Microstructure modeling analyzes the detailed mechanisms of order flow and price formation within financial markets, focusing on how trades impact asset prices and liquidity. Limit order book simulation replicates the dynamic interactions of buy and sell orders, capturing order placement, cancellation, and execution to study market behavior. Explore more to understand the nuances and applications of these approaches in trading strategy development.

Why it is important

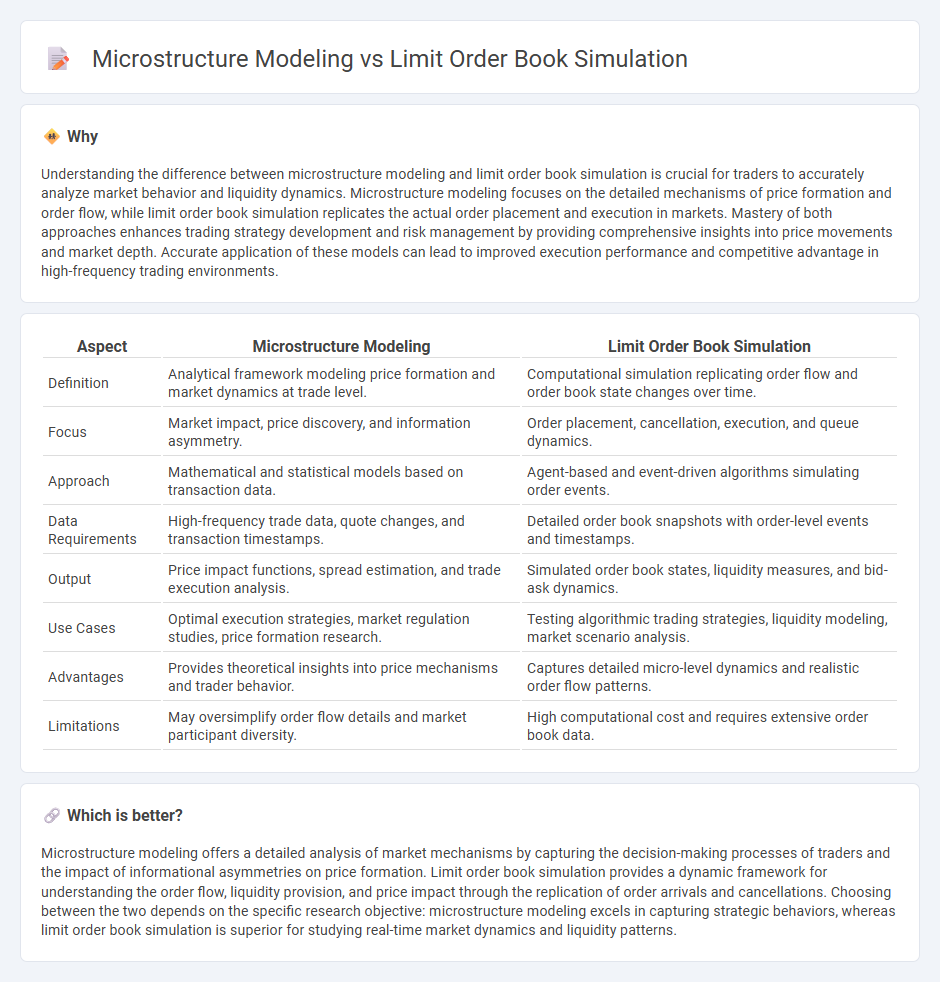

Understanding the difference between microstructure modeling and limit order book simulation is crucial for traders to accurately analyze market behavior and liquidity dynamics. Microstructure modeling focuses on the detailed mechanisms of price formation and order flow, while limit order book simulation replicates the actual order placement and execution in markets. Mastery of both approaches enhances trading strategy development and risk management by providing comprehensive insights into price movements and market depth. Accurate application of these models can lead to improved execution performance and competitive advantage in high-frequency trading environments.

