Alternative data signals incorporate unconventional datasets such as social media trends, satellite imagery, and consumer behavior patterns to inform trading decisions, offering insights beyond traditional market metrics. Price action signals rely solely on historical price movements and chart patterns to predict future market behavior, emphasizing technical analysis without external data influences. Explore the advantages and applications of these distinct signal types to enhance your trading strategy.

Why it is important

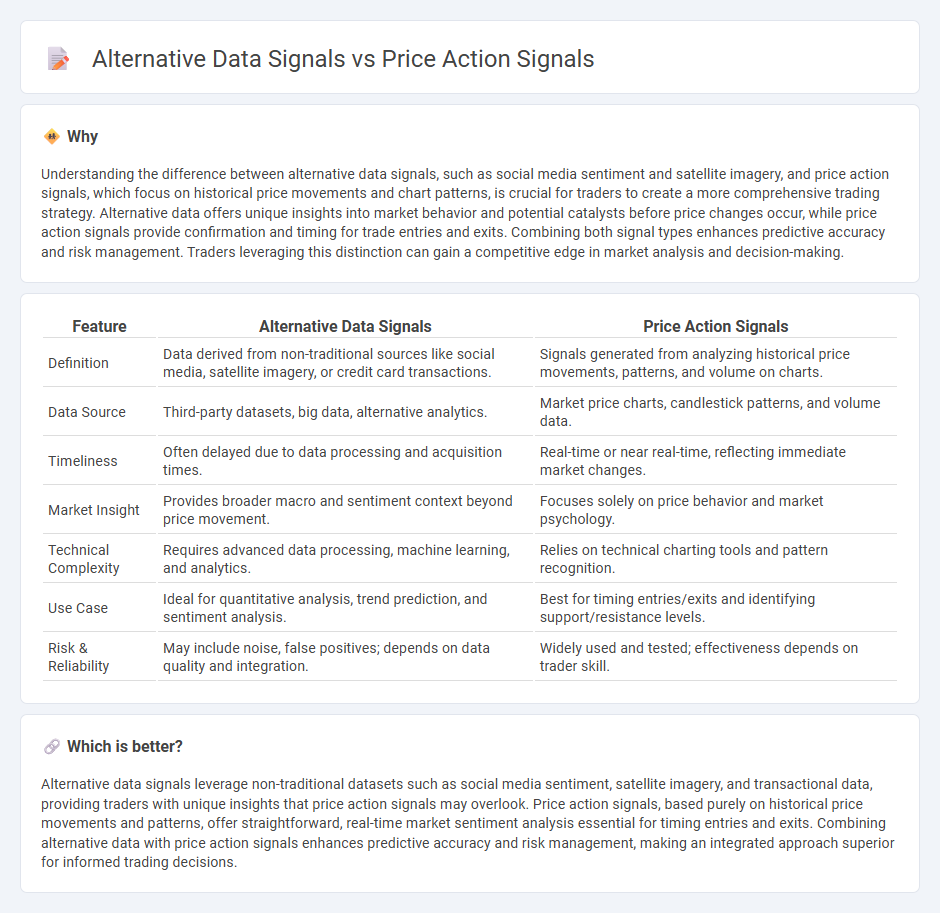

Understanding the difference between alternative data signals, such as social media sentiment and satellite imagery, and price action signals, which focus on historical price movements and chart patterns, is crucial for traders to create a more comprehensive trading strategy. Alternative data offers unique insights into market behavior and potential catalysts before price changes occur, while price action signals provide confirmation and timing for trade entries and exits. Combining both signal types enhances predictive accuracy and risk management. Traders leveraging this distinction can gain a competitive edge in market analysis and decision-making.

Comparison Table

| Feature | Alternative Data Signals | Price Action Signals |

|---|---|---|

| Definition | Data derived from non-traditional sources like social media, satellite imagery, or credit card transactions. | Signals generated from analyzing historical price movements, patterns, and volume on charts. |

| Data Source | Third-party datasets, big data, alternative analytics. | Market price charts, candlestick patterns, and volume data. |

| Timeliness | Often delayed due to data processing and acquisition times. | Real-time or near real-time, reflecting immediate market changes. |

| Market Insight | Provides broader macro and sentiment context beyond price movement. | Focuses solely on price behavior and market psychology. |

| Technical Complexity | Requires advanced data processing, machine learning, and analytics. | Relies on technical charting tools and pattern recognition. |

| Use Case | Ideal for quantitative analysis, trend prediction, and sentiment analysis. | Best for timing entries/exits and identifying support/resistance levels. |

| Risk & Reliability | May include noise, false positives; depends on data quality and integration. | Widely used and tested; effectiveness depends on trader skill. |

Which is better?

Alternative data signals leverage non-traditional datasets such as social media sentiment, satellite imagery, and transactional data, providing traders with unique insights that price action signals may overlook. Price action signals, based purely on historical price movements and patterns, offer straightforward, real-time market sentiment analysis essential for timing entries and exits. Combining alternative data with price action signals enhances predictive accuracy and risk management, making an integrated approach superior for informed trading decisions.

Connection

Alternative data signals provide unique market insights by analyzing unconventional datasets such as social media trends, satellite imagery, and consumer behavior patterns, complementing price action signals derived from historical price movements and technical chart patterns. The integration of alternative data enhances the predictive power of price action analysis by revealing underlying market sentiment and potential catalysts for price changes. Traders leveraging both sources can achieve more informed decisions and improved trade timing, capturing opportunities that purely traditional analysis might miss.

Key Terms

Candlestick Patterns

Candlestick patterns provide crucial price action signals by visually representing market sentiment and potential reversals through open, high, low, and close data. Alternative data signals incorporate non-traditional datasets such as satellite imagery, social media trends, or economic indicators to predict market movements beyond price fluctuations. Explore how combining candlestick analysis with alternative data can enhance trading strategies and improve predictive accuracy.

Sentiment Analysis

Price action signals analyze historical market prices and volumes to predict future movements, focusing on patterns such as candlestick formations, support, and resistance levels. Alternative data signals derived from sentiment analysis evaluate social media trends, news sentiment, and investor mood to gauge market sentiment and potential price shifts. Explore how combining price action with sentiment analysis can enhance your trading strategy and decision-making.

Order Flow

Order Flow signals provide real-time insights into market liquidity and trader intentions by analyzing the actual buy and sell orders, offering a granular perspective that traditional Price Action signals may overlook. Unlike alternative data signals sourced from unconventional datasets like social media sentiment or satellite imagery, Order Flow emphasizes direct market activity, enhancing precision in detecting short-term trend reversals and momentum shifts. Explore the benefits of integrating Order Flow analysis to refine your trading strategy and gain a competitive edge.

Source and External Links

Top 7 Price Action Trading Strategies | IG International - Price action signals include patterns like the pin bar, which shows price rejection and reversal potential, and trend trading techniques such as the head and shoulders trade reversal, helping traders predict market moves by studying price trends and patterns.

The Simplest Trading Strategy in the World | PriceAction.com - Effective price action signals often form at confluence points such as horizontal support or resistance levels, with examples like pin bar formations signaling potential buying or selling opportunities when aligned with market trends or ranges.

What Is Price Action Trading & How to Use It - Blueberry Markets - Price action signals include the pin bar, indicating price rejection and likely reversals, and the inside bar pattern, which signals potential market reversals by highlighting consolidation within two candlesticks, offering good entry and exit points.

dowidth.com

dowidth.com