Social copy trading allows investors to replicate the trades of experienced professionals in real-time, leveraging collective market insights and reducing the need for personal market analysis. Discretionary trading relies on the trader's expertise, judgment, and intuition to make decisions, offering flexibility but requiring deep market knowledge and risk management skills. Explore the advantages and risks of both approaches to determine the best trading strategy for your financial goals.

Why it is important

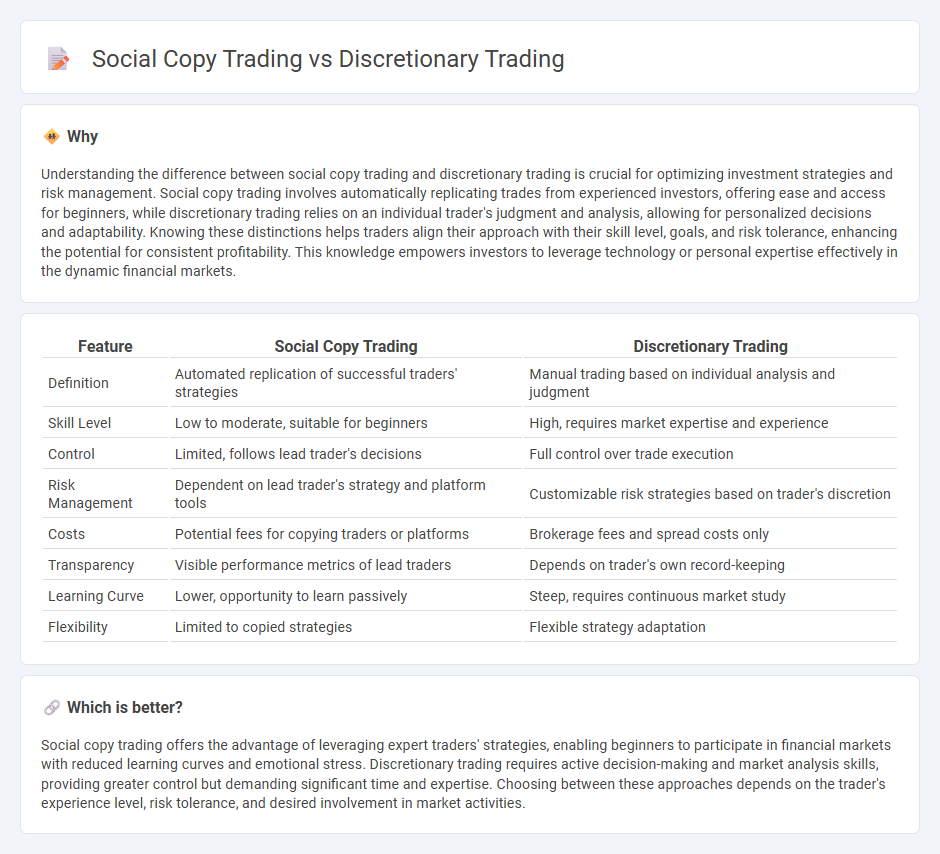

Understanding the difference between social copy trading and discretionary trading is crucial for optimizing investment strategies and risk management. Social copy trading involves automatically replicating trades from experienced investors, offering ease and access for beginners, while discretionary trading relies on an individual trader's judgment and analysis, allowing for personalized decisions and adaptability. Knowing these distinctions helps traders align their approach with their skill level, goals, and risk tolerance, enhancing the potential for consistent profitability. This knowledge empowers investors to leverage technology or personal expertise effectively in the dynamic financial markets.

Comparison Table

| Feature | Social Copy Trading | Discretionary Trading |

|---|---|---|

| Definition | Automated replication of successful traders' strategies | Manual trading based on individual analysis and judgment |

| Skill Level | Low to moderate, suitable for beginners | High, requires market expertise and experience |

| Control | Limited, follows lead trader's decisions | Full control over trade execution |

| Risk Management | Dependent on lead trader's strategy and platform tools | Customizable risk strategies based on trader's discretion |

| Costs | Potential fees for copying traders or platforms | Brokerage fees and spread costs only |

| Transparency | Visible performance metrics of lead traders | Depends on trader's own record-keeping |

| Learning Curve | Lower, opportunity to learn passively | Steep, requires continuous market study |

| Flexibility | Limited to copied strategies | Flexible strategy adaptation |

Which is better?

Social copy trading offers the advantage of leveraging expert traders' strategies, enabling beginners to participate in financial markets with reduced learning curves and emotional stress. Discretionary trading requires active decision-making and market analysis skills, providing greater control but demanding significant time and expertise. Choosing between these approaches depends on the trader's experience level, risk tolerance, and desired involvement in market activities.

Connection

Social copy trading and discretionary trading are interconnected through the replication of expert traders' decisions by followers in real time. Discretionary traders rely on their judgment and experience to make trading choices, which social copy trading platforms automatically mirror for other investors. This connection allows less experienced traders to benefit from the strategic insights and market analysis of seasoned discretionary traders.

Key Terms

Decision-making autonomy

Discretionary trading grants investors full decision-making autonomy, allowing traders to rely on personal analysis and judgment when executing trades. In contrast, social copy trading enables users to replicate the strategies of experienced traders, which limits individual control but offers the advantage of leveraging expert insights. Explore the nuances and benefits of both approaches to optimize your trading strategy.

Trade signal source

Discretionary trading relies on the trader's personal analysis and judgment to generate trade signals, using factors like market trends, news, and technical indicators. Social copy trading obtains trade signals from experienced traders or trading communities, allowing followers to replicate their strategies automatically or manually. Explore the advantages and sources of trade signals in different trading methods to make informed decisions.

Performance accountability

Discretionary trading relies on individual decision-making based on market analysis, where traders bear full responsibility for their performance outcomes. Social copy trading involves replicating the trades of experienced traders, distributing accountability and reducing personal risk exposure. Explore the key differences to understand which approach better aligns with your investment goals.

Source and External Links

Systematic vs. Discretionary Trading Strategies - Discretionary trading depends on the trader's judgment, experience, and intuition, allowing flexible real-time adaptations in entry/exit points and position sizing but carries risks of emotional influence and inconsistency, especially for less experienced traders.

What is discretionary trading? | FBS Glossary - Discretionary trading lets traders control trades based on intuition and market understanding rather than strict rules, offering high adaptability and potential profitability but requiring experience and risking emotional decision-making.

What Is Discretionary Trading and How Does It Differ from Algorithmic Trading? - Discretionary trading relies on human judgment, experience, and qualitative analysis, enabling flexibility to quickly respond to market changes with decisions influenced by intuition and subjective factors.

dowidth.com

dowidth.com