Altcoin sniping involves swiftly purchasing new, undervalued cryptocurrencies immediately after launch to capitalize on early price spikes. Liquidity sniping focuses on targeting fresh liquidity pools on decentralized exchanges to exploit price discrepancies and earn quick profits. Explore deeper insights to master these high-speed trading strategies effectively.

Why it is important

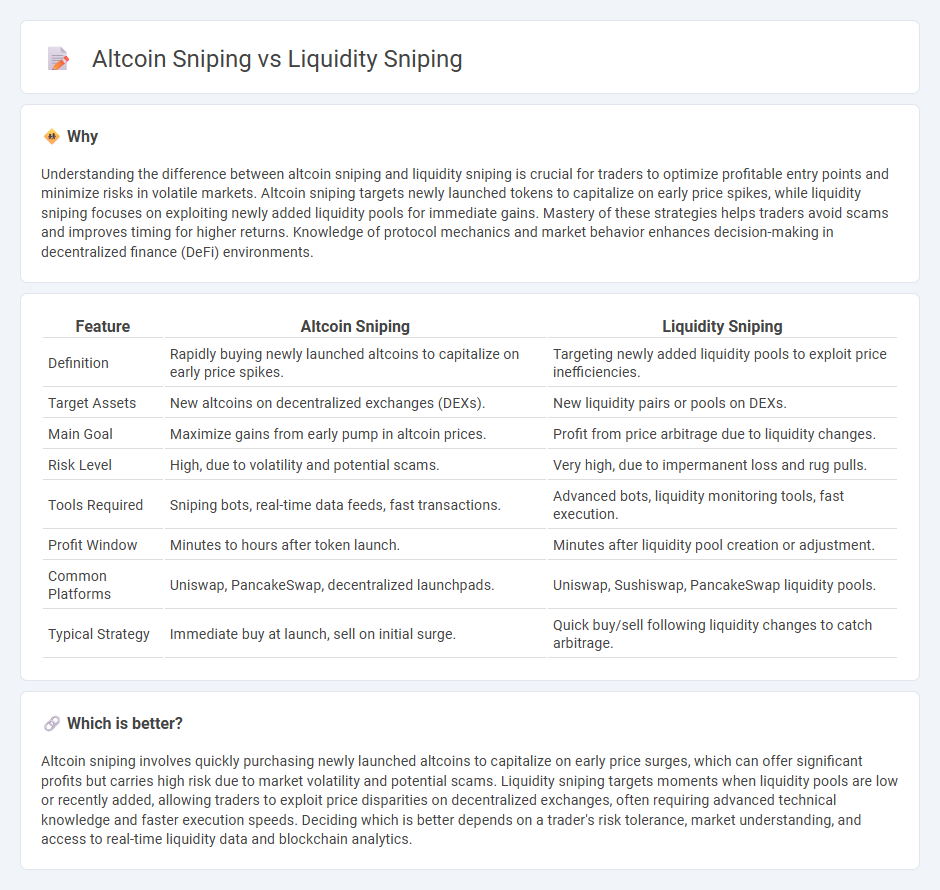

Understanding the difference between altcoin sniping and liquidity sniping is crucial for traders to optimize profitable entry points and minimize risks in volatile markets. Altcoin sniping targets newly launched tokens to capitalize on early price spikes, while liquidity sniping focuses on exploiting newly added liquidity pools for immediate gains. Mastery of these strategies helps traders avoid scams and improves timing for higher returns. Knowledge of protocol mechanics and market behavior enhances decision-making in decentralized finance (DeFi) environments.

Comparison Table

| Feature | Altcoin Sniping | Liquidity Sniping |

|---|---|---|

| Definition | Rapidly buying newly launched altcoins to capitalize on early price spikes. | Targeting newly added liquidity pools to exploit price inefficiencies. |

| Target Assets | New altcoins on decentralized exchanges (DEXs). | New liquidity pairs or pools on DEXs. |

| Main Goal | Maximize gains from early pump in altcoin prices. | Profit from price arbitrage due to liquidity changes. |

| Risk Level | High, due to volatility and potential scams. | Very high, due to impermanent loss and rug pulls. |

| Tools Required | Sniping bots, real-time data feeds, fast transactions. | Advanced bots, liquidity monitoring tools, fast execution. |

| Profit Window | Minutes to hours after token launch. | Minutes after liquidity pool creation or adjustment. |

| Common Platforms | Uniswap, PancakeSwap, decentralized launchpads. | Uniswap, Sushiswap, PancakeSwap liquidity pools. |

| Typical Strategy | Immediate buy at launch, sell on initial surge. | Quick buy/sell following liquidity changes to catch arbitrage. |

Which is better?

Altcoin sniping involves quickly purchasing newly launched altcoins to capitalize on early price surges, which can offer significant profits but carries high risk due to market volatility and potential scams. Liquidity sniping targets moments when liquidity pools are low or recently added, allowing traders to exploit price disparities on decentralized exchanges, often requiring advanced technical knowledge and faster execution speeds. Deciding which is better depends on a trader's risk tolerance, market understanding, and access to real-time liquidity data and blockchain analytics.

Connection

Altcoin sniping exploits rapid trades to buy newly listed tokens before price surges, relying on real-time liquidity detection within decentralized exchanges (DEXs). Liquidity sniping targets fresh liquidity pools by executing transactions instantaneously to capitalize on initial price volatility and slippage. Both strategies depend on precise monitoring of blockchain mempools and automated trading bots to seize opportunities before other market participants.

Key Terms

Slippage

Liquidity sniping exploits low liquidity pools to buy or sell assets before price impacts occur, often facing varying slippage due to thin order books. Altcoin sniping targets newly listed altcoins, where high volatility and unpredictable slippage can lead to either substantial profits or losses. Explore the mechanics of slippage and strategies for both approaches to optimize trading outcomes.

Front-running

Liquidity sniping exploits the detection of newly added liquidity pools to front-run transactions and buy tokens before others, often leading to instant profits by capitalizing on price volatility. Altcoin sniping also involves front-running but specifically targets newly launched altcoins or tokens, using automated bots to place rapid buy orders ahead of the broader market. Explore the nuances of front-running strategies and their impact on decentralized exchanges to understand these techniques better.

Decentralized Exchanges (DEXs)

Liquidity sniping on Decentralized Exchanges (DEXs) involves quickly purchasing newly added liquidity pool tokens to capitalize on early price movements, while altcoin sniping targets freshly launched altcoins to secure tokens before widespread trading begins. Both tactics exploit rapid transaction execution and blockchain transparency, relying heavily on automated bots and low-latency connections to front-run other traders. Explore advanced techniques and tools to optimize your strategy in DEX liquidity and altcoin sniping.

Source and External Links

What is Liquidity Sniping and How to Master It in Crypto Trading | NOTI - Liquidity sniping is a technique in crypto DeFi trading where bots aim to be the first to buy tokens soon after liquidity is added to a new pool, capitalizing on initial price spikes for quick profits by executing trades faster than competitors.

PancakeSwap Sniping Bot: A Guide to Understanding Liquidity Sniping Bots - Sniping bots monitor decentralized exchanges like PancakeSwap for the precise moment liquidity is added to new token pairs and instantly buy tokens to benefit from early price movements, using preset parameters to optimize speed, accuracy, and profit potential.

What Is a Sniper In Crypto? - Volity Trade Ltd - Crypto snipers use automated bots that constantly scan the blockchain and act instantly to buy or sell tokens when liquidity is added or market inefficiencies arise, leveraging speed to gain advantage in token launches and volatile markets, though the practice raises fairness concerns.

dowidth.com

dowidth.com