Atomic swaps enable direct peer-to-peer cryptocurrency exchanges across different blockchains without intermediaries, enhancing security and reducing fees. Wrapped tokens represent one blockchain's asset on another network, allowing seamless trading and liquidity access within decentralized finance ecosystems. Explore more to understand which method best suits your trading strategy and blockchain interoperability needs.

Why it is important

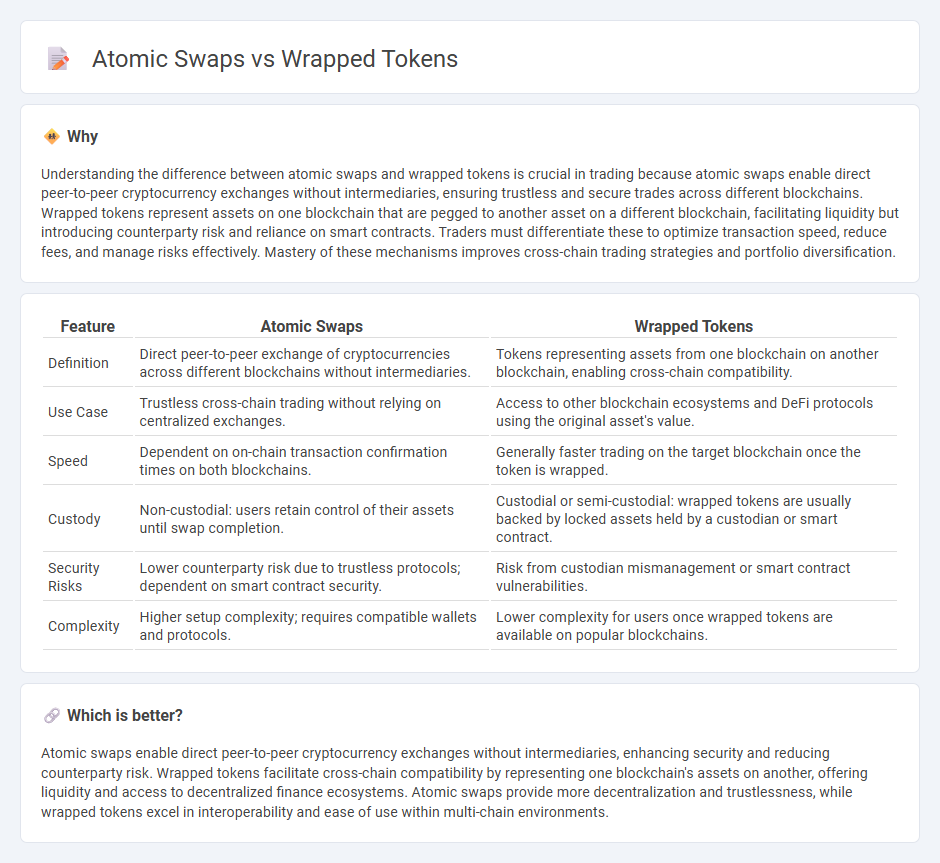

Understanding the difference between atomic swaps and wrapped tokens is crucial in trading because atomic swaps enable direct peer-to-peer cryptocurrency exchanges without intermediaries, ensuring trustless and secure trades across different blockchains. Wrapped tokens represent assets on one blockchain that are pegged to another asset on a different blockchain, facilitating liquidity but introducing counterparty risk and reliance on smart contracts. Traders must differentiate these to optimize transaction speed, reduce fees, and manage risks effectively. Mastery of these mechanisms improves cross-chain trading strategies and portfolio diversification.

Comparison Table

| Feature | Atomic Swaps | Wrapped Tokens |

|---|---|---|

| Definition | Direct peer-to-peer exchange of cryptocurrencies across different blockchains without intermediaries. | Tokens representing assets from one blockchain on another blockchain, enabling cross-chain compatibility. |

| Use Case | Trustless cross-chain trading without relying on centralized exchanges. | Access to other blockchain ecosystems and DeFi protocols using the original asset's value. |

| Speed | Dependent on on-chain transaction confirmation times on both blockchains. | Generally faster trading on the target blockchain once the token is wrapped. |

| Custody | Non-custodial: users retain control of their assets until swap completion. | Custodial or semi-custodial: wrapped tokens are usually backed by locked assets held by a custodian or smart contract. |

| Security Risks | Lower counterparty risk due to trustless protocols; dependent on smart contract security. | Risk from custodian mismanagement or smart contract vulnerabilities. |

| Complexity | Higher setup complexity; requires compatible wallets and protocols. | Lower complexity for users once wrapped tokens are available on popular blockchains. |

Which is better?

Atomic swaps enable direct peer-to-peer cryptocurrency exchanges without intermediaries, enhancing security and reducing counterparty risk. Wrapped tokens facilitate cross-chain compatibility by representing one blockchain's assets on another, offering liquidity and access to decentralized finance ecosystems. Atomic swaps provide more decentralization and trustlessness, while wrapped tokens excel in interoperability and ease of use within multi-chain environments.

Connection

Atomic swaps enable direct peer-to-peer cryptocurrency exchanges across different blockchains without intermediaries, while wrapped tokens represent assets from one blockchain on another, facilitating interoperability. Wrapped tokens rely on atomic swap technology to securely exchange underlying assets between chains, enhancing liquidity and trading efficiency. This connection allows seamless cross-chain trading, reducing reliance on centralized exchanges and minimizing counterparty risk.

Key Terms

Interoperability

Wrapped tokens enhance interoperability by representing assets from one blockchain as tokens on another, enabling seamless transfers and usage across different platforms. Atomic swaps facilitate direct peer-to-peer exchanges of cryptocurrencies between distinct blockchains without intermediaries, promoting trustless interoperability. Explore how these technologies revolutionize cross-chain asset management and decentralized finance.

Trustlessness

Wrapped tokens provide a trust-minimized way to represent assets from one blockchain on another, relying on smart contracts or custodians to maintain transparency and security. Atomic swaps enable fully trustless, peer-to-peer exchanges of cryptocurrencies across different blockchains without intermediaries, ensuring true decentralization and eliminating counterparty risk. Explore how each method enhances trustlessness in cross-chain asset transfers and trading.

Liquidity

Wrapped tokens enhance liquidity by enabling digital assets from one blockchain to be used seamlessly on another, expanding trading pairs and access to decentralized finance platforms. Atomic swaps facilitate direct and trustless exchanges between different cryptocurrencies without intermediaries, but their liquidity depends on user availability and blockchain compatibility. Explore how these mechanisms impact market depth and trading efficiency to optimize your crypto strategies.

Source and External Links

What are wrapped tokens? - Robinhood - Wrapped tokens allow cryptocurrencies from one blockchain to be used on another by locking the original coin and minting an equivalent wrapped token on the target blockchain, enabling interoperability and use in decentralized applications.

What is a Wrapped Token? - OSL - Wrapped tokens represent another cryptocurrency on a different blockchain through a lock-and-mint process, enhancing liquidity and interoperability between blockchains, which expands usage in DeFi and can reduce fees.

What are Wrapped Tokens? - Zerocap - Wrapped tokens are digital assets pegged to another cryptocurrency on a separate blockchain, enabling cross-chain use and participation in DeFi by locking the original asset and issuing an equivalent token on the new chain.

dowidth.com

dowidth.com