Perpetual swaps and warrants are distinct financial instruments used in trading, each offering unique mechanisms and risk profiles. Perpetual swaps provide continuous exposure to an underlying asset without expiry, enabling traders to speculate on price movements with leverage, while warrants grant the right, but not the obligation, to buy or sell an asset at a predetermined price before expiration. Explore their differences in detail to optimize your trading strategy and risk management.

Why it is important

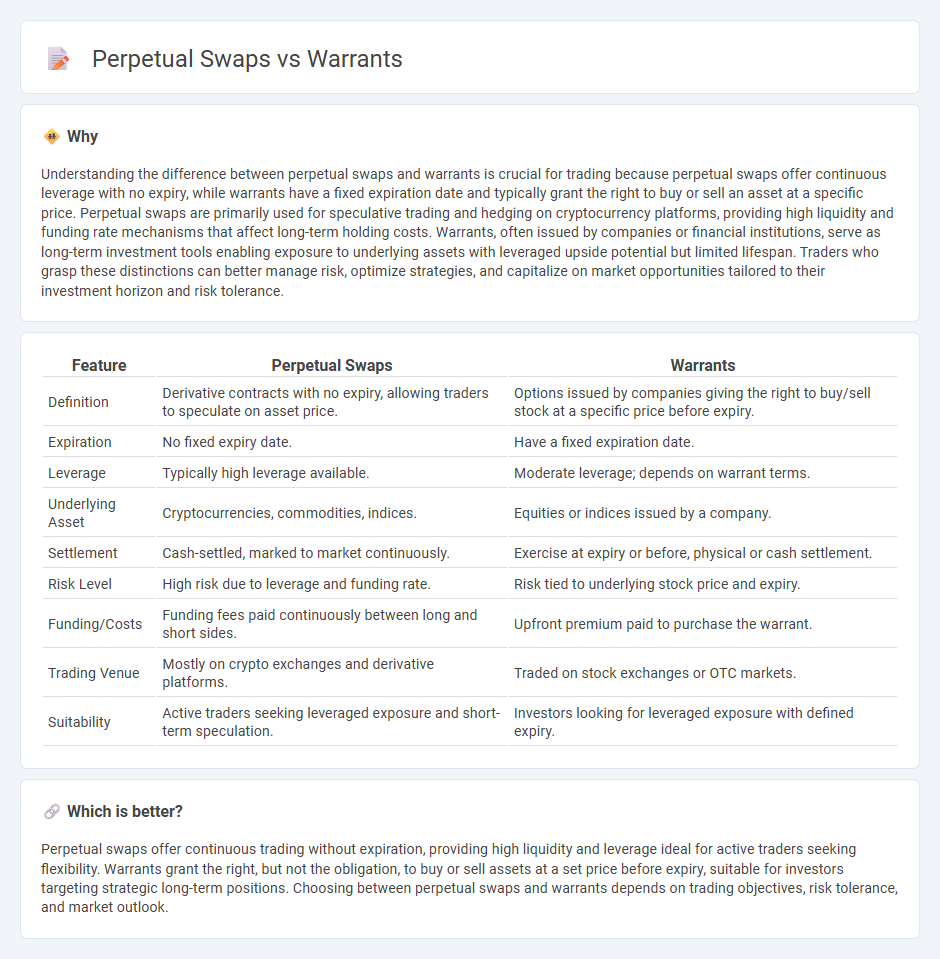

Understanding the difference between perpetual swaps and warrants is crucial for trading because perpetual swaps offer continuous leverage with no expiry, while warrants have a fixed expiration date and typically grant the right to buy or sell an asset at a specific price. Perpetual swaps are primarily used for speculative trading and hedging on cryptocurrency platforms, providing high liquidity and funding rate mechanisms that affect long-term holding costs. Warrants, often issued by companies or financial institutions, serve as long-term investment tools enabling exposure to underlying assets with leveraged upside potential but limited lifespan. Traders who grasp these distinctions can better manage risk, optimize strategies, and capitalize on market opportunities tailored to their investment horizon and risk tolerance.

Comparison Table

| Feature | Perpetual Swaps | Warrants |

|---|---|---|

| Definition | Derivative contracts with no expiry, allowing traders to speculate on asset price. | Options issued by companies giving the right to buy/sell stock at a specific price before expiry. |

| Expiration | No fixed expiry date. | Have a fixed expiration date. |

| Leverage | Typically high leverage available. | Moderate leverage; depends on warrant terms. |

| Underlying Asset | Cryptocurrencies, commodities, indices. | Equities or indices issued by a company. |

| Settlement | Cash-settled, marked to market continuously. | Exercise at expiry or before, physical or cash settlement. |

| Risk Level | High risk due to leverage and funding rate. | Risk tied to underlying stock price and expiry. |

| Funding/Costs | Funding fees paid continuously between long and short sides. | Upfront premium paid to purchase the warrant. |

| Trading Venue | Mostly on crypto exchanges and derivative platforms. | Traded on stock exchanges or OTC markets. |

| Suitability | Active traders seeking leveraged exposure and short-term speculation. | Investors looking for leveraged exposure with defined expiry. |

Which is better?

Perpetual swaps offer continuous trading without expiration, providing high liquidity and leverage ideal for active traders seeking flexibility. Warrants grant the right, but not the obligation, to buy or sell assets at a set price before expiry, suitable for investors targeting strategic long-term positions. Choosing between perpetual swaps and warrants depends on trading objectives, risk tolerance, and market outlook.

Connection

Perpetual swaps and warrants are connected as derivative instruments that enable traders to speculate on asset price movements without owning the underlying asset. Perpetual swaps offer continuous exposure with no expiration date, allowing leveraged trading on cryptocurrency or other financial markets, while warrants provide the right to buy or sell an asset at a specific price within a set timeframe. Both tools enhance market liquidity and offer strategic opportunities for hedging and profit maximization in trading portfolios.

Key Terms

Expiry Date

Warrants have a fixed expiry date that determines the last day holders can exercise their rights to buy or sell the underlying asset, adding time sensitivity to their trading strategies. Perpetual swaps, on the other hand, do not have an expiration date, allowing traders to hold positions indefinitely while paying or receiving funding fees periodically. Explore the evolving landscape of these derivatives to understand how expiry impacts trading flexibility and risk management.

Leverage

Warrants offer leveraged exposure by allowing investors to control a larger number of shares with a smaller capital outlay, though their leverage is limited by strike prices and expiration dates. Perpetual swaps provide continuous, often higher leverage through margin trading without expiry, enabling traders to amplify positions but with increased risk of liquidation. Explore detailed comparisons to understand the optimal leverage strategy for your investment goals.

Settlement Method

Warrants typically settle through physical delivery or cash settlement based on the underlying asset's price at expiration, while perpetual swaps are settled in cash continuously, reflecting the differential between the contract price and the spot price. Warrants have a defined expiration date influencing settlement timing, whereas perpetual swaps have no expiration and employ periodic funding rates to maintain price alignment. Explore deeper insights into how settlement methods impact risk and trading strategies in these derivatives.

Source and External Links

Warrant (law) - A warrant is a legal order issued by a judge or magistrate authorizing law enforcement to perform specific actions such as arrest, search, or seizure, with types including arrest warrants, search warrants, and execution warrants.

warrant | Wex | US Law | LII / Legal Information Institute - A warrant is a writ allowing law enforcement to arrest, search, or seize property, typically based on probable cause and legal standards to protect individual rights.

Warrant (finance) - In finance, a warrant is a security giving the holder the right to buy or sell stock at a fixed price, often issued with bonds or traded independently as a financial instrument.

dowidth.com

dowidth.com