Volatility harvesting focuses on capitalizing on price fluctuations by systematically trading assets with high volatility, aiming to generate consistent returns from market movements. News-based trading relies on interpreting economic releases and breaking news to make short-term investment decisions driven by market sentiment and information flow. Explore deeper insights to understand which strategy aligns best with your trading goals.

Why it is important

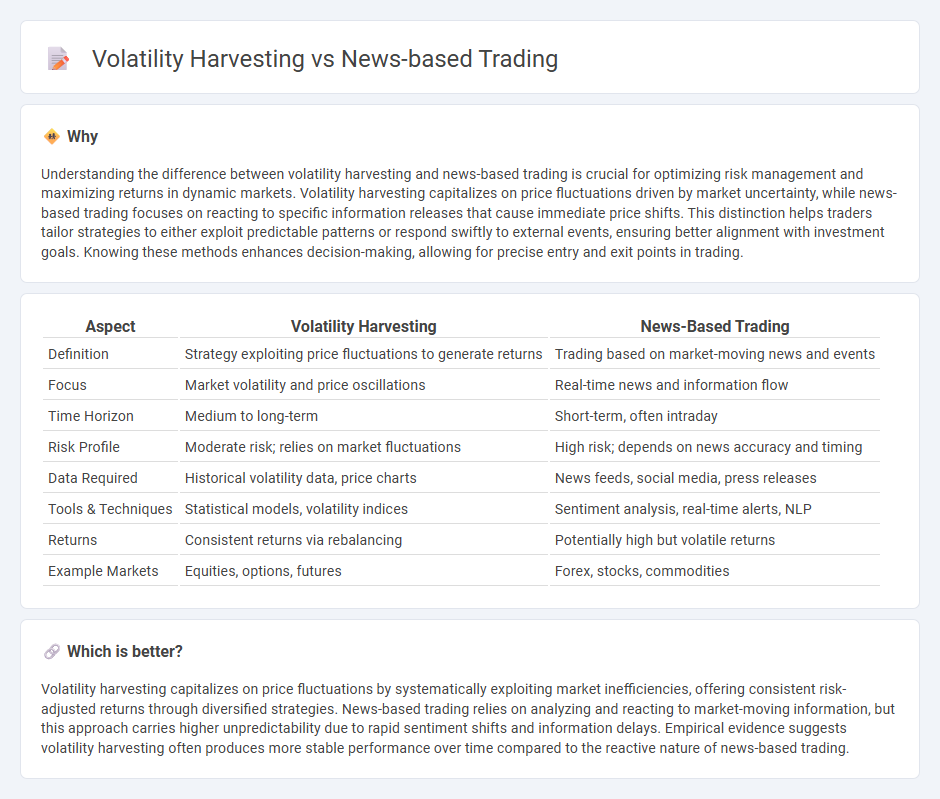

Understanding the difference between volatility harvesting and news-based trading is crucial for optimizing risk management and maximizing returns in dynamic markets. Volatility harvesting capitalizes on price fluctuations driven by market uncertainty, while news-based trading focuses on reacting to specific information releases that cause immediate price shifts. This distinction helps traders tailor strategies to either exploit predictable patterns or respond swiftly to external events, ensuring better alignment with investment goals. Knowing these methods enhances decision-making, allowing for precise entry and exit points in trading.

Comparison Table

| Aspect | Volatility Harvesting | News-Based Trading |

|---|---|---|

| Definition | Strategy exploiting price fluctuations to generate returns | Trading based on market-moving news and events |

| Focus | Market volatility and price oscillations | Real-time news and information flow |

| Time Horizon | Medium to long-term | Short-term, often intraday |

| Risk Profile | Moderate risk; relies on market fluctuations | High risk; depends on news accuracy and timing |

| Data Required | Historical volatility data, price charts | News feeds, social media, press releases |

| Tools & Techniques | Statistical models, volatility indices | Sentiment analysis, real-time alerts, NLP |

| Returns | Consistent returns via rebalancing | Potentially high but volatile returns |

| Example Markets | Equities, options, futures | Forex, stocks, commodities |

Which is better?

Volatility harvesting capitalizes on price fluctuations by systematically exploiting market inefficiencies, offering consistent risk-adjusted returns through diversified strategies. News-based trading relies on analyzing and reacting to market-moving information, but this approach carries higher unpredictability due to rapid sentiment shifts and information delays. Empirical evidence suggests volatility harvesting often produces more stable performance over time compared to the reactive nature of news-based trading.

Connection

Volatility harvesting leverages price fluctuations to generate consistent returns by systematically buying low and selling high during turbulent market conditions. News-based trading capitalizes on market-moving information releases to anticipate and react to price changes, often increasing short-term volatility. Combining both strategies enhances profit potential by exploiting the amplified price swings triggered by breaking news events.

Key Terms

**News-Based Trading:**

News-based trading leverages real-time market-moving information such as earnings reports, economic data releases, and geopolitical events to make rapid investment decisions aimed at capitalizing on price fluctuations. This strategy depends heavily on advanced algorithms and natural language processing to quickly analyze and react to unstructured news data before the market fully absorbs its impact. Explore how cutting-edge technologies and sentiment analysis transform news-based trading to gain a competitive edge in volatile markets.

Event-driven

Event-driven trading strategies capitalize on price movements triggered by specific news events, such as earnings reports, mergers, or regulatory announcements, leveraging market inefficiencies during heightened attention. Volatility harvesting, on the other hand, systematically exploits fluctuations in asset price volatility to generate returns, often independent of directional market moves. Explore the nuances and performance characteristics of these approaches to enhance your event-driven trading insights.

Sentiment analysis

News-based trading leverages real-time sentiment analysis extracted from financial news to predict short-term price movements, capitalizing on market reactions to breaking information. Volatility harvesting, however, utilizes volatility patterns and market sentiment indicators to strategically rebalance portfolios and generate returns through exploiting short-term fluctuations. Explore how advanced sentiment analysis tools can enhance your trading strategies and risk management in dynamic markets.

Source and External Links

News Based Trading - Quantra by QuantInsti - News-based trading is a strategy where traders capitalize on temporary mispricing in securities caused by events or news not yet reflected in prices, often using algorithms to quantify sentiment and make trading decisions.

News Trading Strategies | How To Trade The News | AvaTrade - News trading seeks to exploit market opportunities triggered by economic data releases or headlines, focusing on short-term price moves caused by specific news events rather than broader fundamental analysis.

Trading the news - Wikipedia - Trading the news involves buying or selling financial instruments immediately following events like earnings announcements or economic reports, with methods ranging from manual trading to automated algorithmic systems scanning live news feeds for actionable information.

dowidth.com

dowidth.com