Market microstructure examines the processes and mechanisms through which financial assets are traded, focusing on order types, price formation, and information flow. Transaction costs encompass explicit fees and implicit costs, such as bid-ask spreads and market impact, which directly affect trade execution efficiency. Explore deeper insights into how market microstructure intricacies influence transaction costs and trading strategies.

Why it is important

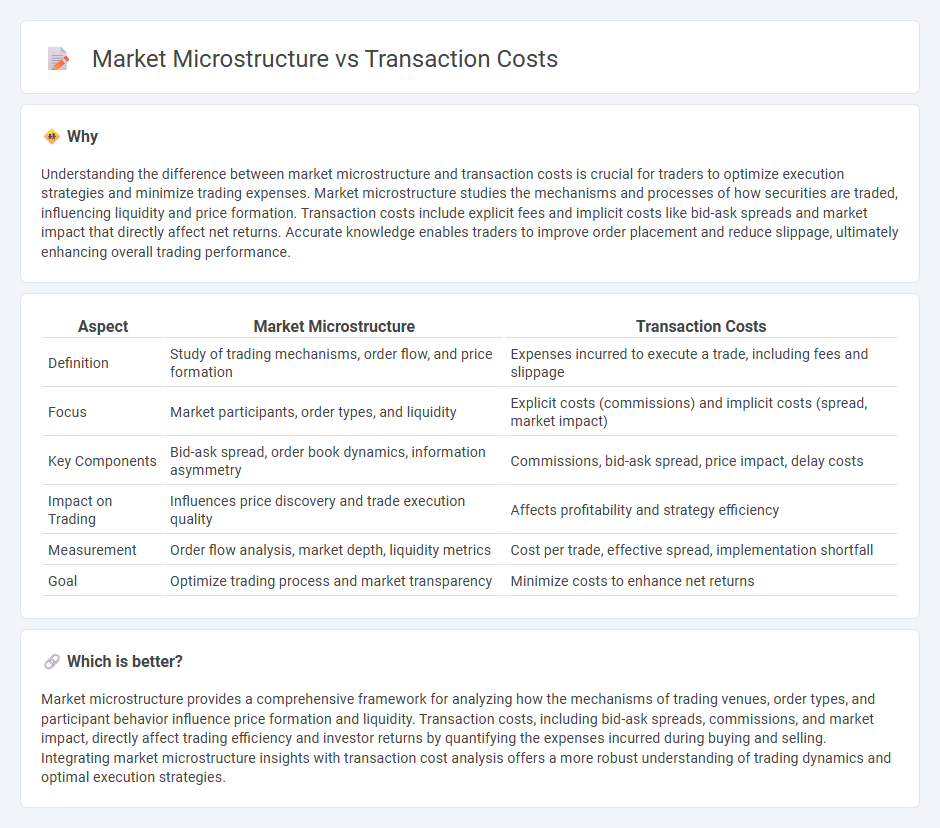

Understanding the difference between market microstructure and transaction costs is crucial for traders to optimize execution strategies and minimize trading expenses. Market microstructure studies the mechanisms and processes of how securities are traded, influencing liquidity and price formation. Transaction costs include explicit fees and implicit costs like bid-ask spreads and market impact that directly affect net returns. Accurate knowledge enables traders to improve order placement and reduce slippage, ultimately enhancing overall trading performance.

Comparison Table

| Aspect | Market Microstructure | Transaction Costs |

|---|---|---|

| Definition | Study of trading mechanisms, order flow, and price formation | Expenses incurred to execute a trade, including fees and slippage |

| Focus | Market participants, order types, and liquidity | Explicit costs (commissions) and implicit costs (spread, market impact) |

| Key Components | Bid-ask spread, order book dynamics, information asymmetry | Commissions, bid-ask spread, price impact, delay costs |

| Impact on Trading | Influences price discovery and trade execution quality | Affects profitability and strategy efficiency |

| Measurement | Order flow analysis, market depth, liquidity metrics | Cost per trade, effective spread, implementation shortfall |

| Goal | Optimize trading process and market transparency | Minimize costs to enhance net returns |

Which is better?

Market microstructure provides a comprehensive framework for analyzing how the mechanisms of trading venues, order types, and participant behavior influence price formation and liquidity. Transaction costs, including bid-ask spreads, commissions, and market impact, directly affect trading efficiency and investor returns by quantifying the expenses incurred during buying and selling. Integrating market microstructure insights with transaction cost analysis offers a more robust understanding of trading dynamics and optimal execution strategies.

Connection

Market microstructure directly influences transaction costs by shaping the trading environment, including the bid-ask spread, order processing, and price impact of trades. High market liquidity and efficient order execution reduce transaction costs, while fragmented markets and information asymmetry increase them. Understanding this connection is crucial for traders aiming to optimize execution strategies and minimize trading expenses.

Key Terms

Bid-Ask Spread

Bid-ask spread is a key component of transaction costs, reflecting the difference between the highest bid price and lowest ask price in financial markets. It directly influences market microstructure by affecting liquidity, trading volume, and price discovery efficiency. Explore how bid-ask spreads shape transaction costs in various market environments to understand their impact on trading strategies more deeply.

Order Flow

Transaction costs in financial markets are intricately linked to market microstructure, particularly through the lens of order flow, which reflects the buying and selling pressure and impacts bid-ask spreads and price impact metrics. Analyzing order flow provides insights into liquidity provision, market depth, and information asymmetry, all of which contribute to the overall cost of executing trades. Explore the dynamics of order flow to better understand how transaction costs evolve within different market environments.

Liquidity

Transaction costs, including bid-ask spreads, impact market microstructure by influencing liquidity levels in financial markets. High liquidity typically reduces transaction costs, enabling smoother trade execution and narrower spreads. Explore the dynamics between transaction costs and market microstructure to deepen your understanding of liquidity's role.

Source and External Links

Transaction costs explained - J.P. Morgan Asset Management - Transaction costs include explicit costs such as broker commissions, taxes, and fees, as well as implicit costs like price spreads or market impact; they arise when trading underlying investments and must be considered comprehensively under regulations like MiFID II.

Transaction Costs: A Definitive Guide (With Examples) | Indeed.com - Transaction costs are the expenses incurred by a buyer or seller during a transaction beyond the product or service price, including broker fees, labor, or shipping costs involved in facilitating the exchange.

Definition, Types, and Transaction Cost Economics - Transaction costs are sunk costs associated with economic transactions, including information costs (search and discovery), bargaining costs (contract negotiation), and enforcement costs (ensuring compliance), which explain why companies exist to reduce market inefficiencies.

dowidth.com

dowidth.com