Order flow analysis focuses on real-time market transactions and liquidity to predict short-term price movements, while fundamental analysis evaluates a company's financial health, economic indicators, and intrinsic value for long-term investment decisions. Traders relying on order flow gain insights from bid-ask dynamics and volume patterns, whereas fundamental analysts assess earnings reports, macroeconomic trends, and industry data. Explore the strengths and applications of each method to enhance your trading strategy.

Why it is important

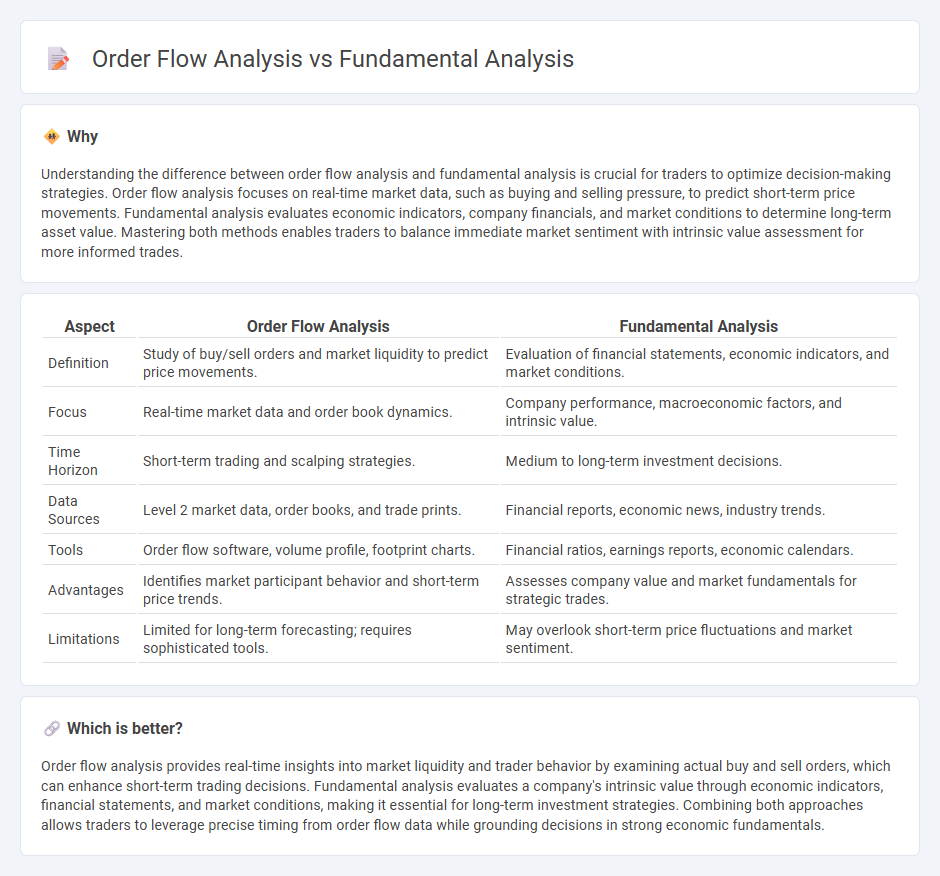

Understanding the difference between order flow analysis and fundamental analysis is crucial for traders to optimize decision-making strategies. Order flow analysis focuses on real-time market data, such as buying and selling pressure, to predict short-term price movements. Fundamental analysis evaluates economic indicators, company financials, and market conditions to determine long-term asset value. Mastering both methods enables traders to balance immediate market sentiment with intrinsic value assessment for more informed trades.

Comparison Table

| Aspect | Order Flow Analysis | Fundamental Analysis |

|---|---|---|

| Definition | Study of buy/sell orders and market liquidity to predict price movements. | Evaluation of financial statements, economic indicators, and market conditions. |

| Focus | Real-time market data and order book dynamics. | Company performance, macroeconomic factors, and intrinsic value. |

| Time Horizon | Short-term trading and scalping strategies. | Medium to long-term investment decisions. |

| Data Sources | Level 2 market data, order books, and trade prints. | Financial reports, economic news, industry trends. |

| Tools | Order flow software, volume profile, footprint charts. | Financial ratios, earnings reports, economic calendars. |

| Advantages | Identifies market participant behavior and short-term price trends. | Assesses company value and market fundamentals for strategic trades. |

| Limitations | Limited for long-term forecasting; requires sophisticated tools. | May overlook short-term price fluctuations and market sentiment. |

Which is better?

Order flow analysis provides real-time insights into market liquidity and trader behavior by examining actual buy and sell orders, which can enhance short-term trading decisions. Fundamental analysis evaluates a company's intrinsic value through economic indicators, financial statements, and market conditions, making it essential for long-term investment strategies. Combining both approaches allows traders to leverage precise timing from order flow data while grounding decisions in strong economic fundamentals.

Connection

Order flow analysis and fundamental analysis intersect by providing a comprehensive view of market dynamics, where order flow reveals real-time trading activity and liquidity patterns while fundamental analysis evaluates underlying economic indicators and company financials. Traders combine order flow data with fundamental insights to anticipate price movements influenced by market sentiment and macroeconomic factors. This integration enhances decision-making accuracy by aligning short-term market behavior with long-term value drivers.

Key Terms

**Fundamental Analysis:**

Fundamental analysis evaluates a company's intrinsic value by examining financial statements, economic indicators, and industry conditions to forecast long-term investment potential. Key metrics include earnings per share (EPS), price-to-earnings (P/E) ratio, and revenue growth, which help investors identify undervalued stocks. Discover more about how fundamental analysis can shape your investment strategy and improve portfolio performance.

Earnings Reports

Earnings reports provide critical data for fundamental analysis by revealing a company's profitability, revenue trends, and future growth potential, which are essential metrics for long-term investment decisions. Order flow analysis interprets real-time buy and sell orders during earnings announcements to gauge market sentiment and price momentum, offering traders immediate insight into short-term price movements. Explore more to understand how combining these approaches can enhance trading strategies around earnings releases.

Valuation Ratios

Valuation ratios such as Price-to-Earnings (P/E), Price-to-Book (P/B), and Dividend Yield are central to fundamental analysis, providing insights into a stock's intrinsic value and financial health. Order flow analysis, however, emphasizes real-time market data like trade volume and bid-ask spreads to gauge supply-demand dynamics and short-term price movements. Explore further to understand how combining these approaches can enhance investment decisions.

Source and External Links

Fundamental Analysis - Corporate Finance Institute - Fundamental analysis is a method of assessing a security's intrinsic value by examining macroeconomic and microeconomic factors, aiming to determine if a security is overvalued or undervalued compared to its market price, and can be done top-down or bottom-up.

Fundamental analysis - Wikipedia - Fundamental analysis evaluates a business through economic, industry, and company analysis to find the true intrinsic value of its shares, guiding buy, hold, or sell decisions based on how that value compares to market price.

Beginners Guide to Fundamental Analysis | Learn to Trade - OANDA - Fundamental analysis involves studying factors like macroeconomic indicators, interest rates, trade balance, and supply-demand events to assess an asset's value and likely price movements, using top-down or bottom-up approaches.

dowidth.com

dowidth.com