Modular blockchains trading enhances scalability and security by separating execution, consensus, and data availability layers, enabling more efficient asset exchange. Cross-chain bridges facilitate token transfers across different blockchains but often face challenges such as security vulnerabilities and slower transaction speeds. Explore the advantages and limitations of both approaches to optimize your trading strategies.

Why it is important

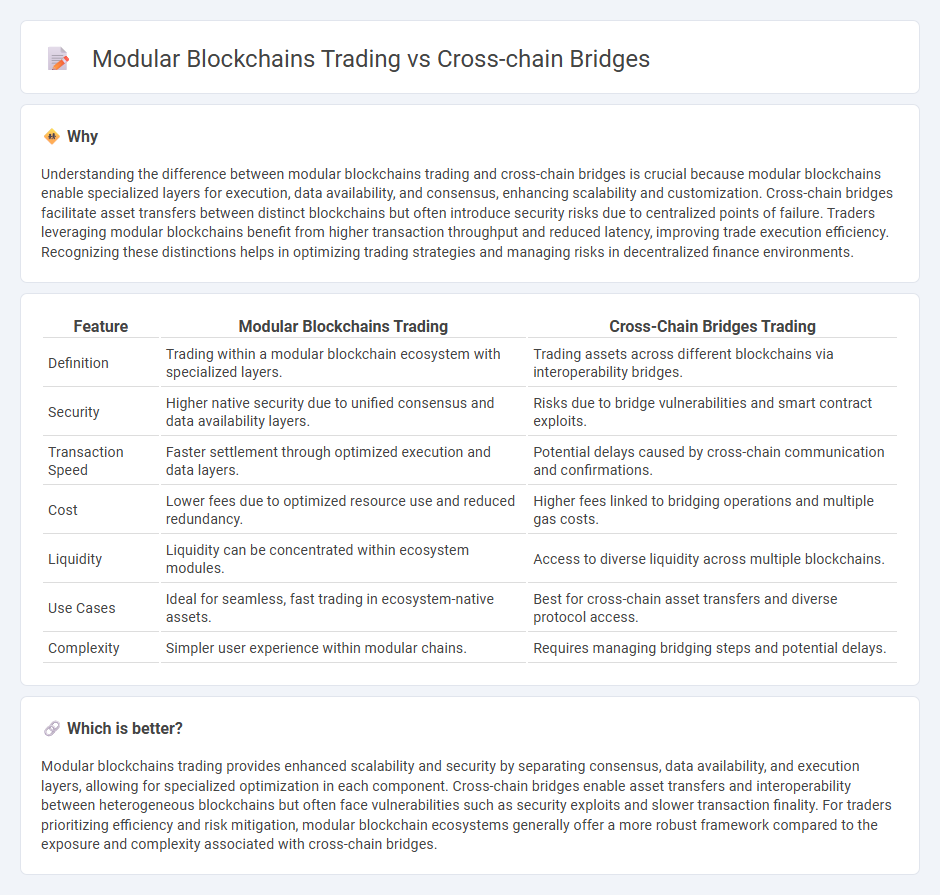

Understanding the difference between modular blockchains trading and cross-chain bridges is crucial because modular blockchains enable specialized layers for execution, data availability, and consensus, enhancing scalability and customization. Cross-chain bridges facilitate asset transfers between distinct blockchains but often introduce security risks due to centralized points of failure. Traders leveraging modular blockchains benefit from higher transaction throughput and reduced latency, improving trade execution efficiency. Recognizing these distinctions helps in optimizing trading strategies and managing risks in decentralized finance environments.

Comparison Table

| Feature | Modular Blockchains Trading | Cross-Chain Bridges Trading |

|---|---|---|

| Definition | Trading within a modular blockchain ecosystem with specialized layers. | Trading assets across different blockchains via interoperability bridges. |

| Security | Higher native security due to unified consensus and data availability layers. | Risks due to bridge vulnerabilities and smart contract exploits. |

| Transaction Speed | Faster settlement through optimized execution and data layers. | Potential delays caused by cross-chain communication and confirmations. |

| Cost | Lower fees due to optimized resource use and reduced redundancy. | Higher fees linked to bridging operations and multiple gas costs. |

| Liquidity | Liquidity can be concentrated within ecosystem modules. | Access to diverse liquidity across multiple blockchains. |

| Use Cases | Ideal for seamless, fast trading in ecosystem-native assets. | Best for cross-chain asset transfers and diverse protocol access. |

| Complexity | Simpler user experience within modular chains. | Requires managing bridging steps and potential delays. |

Which is better?

Modular blockchains trading provides enhanced scalability and security by separating consensus, data availability, and execution layers, allowing for specialized optimization in each component. Cross-chain bridges enable asset transfers and interoperability between heterogeneous blockchains but often face vulnerabilities such as security exploits and slower transaction finality. For traders prioritizing efficiency and risk mitigation, modular blockchain ecosystems generally offer a more robust framework compared to the exposure and complexity associated with cross-chain bridges.

Connection

Modular blockchains enhance trading efficiency by separating consensus, execution, and settlement layers, allowing faster transaction processing and increased scalability. Cross-chain bridges facilitate seamless asset transfers between modular blockchains, enabling traders to access diverse liquidity pools and leverage cross-network arbitrage opportunities. This synergy promotes a more interconnected and liquid trading ecosystem across multiple blockchain platforms.

Key Terms

Interoperability

Cross-chain bridges enable seamless asset transfers between distinct blockchains, enhancing interoperability by facilitating token swaps and data exchange across diverse networks. Modular blockchains optimize scalability and functionality by separating consensus, execution, and data availability layers, improving cross-chain communication efficiency. Explore the nuances of interoperability to better understand how these technologies redefine decentralized trading ecosystems.

Liquidity

Cross-chain bridges enable seamless asset transfers across distinct blockchains by establishing secure interoperability layers, significantly enhancing liquidity pools through shared access to diverse user bases. Modular blockchains optimize liquidity by distributing transaction processing and consensus into specialized layers, improving scalability and reducing cross-chain fragmentation in trading activities. Explore deeper insights into how these technologies revolutionize decentralized trading and liquidity management.

Atomic swaps

Cross-chain bridges enable direct asset transfers between different blockchain networks, reducing reliance on centralized exchanges and enhancing interoperability. Modular blockchains optimize scalability and customization by separating consensus, data availability, and execution layers, improving efficiency for complex transactions. Explore the advantages and mechanisms of atomic swaps within these frameworks to boost secure, trustless trading across decentralized protocols.

Source and External Links

What Is A Cross Chain Bridge? | Chainlink - A cross-chain bridge is a decentralized application enabling asset transfers between blockchains through mechanisms like lock and mint, burn and mint, or lock and unlock, and can support complex cross-chain functions like swapping or staking by combining token bridging with arbitrary data messaging.

Introduction to Cross-Chain Bridges - Chainalysis - Cross-chain bridges facilitate interoperability by allowing different blockchains to securely share data and tokens, expanding decentralized finance options and enabling multi-chain decentralized applications with transaction volumes in the billions.

What are cross-chain bridges? How interoperable crypto transfers ... - Cross-chain bridges improve blockchain scalability and transaction speeds by connecting different blockchains, also reducing reliance on single chains, though they come with inherent risks in Web3.

dowidth.com

dowidth.com