Market microstructure examines the mechanisms and protocols governing how trades are executed, focusing on the behavior of market participants, the formation of prices, and the impact of order types on liquidity and volatility. High-frequency trading (HFT) leverages ultra-fast algorithms and proximity to exchanges to capitalize on minute price discrepancies, often exploiting market microstructure inefficiencies within microseconds. Explore the interplay between market microstructure and high-frequency trading to understand their critical roles in modern financial markets.

Why it is important

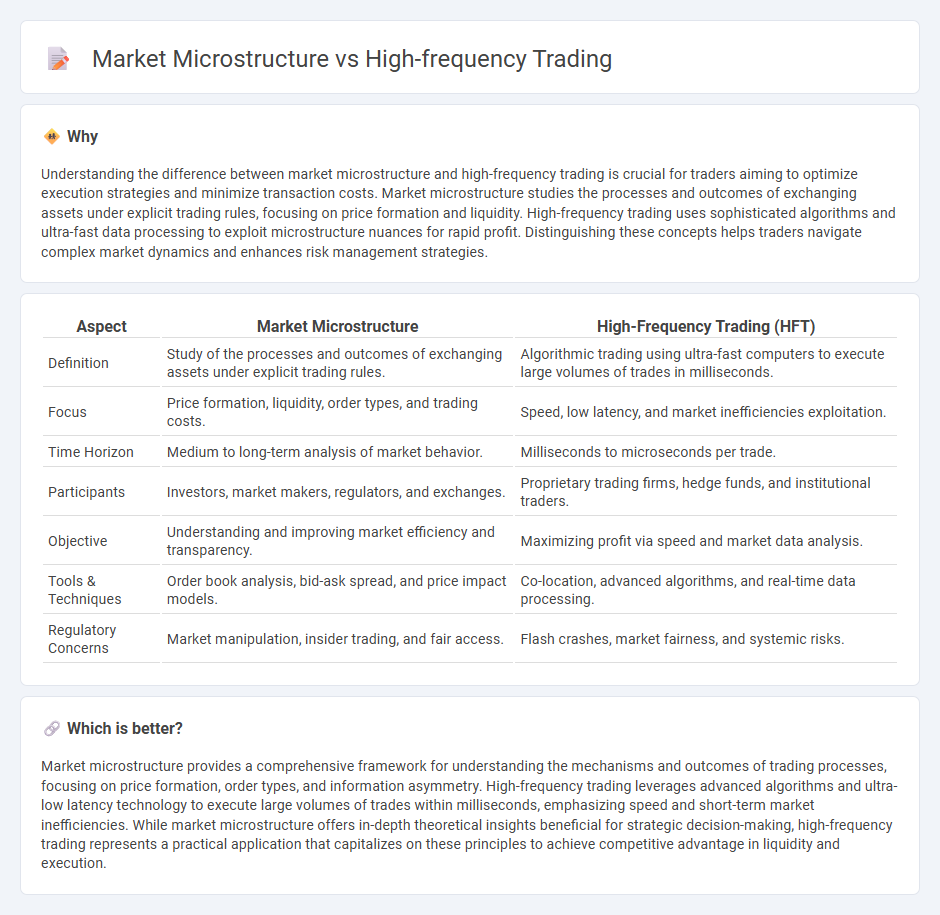

Understanding the difference between market microstructure and high-frequency trading is crucial for traders aiming to optimize execution strategies and minimize transaction costs. Market microstructure studies the processes and outcomes of exchanging assets under explicit trading rules, focusing on price formation and liquidity. High-frequency trading uses sophisticated algorithms and ultra-fast data processing to exploit microstructure nuances for rapid profit. Distinguishing these concepts helps traders navigate complex market dynamics and enhances risk management strategies.

Comparison Table

| Aspect | Market Microstructure | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Study of the processes and outcomes of exchanging assets under explicit trading rules. | Algorithmic trading using ultra-fast computers to execute large volumes of trades in milliseconds. |

| Focus | Price formation, liquidity, order types, and trading costs. | Speed, low latency, and market inefficiencies exploitation. |

| Time Horizon | Medium to long-term analysis of market behavior. | Milliseconds to microseconds per trade. |

| Participants | Investors, market makers, regulators, and exchanges. | Proprietary trading firms, hedge funds, and institutional traders. |

| Objective | Understanding and improving market efficiency and transparency. | Maximizing profit via speed and market data analysis. |

| Tools & Techniques | Order book analysis, bid-ask spread, and price impact models. | Co-location, advanced algorithms, and real-time data processing. |

| Regulatory Concerns | Market manipulation, insider trading, and fair access. | Flash crashes, market fairness, and systemic risks. |

Which is better?

Market microstructure provides a comprehensive framework for understanding the mechanisms and outcomes of trading processes, focusing on price formation, order types, and information asymmetry. High-frequency trading leverages advanced algorithms and ultra-low latency technology to execute large volumes of trades within milliseconds, emphasizing speed and short-term market inefficiencies. While market microstructure offers in-depth theoretical insights beneficial for strategic decision-making, high-frequency trading represents a practical application that capitalizes on these principles to achieve competitive advantage in liquidity and execution.

Connection

Market microstructure analyzes the processes and protocols governing asset exchanges, focusing on order types, bid-ask spreads, and transaction costs. High-frequency trading exploits microstructure elements by using sophisticated algorithms to execute rapid trades, capitalizing on short-lived market inefficiencies. The interplay between these fields shapes liquidity provision, price discovery, and market volatility in modern financial markets.

Key Terms

**High-Frequency Trading:**

High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency communication to execute large volumes of trades within milliseconds, capitalizing on minute price discrepancies across markets. HFT strategies directly influence market microstructure by enhancing liquidity, tightening bid-ask spreads, and increasing trading velocity, which can impact price discovery and volatility. Explore more about how HFT shapes market dynamics and the evolving regulatory landscape.

Latency

High-frequency trading (HFT) exploits ultra-low latency connections to execute trades within microseconds, capitalizing on minute price discrepancies in market microstructure. The intricate design of order books and trade execution algorithms in market microstructure directly influences latency and market efficiency, affecting price discovery and liquidity. Explore how latency impacts the dynamic interplay between HFT strategies and market microstructure for deeper insights.

Co-location

High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency connections to execute trades within microseconds, exploiting market microstructure nuances such as order flow and price signals. Co-location services, where trading firms place their servers in close physical proximity to exchange data centers, significantly reduce transmission delays, enhancing the speed advantage critical for HFT strategies. Discover how co-location transforms market dynamics and amplifies the impact of high-frequency trading by exploring its detailed implications.

Source and External Links

High Frequency Trading (HFT) - Definition, Pros and Cons - High-frequency trading is algorithmic trading characterized by high-speed trade execution, extremely large transaction volume, and very short-term investment horizons, mainly used by large institutional investors with complex algorithms to exploit small price fluctuations and arbitrage opportunities.

High Frequency Trading | EBSCO Research Starters - High-frequency trading uses advanced computer algorithms to execute transactions at speeds measured in millionths of a second, automating analysis of huge financial data to capture small price discrepancies, improving liquidity and lowering trading costs but raising concerns about market fairness and stability.

High-frequency trading - HFT is a form of automated quantitative trading focused on very short portfolio holding periods, employing fast algorithms to process large information volumes and implement strategies like market-making, event arbitrage, and latency arbitrage, competing primarily on execution speed.

dowidth.com

dowidth.com