Altcoin sniping focuses on capitalizing on immediate price spikes by executing rapid, high-frequency trades shortly after new coin listings or significant market events. Trend following involves identifying and riding sustained market movements over time, leveraging technical indicators to enter and exit positions based on established price momentum. Explore comprehensive strategies and tools to optimize your altcoin trading approach.

Why it is important

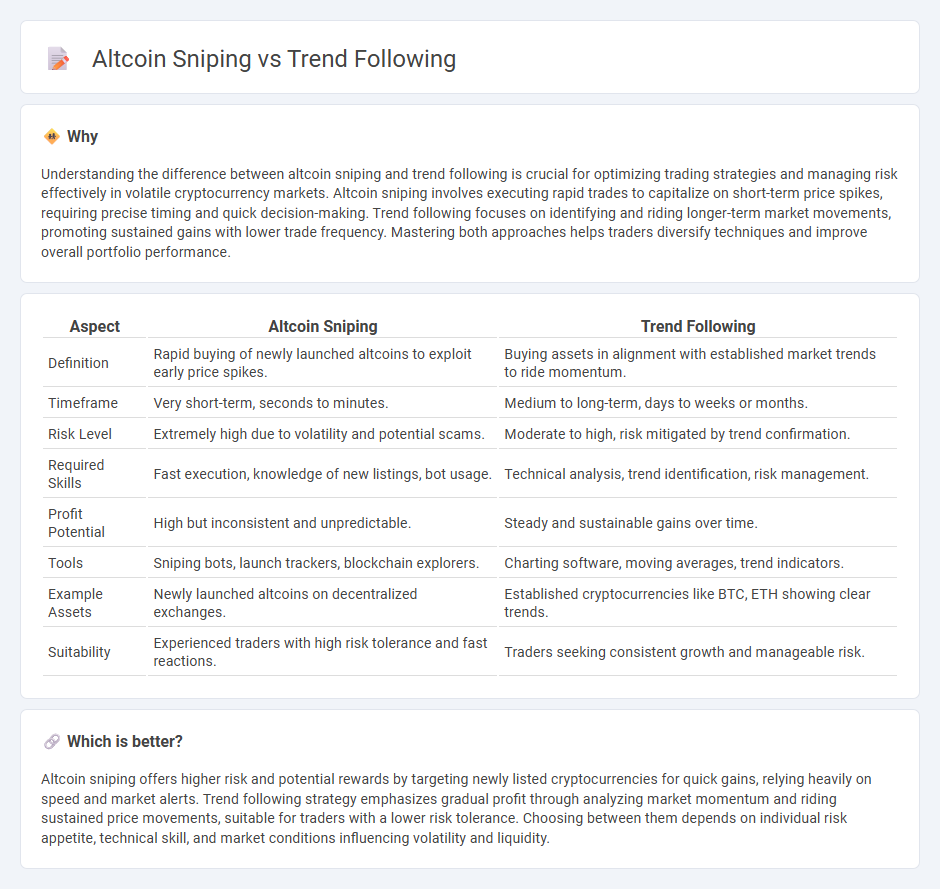

Understanding the difference between altcoin sniping and trend following is crucial for optimizing trading strategies and managing risk effectively in volatile cryptocurrency markets. Altcoin sniping involves executing rapid trades to capitalize on short-term price spikes, requiring precise timing and quick decision-making. Trend following focuses on identifying and riding longer-term market movements, promoting sustained gains with lower trade frequency. Mastering both approaches helps traders diversify techniques and improve overall portfolio performance.

Comparison Table

| Aspect | Altcoin Sniping | Trend Following |

|---|---|---|

| Definition | Rapid buying of newly launched altcoins to exploit early price spikes. | Buying assets in alignment with established market trends to ride momentum. |

| Timeframe | Very short-term, seconds to minutes. | Medium to long-term, days to weeks or months. |

| Risk Level | Extremely high due to volatility and potential scams. | Moderate to high, risk mitigated by trend confirmation. |

| Required Skills | Fast execution, knowledge of new listings, bot usage. | Technical analysis, trend identification, risk management. |

| Profit Potential | High but inconsistent and unpredictable. | Steady and sustainable gains over time. |

| Tools | Sniping bots, launch trackers, blockchain explorers. | Charting software, moving averages, trend indicators. |

| Example Assets | Newly launched altcoins on decentralized exchanges. | Established cryptocurrencies like BTC, ETH showing clear trends. |

| Suitability | Experienced traders with high risk tolerance and fast reactions. | Traders seeking consistent growth and manageable risk. |

Which is better?

Altcoin sniping offers higher risk and potential rewards by targeting newly listed cryptocurrencies for quick gains, relying heavily on speed and market alerts. Trend following strategy emphasizes gradual profit through analyzing market momentum and riding sustained price movements, suitable for traders with a lower risk tolerance. Choosing between them depends on individual risk appetite, technical skill, and market conditions influencing volatility and liquidity.

Connection

Altcoin sniping and trend following are connected through their reliance on market momentum and price action signals to make profitable trades. Altcoin sniping involves quickly capitalizing on newly listed or rapidly moving altcoins by identifying early bullish trends, while trend following focuses on confirming and riding sustained price movements across various assets. Both strategies utilize technical indicators such as moving averages and volume spikes to optimize entry and exit points in volatile cryptocurrency markets.

Key Terms

**Trend Following:**

Trend following leverages technical analysis tools such as moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify and capitalize on sustained price movements in cryptocurrency markets. This strategy minimizes risk by entering positions aligned with established market momentum, primarily targeting Bitcoin and high-cap altcoins with consistent liquidity. Explore in-depth methodologies and optimized trading tactics for effective trend following.

Moving Average

Trend following using Moving Average strategies involves analyzing price trends over specific periods to identify asset momentum and potential entry or exit points, emphasizing market stability and long-term gains. Altcoin sniping leverages the Moving Average for rapid, high-risk trades on newly launched or volatile altcoins, aiming to capitalize on sudden price movements and short-term opportunities. Explore these techniques in depth to optimize your cryptocurrency trading strategies.

Breakout

Trend following leverages sustained price momentum by entering positions during clearly defined upward or downward movements, while altcoin sniping concentrates on capturing rapid price spikes at breakout points immediately after listing or announcement. Breakout-focused strategies emphasize identifying key resistance and support levels to time entries precisely, maximizing potential profits from sudden volatility in altcoin markets. Explore detailed insights on breakout techniques to enhance your trading effectiveness and capitalize on market shifts.

Source and External Links

Trend following - Wikipedia - Trend following is a trading strategy that buys assets when their price trends upward and sells when the trend goes downward, using techniques like moving averages and channel breakouts to identify trends, without attempting to predict exact price levels.

Trend Following Trading Strategies and Systems (Backtest Results) - Trend following strategies rely on technical analysis to enter trades aligned with existing market momentum and exit on reversals, emphasizing systematic rules, risk management, and diversification across asset classes, with examples including ATR and Bollinger Channel breakout methods.

Trend-Following Primer - Graham Capital Management - As a major alternative investment strategy managing over $300 billion, trend following employs systematic, algorithmic models to capture price trends by taking long or short positions in diverse liquid markets, serving as an effective portfolio diversifier with potential to perform in rising and falling markets.

dowidth.com

dowidth.com