Options flow reveals real-time trading activity by tracking large volume trades and unusual options contracts, providing insights into market participants' intentions. Sentiment analysis evaluates public opinions and news trends to gauge overall market sentiment, influencing potential price movements. Explore the distinctions and benefits of options flow and sentiment analysis to enhance your trading strategy.

Why it is important

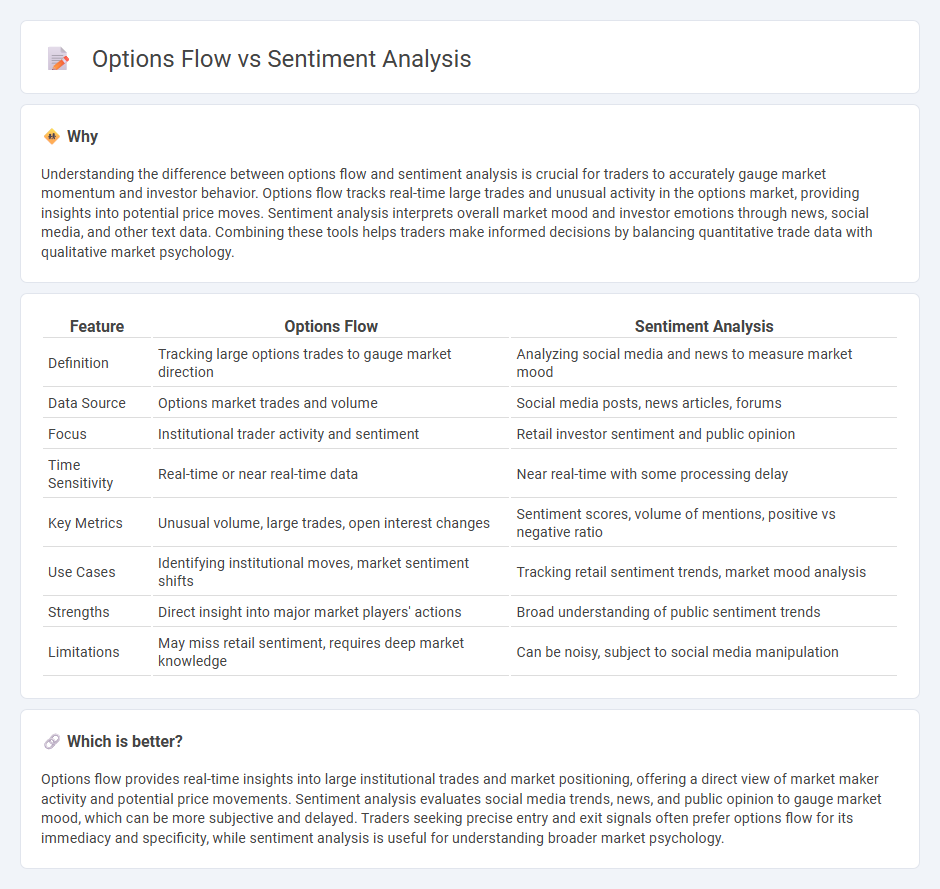

Understanding the difference between options flow and sentiment analysis is crucial for traders to accurately gauge market momentum and investor behavior. Options flow tracks real-time large trades and unusual activity in the options market, providing insights into potential price moves. Sentiment analysis interprets overall market mood and investor emotions through news, social media, and other text data. Combining these tools helps traders make informed decisions by balancing quantitative trade data with qualitative market psychology.

Comparison Table

| Feature | Options Flow | Sentiment Analysis |

|---|---|---|

| Definition | Tracking large options trades to gauge market direction | Analyzing social media and news to measure market mood |

| Data Source | Options market trades and volume | Social media posts, news articles, forums |

| Focus | Institutional trader activity and sentiment | Retail investor sentiment and public opinion |

| Time Sensitivity | Real-time or near real-time data | Near real-time with some processing delay |

| Key Metrics | Unusual volume, large trades, open interest changes | Sentiment scores, volume of mentions, positive vs negative ratio |

| Use Cases | Identifying institutional moves, market sentiment shifts | Tracking retail sentiment trends, market mood analysis |

| Strengths | Direct insight into major market players' actions | Broad understanding of public sentiment trends |

| Limitations | May miss retail sentiment, requires deep market knowledge | Can be noisy, subject to social media manipulation |

Which is better?

Options flow provides real-time insights into large institutional trades and market positioning, offering a direct view of market maker activity and potential price movements. Sentiment analysis evaluates social media trends, news, and public opinion to gauge market mood, which can be more subjective and delayed. Traders seeking precise entry and exit signals often prefer options flow for its immediacy and specificity, while sentiment analysis is useful for understanding broader market psychology.

Connection

Options flow reveals real-time trading activity by tracking large trades and unusual option volumes, serving as a proxy for market participants' expectations. Sentiment analysis interprets this data to gauge investor mood, helping traders predict price movements and market trends. Combining these tools enhances decision-making by providing insights into market psychology and potential directional shifts.

Key Terms

**Sentiment Analysis:**

Sentiment analysis leverages natural language processing and machine learning algorithms to interpret and categorize emotions within textual data, such as news articles, social media posts, and financial reports, providing insights into market sentiment and investor behavior. This technique enables traders and analysts to gauge positive, negative, or neutral sentiments which can impact stock prices and trading decisions by identifying market trends and potential reversals early. Explore our detailed guide to learn how sentiment analysis can enhance your trading strategies and inform smarter market predictions.

Market Emotion

Sentiment analysis evaluates market emotion by processing news, social media, and financial reports to gauge overall investor mood, while options flow tracks real-time buying and selling activity of options contracts to identify large trades that signal market sentiment shifts. Sentiment analysis provides a broad emotional context, whereas options flow delivers precise, actionable insights into institutional and retail trader behavior. Explore how integrating both methods can enhance your understanding of market emotion dynamics.

News Sentiment

News sentiment analysis evaluates the emotional tone conveyed in financial news articles, identifying market impact by categorizing content as positive, negative, or neutral. Options flow analysis tracks large trades and unusual activity in options markets to predict potential price movements based on investor behavior. Explore the nuances of news sentiment analysis to gain deeper insights into its influence on market trends.

Source and External Links

Sentiment Analysis and How to Leverage It - Sentiment analysis identifies and interprets qualitative data to understand people's feelings about a topic, product, or service and includes types like fine-grained, aspect-based, and intent-based sentiment analysis for detailed emotional insights.

What is Sentiment Analysis? | Definition from TechTarget - Sentiment analysis, also called opinion mining, uses NLP, AI, and machine learning to detect positive, negative, or neutral emotional tone in text and helps organizations analyze customer opinions from various digital sources.

What is Sentiment Analysis? - Sentiment analysis is the process of analyzing text to classify it into emotional tones such as positive, negative, or neutral, with types including fine-grained, aspect-based, intent-based, and emotional detection to understand customer sentiment in depth.

dowidth.com

dowidth.com