Comparison Table

| Aspect | Microstructure Modeling | Limit Order Book Simulation |

|---|---|---|

| Definition | Analytical framework modeling price formation and market dynamics at trade level. | Computational simulation replicating order flow and order book state changes over time. |

| Focus | Market impact, price discovery, and information asymmetry. | Order placement, cancellation, execution, and queue dynamics. |

| Approach | Mathematical and statistical models based on transaction data. | Agent-based and event-driven algorithms simulating order events. |

| Data Requirements | High-frequency trade data, quote changes, and transaction timestamps. | Detailed order book snapshots with order-level events and timestamps. |

| Output | Price impact functions, spread estimation, and trade execution analysis. | Simulated order book states, liquidity measures, and bid-ask dynamics. |

| Use Cases | Optimal execution strategies, market regulation studies, price formation research. | Testing algorithmic trading strategies, liquidity modeling, market scenario analysis. |

| Advantages | Provides theoretical insights into price mechanisms and trader behavior. | Captures detailed micro-level dynamics and realistic order flow patterns. |

| Limitations | May oversimplify order flow details and market participant diversity. | High computational cost and requires extensive order book data. |

Which is better?

Microstructure modeling offers a detailed analysis of market mechanisms by capturing the decision-making processes of traders and the impact of informational asymmetries on price formation. Limit order book simulation provides a dynamic framework for understanding the order flow, liquidity provision, and price impact through the replication of order arrivals and cancellations. Choosing between the two depends on the specific research objective: microstructure modeling excels in capturing strategic behaviors, whereas limit order book simulation is superior for studying real-time market dynamics and liquidity patterns.

Connection

Microstructure modeling focuses on understanding the detailed mechanisms of trade execution, price formation, and order flow dynamics within financial markets. Limit order book simulation replicates the continuous flow of buy and sell orders, capturing the state of supply and demand at various price levels. Together, these approaches provide insights into market liquidity, price impact, and trading strategies by analyzing the real-time interaction between orders and market participants.

Key Terms

Order Matching Algorithm

The order matching algorithm is central to both limit order book simulation and microstructure modeling, dictating how buy and sell orders are paired based on price-time priority and market rules. Limit order books simulate the dynamic process of order submissions, cancellations, and executions, capturing the evolving depth and liquidity of the market, while microstructure models analyze the impact of these matching mechanisms on price formation and market efficiency. Explore in-depth how varying order matching algorithms influence market behavior and trading outcomes.

Bid-Ask Spread

Limit order book simulation provides detailed, agent-based replication of market dynamics, capturing real-time order flow and liquidity variations influencing the Bid-Ask Spread. Microstructure modeling uses mathematical frameworks, such as the Glosten-Milgrom or Kyle models, to analyze the informational and strategic components driving spread formation. Explore deeper insights into how these approaches uniquely reveal market liquidity and price discovery mechanisms.

Agent-Based Modeling

Limit order book simulation provides a granular view of order submissions, cancellations, and executions, capturing the dynamic interaction of buy and sell orders in a market. Microstructure modeling, particularly through Agent-Based Modeling, emphasizes the strategic behavior of heterogeneous agents, allowing for the exploration of emergent phenomena like price formation and volatility clustering. Explore deeper insights into how Agent-Based Models reveal complex market dynamics beyond traditional simulation techniques.

Source and External Links

A stochastic model for order book dynamics - This paper proposes a continuous-time stochastic model for limit order book dynamics that balances analytical tractability and realistic simulation of order arrivals, executions, and cancellations.

Simulating Limit Order Book Models | Samuel Watts - Describes simulation of limit order book models using two-part software: one to maintain and update the book state and one to generate order arrivals via Poisson processes, implementing models like Cont's to realistically simulate order placement and execution.

Limit Order Book Simulation with Generative Adversarial Networks - Introduces a nonparametric GAN-based method to simulate limit order book dynamics that captures stylized market facts and reproduces market impact effects more realistically than traditional models.

dowidth.com

dowidth.com