Quantitative momentum trading leverages historical price trends and statistical models to identify assets exhibiting strong performance patterns likely to persist, emphasizing systematic rule-based strategies. Machine learning trading employs advanced algorithms and neural networks to analyze vast datasets, uncovering complex, nonlinear patterns for adaptive market predictions and decision-making. Explore how these approaches revolutionize trading strategies and portfolio optimization.

Why it is important

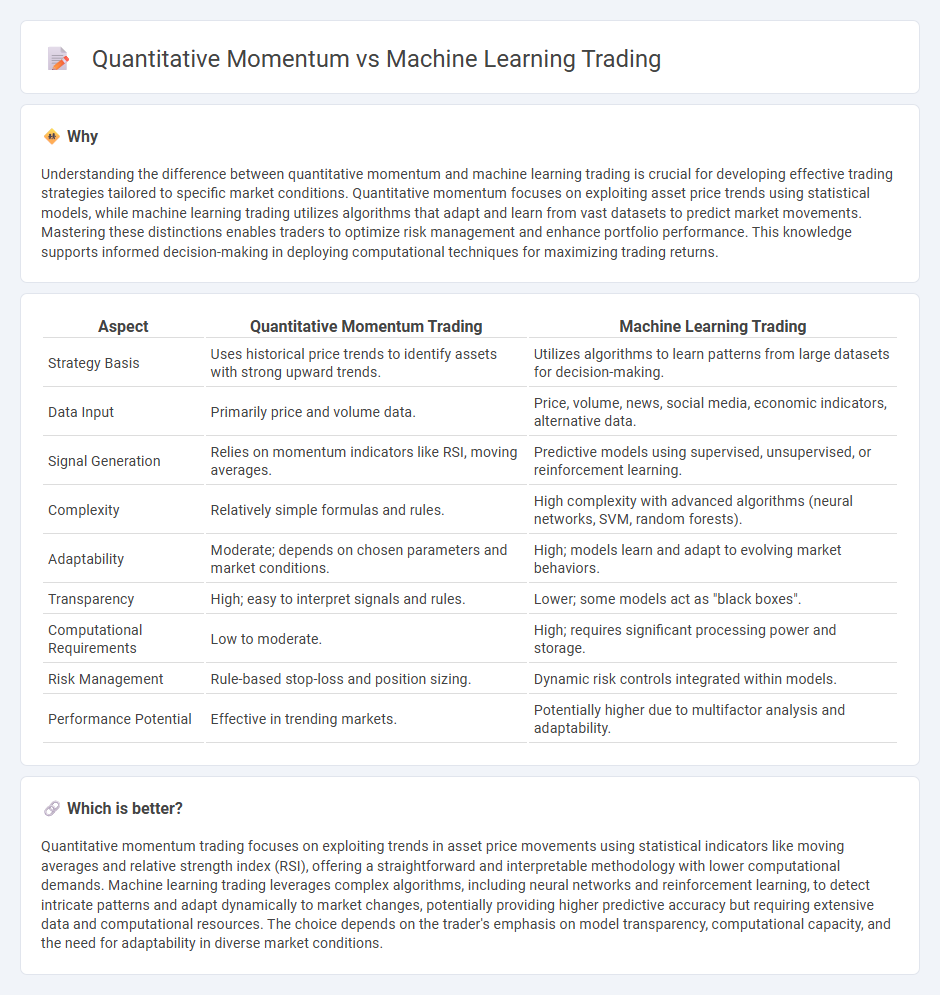

Understanding the difference between quantitative momentum and machine learning trading is crucial for developing effective trading strategies tailored to specific market conditions. Quantitative momentum focuses on exploiting asset price trends using statistical models, while machine learning trading utilizes algorithms that adapt and learn from vast datasets to predict market movements. Mastering these distinctions enables traders to optimize risk management and enhance portfolio performance. This knowledge supports informed decision-making in deploying computational techniques for maximizing trading returns.

