Order book imbalance measures the difference between buy and sell orders, revealing market sentiment and potential price movements. Trade aggressor identifies which side--buyers or sellers--is initiating trades, providing insight into market momentum and order flow dynamics. Explore how combining these metrics can enhance your trading strategies and decision-making.

Why it is important

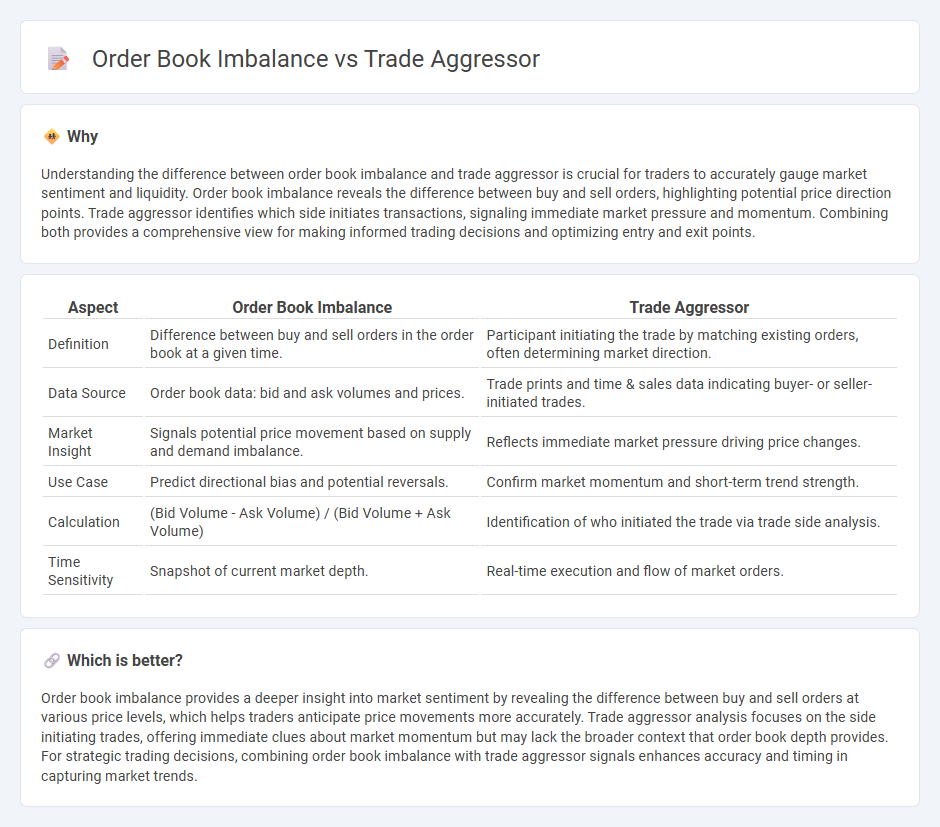

Understanding the difference between order book imbalance and trade aggressor is crucial for traders to accurately gauge market sentiment and liquidity. Order book imbalance reveals the difference between buy and sell orders, highlighting potential price direction points. Trade aggressor identifies which side initiates transactions, signaling immediate market pressure and momentum. Combining both provides a comprehensive view for making informed trading decisions and optimizing entry and exit points.

Comparison Table

| Aspect | Order Book Imbalance | Trade Aggressor |

|---|---|---|

| Definition | Difference between buy and sell orders in the order book at a given time. | Participant initiating the trade by matching existing orders, often determining market direction. |

| Data Source | Order book data: bid and ask volumes and prices. | Trade prints and time & sales data indicating buyer- or seller-initiated trades. |

| Market Insight | Signals potential price movement based on supply and demand imbalance. | Reflects immediate market pressure driving price changes. |

| Use Case | Predict directional bias and potential reversals. | Confirm market momentum and short-term trend strength. |

| Calculation | (Bid Volume - Ask Volume) / (Bid Volume + Ask Volume) | Identification of who initiated the trade via trade side analysis. |

| Time Sensitivity | Snapshot of current market depth. | Real-time execution and flow of market orders. |

Which is better?

Order book imbalance provides a deeper insight into market sentiment by revealing the difference between buy and sell orders at various price levels, which helps traders anticipate price movements more accurately. Trade aggressor analysis focuses on the side initiating trades, offering immediate clues about market momentum but may lack the broader context that order book depth provides. For strategic trading decisions, combining order book imbalance with trade aggressor signals enhances accuracy and timing in capturing market trends.

Connection

Order book imbalance measures the difference between buy and sell orders, signaling potential price movements by indicating market pressure. Trade aggressor identifies whether buyers or sellers initiate trades, directly impacting order book dynamics by consuming available liquidity on one side. The interplay between order book imbalance and trade aggressor reveals shifts in market sentiment, aiding traders in predicting short-term price trends and optimizing trade execution.

Key Terms

Market Orders

Market orders often serve as the primary trade aggressors, executing immediately against resting limit orders in the order book, thereby impacting short-term price direction. Order book imbalance, reflecting the relative quantities of buy and sell limit orders, provides insight into potential supply-demand dynamics but does not itself execute trades. Explore further how market orders influence momentum through order book imbalances for enhanced trading strategies.

Limit Orders

Trade aggressor identification primarily involves pinpointing market participants who initiate trades by crossing the spread, often utilizing market or aggressive limit orders to execute immediate transactions. Order book imbalance measures the disparity between outstanding limit buy and sell orders at various price levels, providing insights into potential price movements based on supply and demand dynamics. To explore how limit orders shape market liquidity and price discovery through trade aggressor behavior and order book imbalances, learn more about their intricate relationship.

Bid-Ask Spread

Trade aggressor refers to the party initiating a transaction at the current market price, often impacting the bid-ask spread by executing market orders that consume available liquidity. An order book imbalance occurs when there is a disproportionate volume of buy or sell orders at various price levels, directly influencing the bid-ask spread by tightening or widening it based on market demand and supply dynamics. Explore how understanding the interplay between trade aggressors and order book imbalance can enhance trading strategies and market timing.

Source and External Links

Aggressor - Definition, What is Aggressor, Advantages of ... - ClearTax - A trade aggressor is a trader who removes liquidity from the market by executing orders immediately at the best available price, typically through market orders or marketable limit orders, rather than placing passive bids or offers.

What Is Market Making? | River - In every trade, the aggressor initiates an immediate execution by matching an existing passive order, acting as a liquidity taker, while the passive trader waits for execution; aggressors are also referred to as takers and are charged higher fees than liquidity providers (makers).

Aggressor Flag - CQG IC Help - The aggressor pulls liquidity from the order book by triggering matches that remove resting orders and potentially move prices, and exchanges often flag which side (buyer or seller) was the aggressor at the time of trade execution.

dowidth.com

dowidth.com