | Limit downside risk with defined maximum loss and moderate profit potential. |

| Risk Profile | Unlimited upside profit potential; downside risk depends on position. | Limited risk and capped profit due to short call offset. |

| Profit Potential | High; profit increases with favorable price move beyond strike prices. | Moderate; profit capped by short call strike. |

| Use Case | Directional trade with risk offset; used in forex, equity options. | Defined risk trade; preferred when protecting capital while seeking profit. |

| Complexity | Moderate; involves two options with opposite positions. | Higher; involves three option legs and strike selection. |

| Cost | Usually low-cost or zero premium spread. | Higher initial cost due to multiple legs. |

Which is better?

Risk reversal offers directional exposure by combining put and call options, ideal for traders seeking to hedge or speculate on price movements with a defined risk profile. Seagull spread, consisting of a long call, short call, and long put, provides a cost-effective strategy with limited downside and upside potential, suited for managing volatility and income generation. Choosing between them depends on market outlook, risk tolerance, and desired payoff structure, with risk reversal favored for directional plays and seagull spreads preferred for income-focused, limited-risk strategies.

Connection

Risk reversal and seagull spread are related options strategies used to hedge or speculate on directional moves in the underlying asset. Risk reversal involves buying a call and selling a put, creating a synthetic long position, while the seagull spread adds an extra sold call to limit upside risk and reduce potential cost. Both strategies utilize combinations of calls and puts to manage exposure and tailor risk-reward profiles in volatile markets.

Key Terms

Options Strategy

Seagull spreads and risk reversals are advanced options strategies used to hedge or speculate on price movements with defined risk profiles. The seagull spread combines a bull call spread and a long put, limiting both potential profit and loss, while a risk reversal involves buying a call and selling a put to gain directional exposure with limited upfront cost. Explore detailed scenarios and payoff structures to master these dynamic options strategies.

Strike Price

Seagull spread options combine a long call, a short call at a higher strike, and a long put, creating a payoff structure centered around multiple strike prices to limit risk and profit zones. Risk reversal involves buying a call and selling a put, focusing on two strike prices that reflect market sentiment for bullish or bearish moves, impacting the position's directional bias. Explore detailed strike price strategies to optimize these option strategies effectively.

Hedging

Seagull spread and risk reversal are strategic options trading techniques used for hedging against market volatility and price fluctuations. Seagull spread combines long and short call and put options to create a defined risk profile, effective for protecting against moderate adverse price movements, while risk reversal involves simultaneously buying a call and selling a put (or vice versa) to hedge directional risk with potential cost advantages. Explore detailed comparisons and practical applications to optimize your hedging strategy.

Source and External Links

Understanding the Seagull Option Strategy in Trading - StockGro - The seagull spread is an options strategy with two main types: bullish seagull (buy lower strike call, sell higher strike call, and sell put) and bearish seagull spreads, used when moderate movement is expected but direction is uncertain.

What is a Seagull Option Spread? - SteadyOptions Trading Blog - The seagull spread adds a third short option to a vertical debit spread to reduce the net debit and risk while maintaining upside potential, popular in Forex and sometimes in stocks/indices for directional plays.

Seagull spread. can someone explain this? - AnalystForum - A seagull spread can be structured by writing an ATM call and buying an OTM call and put, offering downside protection and unlimited upside participation beyond the higher strike call, differing from vertical spreads by combining short and long option legs creatively.

dowidth.com

dowidth.com