Synthetic positions replicate the payoff of traditional options strategies by combining long and short options to mimic the risk and reward of owning the underlying asset. Calendar spreads involve simultaneously buying and selling options with the same strike price but different expiration dates, capitalizing on time decay and volatility differences. Explore further to understand how synthetic positions and calendar spreads can enhance your trading strategy.

Why it is important

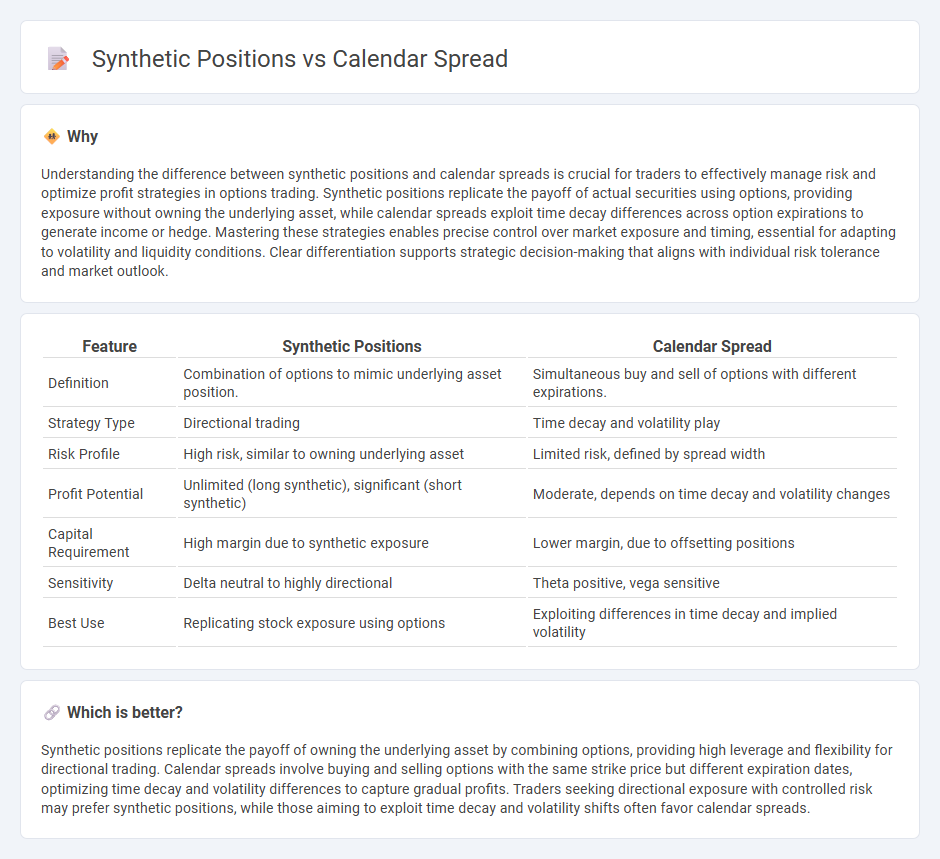

Understanding the difference between synthetic positions and calendar spreads is crucial for traders to effectively manage risk and optimize profit strategies in options trading. Synthetic positions replicate the payoff of actual securities using options, providing exposure without owning the underlying asset, while calendar spreads exploit time decay differences across option expirations to generate income or hedge. Mastering these strategies enables precise control over market exposure and timing, essential for adapting to volatility and liquidity conditions. Clear differentiation supports strategic decision-making that aligns with individual risk tolerance and market outlook.

Comparison Table

| Feature | Synthetic Positions | Calendar Spread |

|---|---|---|

| Definition | Combination of options to mimic underlying asset position. | Simultaneous buy and sell of options with different expirations. |

| Strategy Type | Directional trading | Time decay and volatility play |

| Risk Profile | High risk, similar to owning underlying asset | Limited risk, defined by spread width |

| Profit Potential | Unlimited (long synthetic), significant (short synthetic) | Moderate, depends on time decay and volatility changes |

| Capital Requirement | High margin due to synthetic exposure | Lower margin, due to offsetting positions |

| Sensitivity | Delta neutral to highly directional | Theta positive, vega sensitive |

| Best Use | Replicating stock exposure using options | Exploiting differences in time decay and implied volatility |

Which is better?

Synthetic positions replicate the payoff of owning the underlying asset by combining options, providing high leverage and flexibility for directional trading. Calendar spreads involve buying and selling options with the same strike price but different expiration dates, optimizing time decay and volatility differences to capture gradual profits. Traders seeking directional exposure with controlled risk may prefer synthetic positions, while those aiming to exploit time decay and volatility shifts often favor calendar spreads.

Connection

Synthetic positions replicate the payoff of owning an asset by combining options, often involving a long call and a short put with the same strike price and expiration. Calendar spreads, constructed by buying and selling options with different expiration dates but the same strike price, can create synthetic positions to leverage time decay and volatility differences. Traders use this connection to optimize strategies for risk management and profit in various market conditions.

Key Terms

Expiration Dates

Calendar spreads involve buying and selling options with the same strike price but different expiration dates, exploiting time decay differences for potential profits. Synthetic positions replicate the payoff of another asset by combining options and underlying instruments, often manipulating expiration dates to adjust risk and return profiles. Explore deeper insights on how expiration dates impact these strategies and optimize trading outcomes.

Option Legs

Calendar spreads involve buying and selling options of the same underlying asset and strike price but with different expiration dates, capitalizing on time decay differences. Synthetic positions mimic underlying asset positions using combinations of options, such as synthetic longs created by buying calls and selling puts at the same strike and expiration. Explore deeper insights on option legs to master strategy execution and risk management.

Payoff Structure

Calendar spreads involve options with the same strike price but different expiration dates, creating a payoff structure that benefits from time decay disparities and volatility changes. Synthetic positions replicate the payoff of another security by combining options or options with the underlying asset, often mirroring stock ownership or short positions. Explore detailed comparisons to understand how payoff structures influence risk and return profiles.

Source and External Links

Calendar spread - Wikipedia - A calendar spread is an options strategy involving the simultaneous purchase and sale of options on the same underlying asset and strike price but with different expiration dates, typically buying longer-dated options and selling shorter-dated ones to profit from volatility differences and time decay.

What is a Calendar Spread Option? - tastylive - A calendar spread is a low-risk, directionally neutral strategy that profits mainly from time decay and/or increases in implied volatility by selling an option with longer expiration and buying one with near-term expiration at the same strike.

Option Calendar Spreads - CME Group - Calendar spreads involve selling a near-term option and buying a longer-term option with the same strike and type, offering low-risk profit potential from time passage with strategies often used when expecting low market movement until a future event.

dowidth.com

dowidth.com