Risk reversal involves simultaneously buying a call option and selling a put option to hedge against or speculate on directional market moves, providing asymmetric risk exposure. Iron condor is a neutral options strategy that combines a bull put spread and a bear call spread, aiming to profit from low volatility and limited price movement. Explore detailed comparisons to understand which strategy aligns with your trading goals.

Why it is important

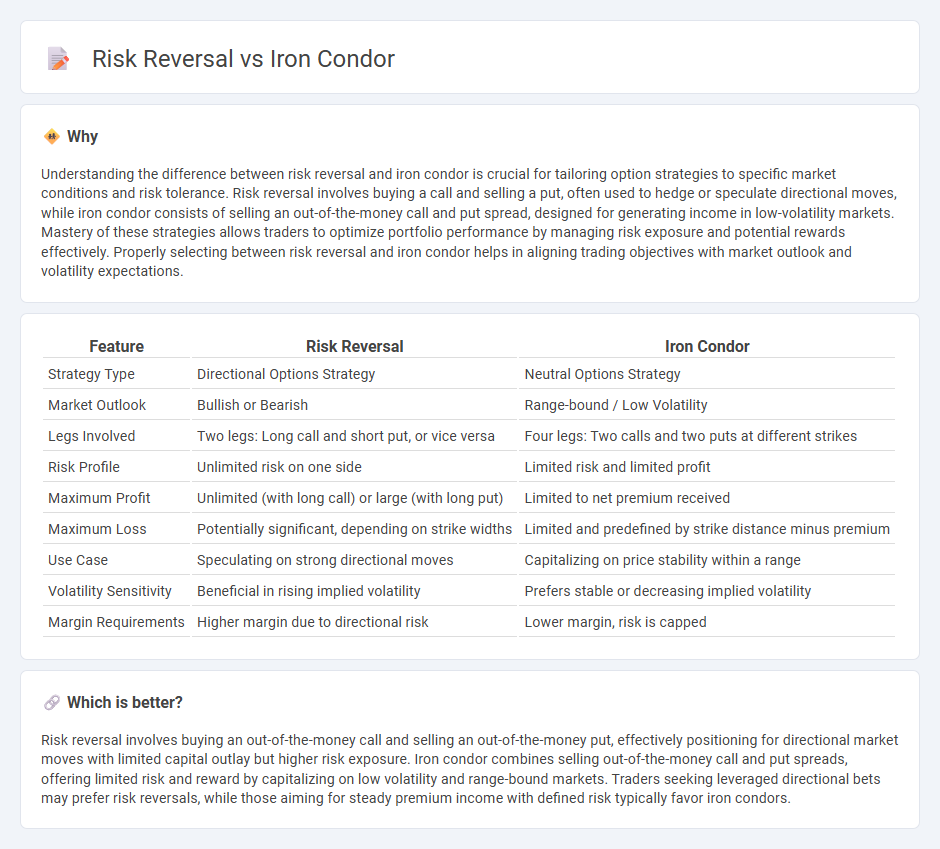

Understanding the difference between risk reversal and iron condor is crucial for tailoring option strategies to specific market conditions and risk tolerance. Risk reversal involves buying a call and selling a put, often used to hedge or speculate directional moves, while iron condor consists of selling an out-of-the-money call and put spread, designed for generating income in low-volatility markets. Mastery of these strategies allows traders to optimize portfolio performance by managing risk exposure and potential rewards effectively. Properly selecting between risk reversal and iron condor helps in aligning trading objectives with market outlook and volatility expectations.

Comparison Table

| Feature | Risk Reversal | Iron Condor |

|---|---|---|

| Strategy Type | Directional Options Strategy | Neutral Options Strategy |

| Market Outlook | Bullish or Bearish | Range-bound / Low Volatility |

| Legs Involved | Two legs: Long call and short put, or vice versa | Four legs: Two calls and two puts at different strikes |

| Risk Profile | Unlimited risk on one side | Limited risk and limited profit |

| Maximum Profit | Unlimited (with long call) or large (with long put) | Limited to net premium received |

| Maximum Loss | Potentially significant, depending on strike widths | Limited and predefined by strike distance minus premium |

| Use Case | Speculating on strong directional moves | Capitalizing on price stability within a range |

| Volatility Sensitivity | Beneficial in rising implied volatility | Prefers stable or decreasing implied volatility |

| Margin Requirements | Higher margin due to directional risk | Lower margin, risk is capped |

Which is better?

Risk reversal involves buying an out-of-the-money call and selling an out-of-the-money put, effectively positioning for directional market moves with limited capital outlay but higher risk exposure. Iron condor combines selling out-of-the-money call and put spreads, offering limited risk and reward by capitalizing on low volatility and range-bound markets. Traders seeking leveraged directional bets may prefer risk reversals, while those aiming for steady premium income with defined risk typically favor iron condors.

Connection

Risk reversal and iron condor are both advanced options trading strategies used to manage risk and capitalize on market volatility. While risk reversal involves simultaneously buying a call and selling a put (or vice versa) to create a directional bias, the iron condor combines two spreads--selling an out-of-the-money call spread and an out-of-the-money put spread--to profit from a range-bound market by limiting both upside and downside risk. Both strategies rely on volatility forecasts and option premiums but differ in directional exposure and risk profiles, making them complementary tools for traders.

Key Terms

Strike Price

Iron condors involve selling out-of-the-money call and put spreads with strike prices positioned to capitalize on low volatility, typically maintaining a wide range between strikes to limit risk and reward. Risk reversals consist of buying an out-of-the-money call and selling an out-of-the-money put, focusing on directional bias with strike prices chosen to leverage expected price movement while managing downside exposure. Explore detailed strike price strategies in iron condors and risk reversals to refine your options trading approach.

Net Premium

An iron condor strategy involves selling both a lower strike put and a higher strike call while buying further out-of-the-money options to limit risk, generating net premium from the short strikes. Risk reversal consists of selling an out-of-the-money put and buying an out-of-the-money call, typically resulting in a debit or minimal credit depending on strike selection and implied volatility skew. Explore detailed comparisons on how net premium impacts profit potential and risk exposure in options trading strategies.

Maximum Risk

Iron condors offer limited maximum risk defined by the difference between strike prices minus the net premium received, making them a popular choice for traders seeking controlled losses. Risk reversals, on the other hand, have asymmetric risk profiles where potential losses can be substantial due to naked short call or put options, depending on the positioning. Explore detailed comparisons to understand which strategy optimally balances risk and reward in various market conditions.

Source and External Links

Iron Condor options strategy - Fidelity Investments - The iron condor is a limited-risk, limited-profit options strategy combining a bear call spread and a bull put spread, designed to profit if the underlying stock stays within a certain price range through expiration, generating premium income while limiting losses.

Iron Condor Options Trading Strategy - tastylive - An iron condor is a directionally neutral, defined risk strategy that combines an out-of-the-money put credit spread and call credit spread, profiting from a stock trading within a range, benefiting from time decay and decreases in volatility.

Iron Condors & Butterflies Explained - TradeStation - The iron condor strategy involves simultaneously selling two out-of-the-money credit spreads to collect premium and aims for the underlying security to trade between the short strike prices at expiration, capping both profit and loss compared to the riskier short strangle.

dowidth.com

dowidth.com