Paper trading platforms simulate real market conditions allowing traders to practice strategies without financial risk, making them ideal for beginners and strategy testing. Web-based trading platforms offer direct access to live markets through browsers, providing real-time data, advanced tools, and seamless trade execution from any device. Explore the key differences and benefits to determine which platform suits your trading goals.

Why it is important

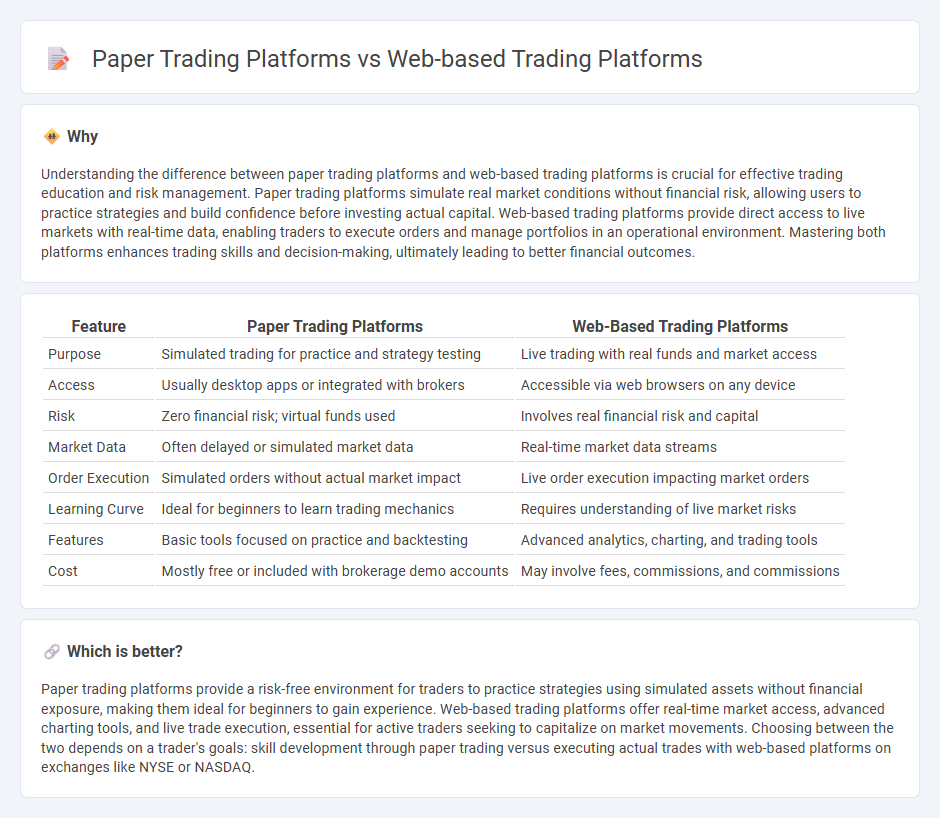

Understanding the difference between paper trading platforms and web-based trading platforms is crucial for effective trading education and risk management. Paper trading platforms simulate real market conditions without financial risk, allowing users to practice strategies and build confidence before investing actual capital. Web-based trading platforms provide direct access to live markets with real-time data, enabling traders to execute orders and manage portfolios in an operational environment. Mastering both platforms enhances trading skills and decision-making, ultimately leading to better financial outcomes.

Comparison Table

| Feature | Paper Trading Platforms | Web-Based Trading Platforms |

|---|---|---|

| Purpose | Simulated trading for practice and strategy testing | Live trading with real funds and market access |

| Access | Usually desktop apps or integrated with brokers | Accessible via web browsers on any device |

| Risk | Zero financial risk; virtual funds used | Involves real financial risk and capital |

| Market Data | Often delayed or simulated market data | Real-time market data streams |

| Order Execution | Simulated orders without actual market impact | Live order execution impacting market orders |

| Learning Curve | Ideal for beginners to learn trading mechanics | Requires understanding of live market risks |

| Features | Basic tools focused on practice and backtesting | Advanced analytics, charting, and trading tools |

| Cost | Mostly free or included with brokerage demo accounts | May involve fees, commissions, and commissions |

Which is better?

Paper trading platforms provide a risk-free environment for traders to practice strategies using simulated assets without financial exposure, making them ideal for beginners to gain experience. Web-based trading platforms offer real-time market access, advanced charting tools, and live trade execution, essential for active traders seeking to capitalize on market movements. Choosing between the two depends on a trader's goals: skill development through paper trading versus executing actual trades with web-based platforms on exchanges like NYSE or NASDAQ.

Connection

Paper trading platforms simulate real trading environments using virtual funds, enabling traders to practice strategies without financial risk. Web-based trading platforms provide access to live markets through internet browsers, offering real-time data and actual order execution. Integration between these platforms allows users to transition seamlessly from practice to live trading, utilizing shared interfaces and synchronized data feeds for consistency in experience.

Key Terms

Real-time Execution

Web-based trading platforms offer real-time execution with instantaneous order placement, market updates, and price fluctuations reflecting live market conditions. Paper trading platforms simulate trades without actual market interaction, lacking genuine real-time data and order execution but providing risk-free practice environments. Explore the distinct advantages of each platform type to optimize your trading strategy effectively.

Virtual Simulation

Web-based trading platforms offer real-time market data, interactive charts, and direct order execution, making them crucial for practicing live trading scenarios in virtual simulations. Paper trading platforms focus on simulated transactions without real financial risk, allowing users to test strategies and learn market mechanics with historical or delayed data. Explore in-depth comparisons to understand which platform best suits your virtual trading practice needs.

Market Connectivity

Web-based trading platforms offer real-time market connectivity with seamless access to live price feeds, order execution, and market depth, enhancing trading efficiency and responsiveness. Paper trading platforms simulate market conditions without direct linkages to live data, providing a risk-free environment for strategy testing but lacking dynamic market interaction. Explore our detailed comparison to understand how market connectivity impacts trading performance.

Source and External Links

Online Trading Apps and Platforms | E*TRADE - E*TRADE's Power E*TRADE Web is a top-rated, intuitive web-based trading platform with advanced tools for active, advanced, and aspiring investors, requiring no download and providing extensive research and trade options.

Best Online Trading Platforms In July 2025 - Bankrate - Leading web-based trading platforms in 2025 include Merrill Edge's MarketPro with customizable dashboards and advanced analytics, and Ally Invest offering robust charting and probability tools, suited for active traders.

Advanced Web Trading Platform - TradeStation - TradeStation's web platform offers no-download, browser-based trading with real-time data, powerful charting, and institutional-grade tools across stocks, options, futures, and futures options, with simulated trading environments available.

dowidth.com

dowidth.com