Proprietary firm challenges require traders to prove their skills by meeting strict profit targets and risk management rules to secure funded accounts, demanding discipline and consistent performance. Copy trading allows less experienced investors to replicate the moves of expert traders automatically, offering a hands-off approach with varied risk exposure depending on the chosen trader. Explore in-depth strategies and advantages of prop firm challenges versus copy trading to determine the best fit for your trading goals.

Why it is important

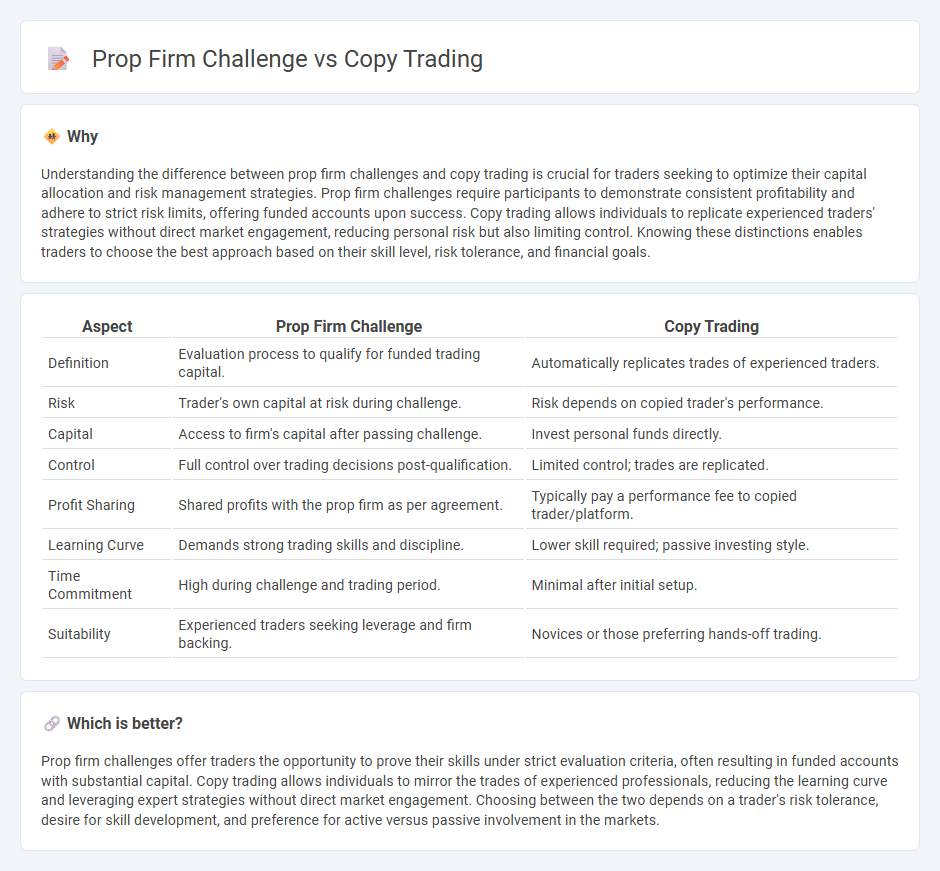

Understanding the difference between prop firm challenges and copy trading is crucial for traders seeking to optimize their capital allocation and risk management strategies. Prop firm challenges require participants to demonstrate consistent profitability and adhere to strict risk limits, offering funded accounts upon success. Copy trading allows individuals to replicate experienced traders' strategies without direct market engagement, reducing personal risk but also limiting control. Knowing these distinctions enables traders to choose the best approach based on their skill level, risk tolerance, and financial goals.

Comparison Table

| Aspect | Prop Firm Challenge | Copy Trading |

|---|---|---|

| Definition | Evaluation process to qualify for funded trading capital. | Automatically replicates trades of experienced traders. |

| Risk | Trader's own capital at risk during challenge. | Risk depends on copied trader's performance. |

| Capital | Access to firm's capital after passing challenge. | Invest personal funds directly. |

| Control | Full control over trading decisions post-qualification. | Limited control; trades are replicated. |

| Profit Sharing | Shared profits with the prop firm as per agreement. | Typically pay a performance fee to copied trader/platform. |

| Learning Curve | Demands strong trading skills and discipline. | Lower skill required; passive investing style. |

| Time Commitment | High during challenge and trading period. | Minimal after initial setup. |

| Suitability | Experienced traders seeking leverage and firm backing. | Novices or those preferring hands-off trading. |

Which is better?

Prop firm challenges offer traders the opportunity to prove their skills under strict evaluation criteria, often resulting in funded accounts with substantial capital. Copy trading allows individuals to mirror the trades of experienced professionals, reducing the learning curve and leveraging expert strategies without direct market engagement. Choosing between the two depends on a trader's risk tolerance, desire for skill development, and preference for active versus passive involvement in the markets.

Connection

Prop firm challenges provide traders with an opportunity to prove their skills and secure funding, while copy trading allows investors to replicate the strategies of successful traders, often including those who have passed these challenges. Traders who excel in prop firm challenges gain credibility, making their trades attractive for copy trading platforms that seek reliable performance. This connection creates a symbiotic relationship where prop traders receive capital and visibility, and copy traders access vetted, high-potential trading strategies.

Key Terms

**Copy Trading:**

Copy trading allows investors to replicate the trades of experienced traders in real-time, leveraging their expertise to potentially increase profits while minimizing the need for in-depth market analysis. This strategy offers greater accessibility and lower risk compared to proprietary firm challenges, as traders do not have to pass rigorous evaluations or commit substantial capital upfront. Explore more about the advantages and limitations of copy trading to enhance your investment approach.

Signal Provider

Signal providers in copy trading offer proven strategies by sharing real-time trade signals, enabling followers to replicate their successful trades without active management. In contrast, prop firm challenges require traders to pass specific trading assessments to qualify for capital allocation, emphasizing individual skill over shared signals. Explore the key differences in performance metrics and risk management to understand which approach suits your trading goals best.

Automated Execution

Automated execution in copy trading leverages real-time algorithmic strategies to mirror experienced traders' positions instantly, reducing latency and human error. Prop firm challenges test traders' skills under strict risk and return criteria while often incorporating automated tools to optimize performance during the evaluation period. Explore how automated execution can enhance your trading strategy by balancing risk management and efficiency in both copy trading and prop firm challenges.

Source and External Links

Copy trading - Wikipedia - Copy trading enables individuals to automatically copy financial market positions opened and managed by selected traders, linking a portion of the copier's funds to those traders' accounts with the ability to manage copied trades independently.

Copy Trading | Copy the Best Traders in 2025 | AvaTrade - Copy trading allows one trader to automatically replicate the trades of a more experienced trader, offering an accessible, automated, and hands-off way for beginners to participate in financial markets while benefiting from skilled traders.

What is Copy Trading, How Does it Work and How to ... - PrimeXBT - Copy trading enables investors to replicate trades of profitable traders automatically by allocating capital to them, making it useful for novices and busy traders who want to benefit from experience without active market analysis.

dowidth.com

dowidth.com