Option selling wheel strategy generates consistent income by repeatedly selling options and managing assignments, ideal for traders seeking steady cash flow with moderate risk. Butterfly spread limits risk and potential profit through a combination of buying and selling options at different strike prices, offering precise control over payoff structure. Explore detailed comparisons to decide which strategy best suits your trading goals and risk tolerance.

Why it is important

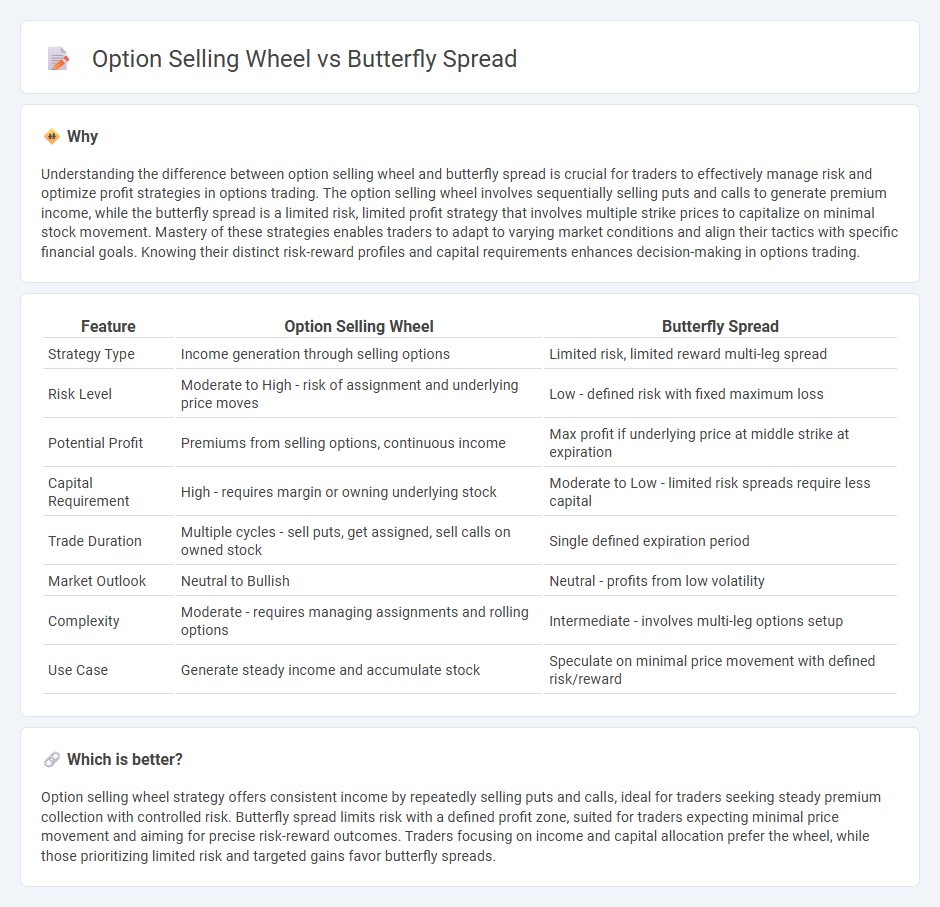

Understanding the difference between option selling wheel and butterfly spread is crucial for traders to effectively manage risk and optimize profit strategies in options trading. The option selling wheel involves sequentially selling puts and calls to generate premium income, while the butterfly spread is a limited risk, limited profit strategy that involves multiple strike prices to capitalize on minimal stock movement. Mastery of these strategies enables traders to adapt to varying market conditions and align their tactics with specific financial goals. Knowing their distinct risk-reward profiles and capital requirements enhances decision-making in options trading.

Comparison Table

| Feature | Option Selling Wheel | Butterfly Spread |

|---|---|---|

| Strategy Type | Income generation through selling options | Limited risk, limited reward multi-leg spread |

| Risk Level | Moderate to High - risk of assignment and underlying price moves | Low - defined risk with fixed maximum loss |

| Potential Profit | Premiums from selling options, continuous income | Max profit if underlying price at middle strike at expiration |

| Capital Requirement | High - requires margin or owning underlying stock | Moderate to Low - limited risk spreads require less capital |

| Trade Duration | Multiple cycles - sell puts, get assigned, sell calls on owned stock | Single defined expiration period |

| Market Outlook | Neutral to Bullish | Neutral - profits from low volatility |

| Complexity | Moderate - requires managing assignments and rolling options | Intermediate - involves multi-leg options setup |

| Use Case | Generate steady income and accumulate stock | Speculate on minimal price movement with defined risk/reward |

Which is better?

Option selling wheel strategy offers consistent income by repeatedly selling puts and calls, ideal for traders seeking steady premium collection with controlled risk. Butterfly spread limits risk with a defined profit zone, suited for traders expecting minimal price movement and aiming for precise risk-reward outcomes. Traders focusing on income and capital allocation prefer the wheel, while those prioritizing limited risk and targeted gains favor butterfly spreads.

Connection

Option selling, wheel strategy, and butterfly spread are connected as advanced trading techniques that capitalize on different aspects of options pricing and market behaviors. The wheel strategy focuses on generating income through selling options, primarily puts and calls, by systematically rolling positions, while the butterfly spread uses multiple strike prices to limit risk and maximize potential profit from minimal price movement. Both strategies employ option selling to manage risk and enhance returns, with the wheel emphasizing consistent premium collection and the butterfly aiming for precision in price targets.

Key Terms

Strike Price

Butterfly spreads involve simultaneously buying and selling options at three strike prices, with the middle strike price typically close to the current underlying asset price to capitalize on low volatility. Option selling wheel strategy focuses on repeatedly selling cash-secured puts at lower strike prices, then selling covered calls at higher strikes if assigned, prioritizing strike prices that balance premium income and risk management. Explore detailed strike price selection tactics in both strategies to optimize returns.

Premium

Butterfly spread strategies optimize premium by simultaneously buying and selling options at different strike prices, minimizing net cost while capping risk and reward. Option selling wheel generates consistent premium through systematic selling of puts and calls, aiming for steady income with potential assignment risk. Explore detailed comparisons to understand which premium strategy aligns with your trading goals.

Assignment

Butterfly spread limits assignment risk by involving simultaneous buying and selling of call or put options at different strike prices, reducing exposure to early assignment due to its neutral to limited risk profile. The option selling wheel strategy, involving selling cash-secured puts and covered calls, carries higher assignment risk as investors are more likely to be assigned shares during the put or call exercise, especially near expiration. To deepen your understanding of assignment risks and strategy optimization, explore detailed option management techniques.

Source and External Links

Understanding the butterfly spread option strategy - Saxo Bank - A butterfly spread is an advanced options strategy involving buying and selling options at three different strike prices to profit from the underlying asset's price remaining stable at the middle strike price while limiting risk at the wings.

Mastering Butterfly Spread - The butterfly spread combines three options with the same expiration but different strike prices, designed to benefit from price stability within a defined range and includes two main variations: long and short butterfly spreads.

Long Butterfly Spread - A long butterfly spread profits most when the underlying expires exactly at the middle strike price and involves selling two options at this price while buying options at the lower and higher strikes, offering limited risk and reward.

dowidth.com

dowidth.com