Comparison Table

| Aspect | Quantitative Momentum Trading | Machine Learning Trading |

|---|---|---|

| Strategy Basis | Uses historical price trends to identify assets with strong upward trends. | Utilizes algorithms to learn patterns from large datasets for decision-making. |

| Data Input | Primarily price and volume data. | Price, volume, news, social media, economic indicators, alternative data. |

| Signal Generation | Relies on momentum indicators like RSI, moving averages. | Predictive models using supervised, unsupervised, or reinforcement learning. |

| Complexity | Relatively simple formulas and rules. | High complexity with advanced algorithms (neural networks, SVM, random forests). |

| Adaptability | Moderate; depends on chosen parameters and market conditions. | High; models learn and adapt to evolving market behaviors. |

| Transparency | High; easy to interpret signals and rules. | Lower; some models act as "black boxes". |

| Computational Requirements | Low to moderate. | High; requires significant processing power and storage. |

| Risk Management | Rule-based stop-loss and position sizing. | Dynamic risk controls integrated within models. |

| Performance Potential | Effective in trending markets. | Potentially higher due to multifactor analysis and adaptability. |

Which is better?

Quantitative momentum trading focuses on exploiting trends in asset price movements using statistical indicators like moving averages and relative strength index (RSI), offering a straightforward and interpretable methodology with lower computational demands. Machine learning trading leverages complex algorithms, including neural networks and reinforcement learning, to detect intricate patterns and adapt dynamically to market changes, potentially providing higher predictive accuracy but requiring extensive data and computational resources. The choice depends on the trader's emphasis on model transparency, computational capacity, and the need for adaptability in diverse market conditions.

Connection

Quantitative momentum trading leverages mathematical models to identify stocks showing strong price trends, while machine learning algorithms enhance these models by analyzing vast datasets to predict momentum shifts more accurately. Integrating machine learning allows for adaptive strategies that continuously learn from market patterns, improving momentum signal detection and trade execution. This synergy enables traders to capitalize on transient price movements with higher precision and reduced risk.

Key Terms

**Machine Learning Trading:**

Machine learning trading leverages algorithms and vast datasets to identify complex patterns and make predictive decisions in financial markets, enhancing the accuracy of trade execution and risk management. It continuously adapts to new market conditions by improving its models through real-time data analysis, outperforming traditional quantitative momentum strategies that rely on fixed indicators and historical price trends. Explore the latest advancements in machine learning trading to understand its transformative impact on algorithmic finance.

Feature Engineering

Feature engineering is crucial in machine learning trading, where selecting and transforming datasets enhances model prediction accuracy across diverse market conditions. In quantitative momentum strategies, feature engineering emphasizes identifying and refining price trend indicators to optimize trade timing and signal strength. Explore further to understand how tailored feature engineering impacts trading strategy performance and profitability.

Model Training

Machine learning trading relies on complex algorithms and large datasets for model training, enabling adaptive prediction of market trends through pattern recognition and feature extraction. Quantitative momentum strategies typically use simpler statistical models and historical price momentum indicators to guide trading decisions, focusing on identifying trends with less computational intensity. Explore the nuances of model training in each approach to enhance your trading strategy formulation.

Source and External Links

What is Machine Learning in Trading? Examples and Types - Machine learning in trading involves using supervised, unsupervised, and reinforcement learning to forecast stock prices, find hidden patterns, and make trading decisions that maximize profits, particularly applied in markets like the Indian stock market.

stefan-jansen/machine-learning-for-trading - This resource and book provide a comprehensive practical guide on applying a wide range of machine learning techniques, from linear regression to deep reinforcement learning, to algorithmic trading strategies including data sourcing, feature engineering, backtesting, and portfolio management.

Machine Learning for Trading - A detailed workflow for machine learning-driven trading strategies covering data sourcing, feature engineering, supervised and unsupervised learning, and deep learning applications like combining text and price data to improve predictions and train trading agents using reinforcement learning.

dowidth.com

dowidth.com