Dark pool prints offer an alternative trading venue where large orders can be executed anonymously, minimizing market impact, while lit exchanges provide transparent order books and real-time market data visible to all participants. These two trading environments cater to different strategies, with dark pools favoring institutional traders seeking discretion and lit exchanges attracting a broader range of market participants focused on price discovery. Explore the distinct dynamics and advantages of dark pool prints versus lit exchanges to enhance your trading strategy.

Why it is important

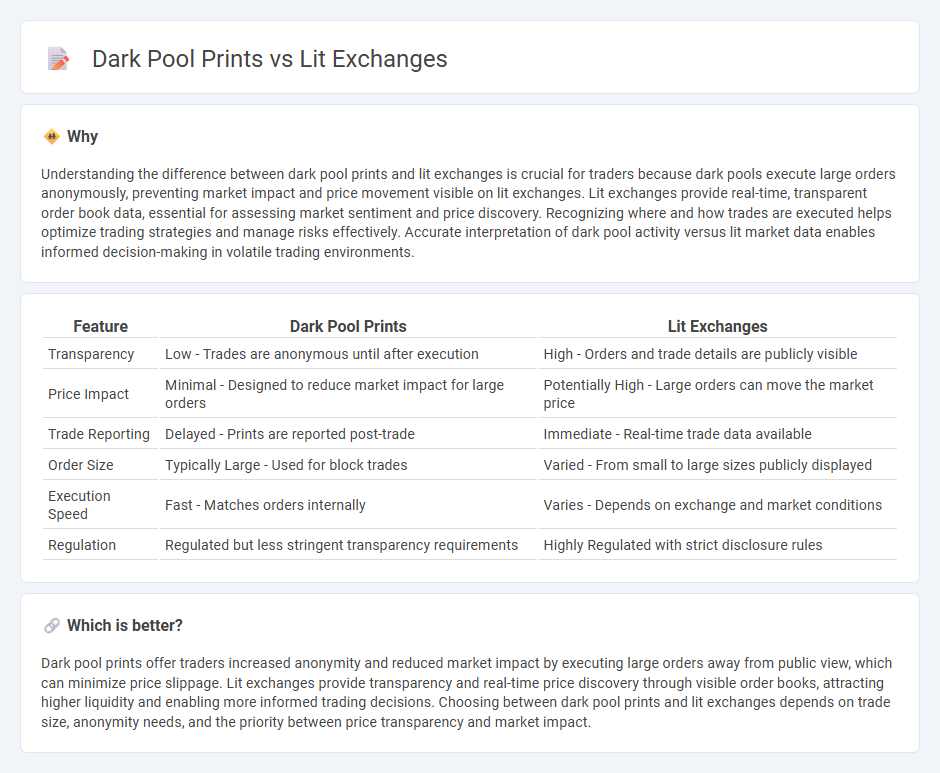

Understanding the difference between dark pool prints and lit exchanges is crucial for traders because dark pools execute large orders anonymously, preventing market impact and price movement visible on lit exchanges. Lit exchanges provide real-time, transparent order book data, essential for assessing market sentiment and price discovery. Recognizing where and how trades are executed helps optimize trading strategies and manage risks effectively. Accurate interpretation of dark pool activity versus lit market data enables informed decision-making in volatile trading environments.

Comparison Table

| Feature | Dark Pool Prints | Lit Exchanges |

|---|---|---|

| Transparency | Low - Trades are anonymous until after execution | High - Orders and trade details are publicly visible |

| Price Impact | Minimal - Designed to reduce market impact for large orders | Potentially High - Large orders can move the market price |

| Trade Reporting | Delayed - Prints are reported post-trade | Immediate - Real-time trade data available |

| Order Size | Typically Large - Used for block trades | Varied - From small to large sizes publicly displayed |

| Execution Speed | Fast - Matches orders internally | Varies - Depends on exchange and market conditions |

| Regulation | Regulated but less stringent transparency requirements | Highly Regulated with strict disclosure rules |

Which is better?

Dark pool prints offer traders increased anonymity and reduced market impact by executing large orders away from public view, which can minimize price slippage. Lit exchanges provide transparency and real-time price discovery through visible order books, attracting higher liquidity and enabling more informed trading decisions. Choosing between dark pool prints and lit exchanges depends on trade size, anonymity needs, and the priority between price transparency and market impact.

Connection

Dark pool prints represent large block trades executed privately away from public markets, while lit exchanges display real-time order book data and trade prints visible to all participants. The connection lies in price discovery, as dark pool prints can influence lit market prices by signaling institutional trading interest before the information becomes fully transparent. Understanding this dynamic helps traders anticipate price moves and optimize order execution strategies across both trading venues.

Key Terms

Order Book Transparency

Lit exchanges offer full order book transparency, displaying real-time bids and offers that enhance price discovery and market efficiency. Dark pool prints, in contrast, execute large trades anonymously, limiting visibility and reducing market impact but sacrificing transparency. Explore the intricacies of order book transparency between lit exchanges and dark pools to understand their effects on trading strategies.

Trade Reporting

Lit exchanges provide transparent price discovery by openly displaying real-time order book data and executed trade information, ensuring regulatory compliance and market efficiency. Dark pool prints, executed in private venues, offer anonymity and reduced market impact but lack pre-trade transparency, presenting challenges for accurate trade reporting and market surveillance. Explore the nuances of trade reporting requirements and implications for market participants to understand the full landscape.

Market Impact

Lit exchanges provide transparent order books enabling real-time price discovery, while dark pool prints execute large trades anonymously to minimize market impact. Market impact is often lower in dark pools due to reduced information leakage, yet they can obscure true market liquidity compared to lit exchanges. Explore further to understand how each venue influences trading strategies and price dynamics.

Source and External Links

Dark Pool vs. Lit Exchange: Transparency Trade-Offs - Lit exchanges are public trading venues where every order is displayed in real time on a central order book, showing visible bids, asks, and trade executions, offering transparency and robust price discovery like the NYSE and NASDAQ.

Lit pool - Wikipedia - Lit pools, or lit markets, are stock exchanges where order prices and volumes are always visible, making up about 70% of trades and contrasting with dark pools which do not display these orders.

Understanding market liquidity - Forrs.de - Lit auctions are scheduled trading events within lit exchanges that aggregate buy and sell offers to determine fair market prices at key session moments, reducing volatility compared to continuous trading.

dowidth.com

dowidth.com