Quantitative signals in trading rely on predefined statistical rules and historical data patterns to generate buy or sell decisions, providing consistency and transparency. Machine learning models analyze vast datasets to identify complex, nonlinear relationships and adapt to evolving market conditions, often enhancing predictive accuracy. Explore how integrating both approaches can optimize trading strategies for superior performance.

Why it is important

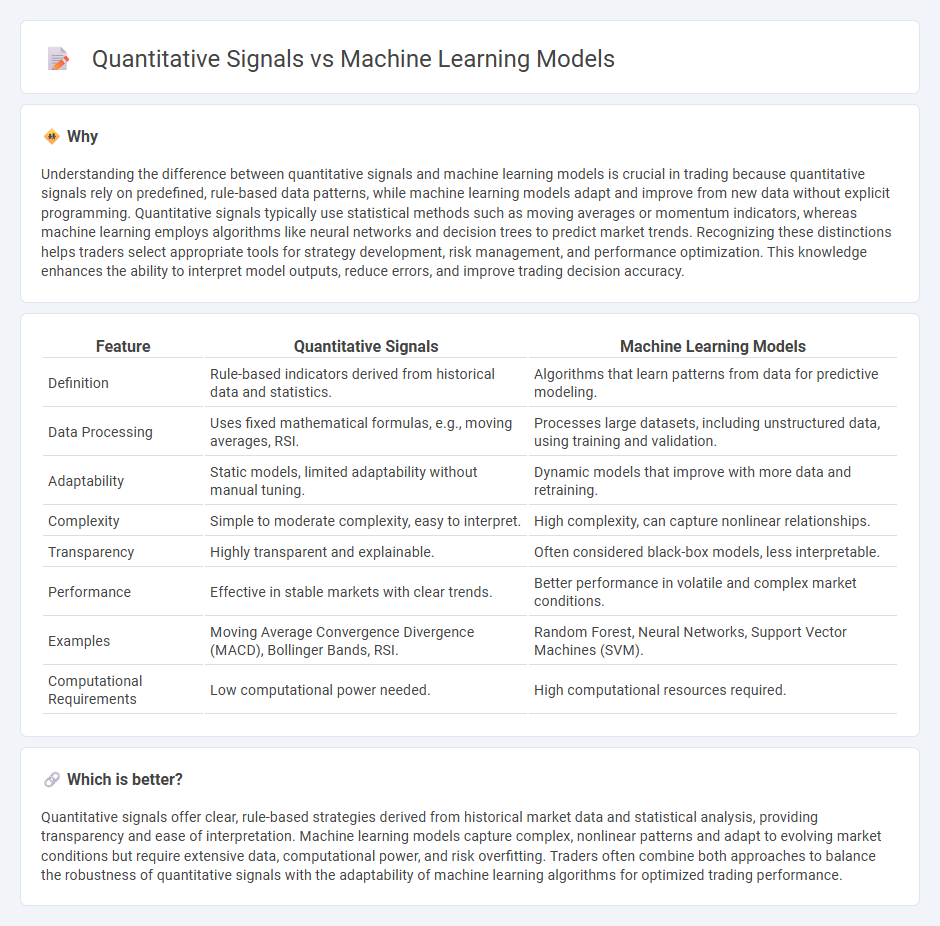

Understanding the difference between quantitative signals and machine learning models is crucial in trading because quantitative signals rely on predefined, rule-based data patterns, while machine learning models adapt and improve from new data without explicit programming. Quantitative signals typically use statistical methods such as moving averages or momentum indicators, whereas machine learning employs algorithms like neural networks and decision trees to predict market trends. Recognizing these distinctions helps traders select appropriate tools for strategy development, risk management, and performance optimization. This knowledge enhances the ability to interpret model outputs, reduce errors, and improve trading decision accuracy.

Comparison Table

| Feature | Quantitative Signals | Machine Learning Models |

|---|---|---|

| Definition | Rule-based indicators derived from historical data and statistics. | Algorithms that learn patterns from data for predictive modeling. |

| Data Processing | Uses fixed mathematical formulas, e.g., moving averages, RSI. | Processes large datasets, including unstructured data, using training and validation. |

| Adaptability | Static models, limited adaptability without manual tuning. | Dynamic models that improve with more data and retraining. |

| Complexity | Simple to moderate complexity, easy to interpret. | High complexity, can capture nonlinear relationships. |

| Transparency | Highly transparent and explainable. | Often considered black-box models, less interpretable. |

| Performance | Effective in stable markets with clear trends. | Better performance in volatile and complex market conditions. |

| Examples | Moving Average Convergence Divergence (MACD), Bollinger Bands, RSI. | Random Forest, Neural Networks, Support Vector Machines (SVM). |

| Computational Requirements | Low computational power needed. | High computational resources required. |

Which is better?

Quantitative signals offer clear, rule-based strategies derived from historical market data and statistical analysis, providing transparency and ease of interpretation. Machine learning models capture complex, nonlinear patterns and adapt to evolving market conditions but require extensive data, computational power, and risk overfitting. Traders often combine both approaches to balance the robustness of quantitative signals with the adaptability of machine learning algorithms for optimized trading performance.

Connection

Quantitative signals derived from statistical and mathematical models provide critical input features for machine learning algorithms in trading, enabling the identification of complex market patterns and predictive insights. Machine learning models leverage these quantitative signals to optimize trading strategies by adapting to evolving market conditions and reducing human biases. The integration of quantitative signals with advanced machine learning techniques enhances decision-making accuracy, risk management, and trade execution efficiency in algorithmic trading systems.

Key Terms

Feature Engineering

Machine learning models rely heavily on advanced feature engineering to transform raw quantitative signals into meaningful predictors that improve model accuracy and robustness. Quantitative signals, such as price, volume, and volatility metrics, serve as the foundational input, but their effective enhancement through techniques like normalization, scaling, and interaction terms is critical in capturing complex market patterns. Explore how tailored feature engineering techniques can unlock the full potential of machine learning in predictive analytics.

Backtesting

Backtesting evaluates machine learning models and quantitative signals by simulating their performance on historical data to assess predictive accuracy and robustness. Machine learning models adaptively capture complex, nonlinear patterns, while quantitative signals rely on predefined statistical rules and financial indicators. Explore detailed comparisons and best practices to optimize your backtesting strategy.

Alpha Generation

Machine learning models leverage complex algorithms and vast datasets to identify non-linear patterns for alpha generation, outperforming traditional quantitative signals that rely on predefined financial metrics. Quantitative signals use statistical methods and historical data to capture market inefficiencies but may miss subtle behavioral or macroeconomic factors that machine learning can detect. Explore detailed comparisons and case studies to understand how these approaches uniquely contribute to alpha in investment strategies.

Source and External Links

What are Machine Learning Models? - Machine learning models are programs that identify patterns or make decisions from new data, with popular types including supervised models like logistic regression, SVM, decision trees, random forest, and boosting, as well as unsupervised models like k-means and hierarchical clustering.

Machine Learning Models and How to Build Them - Machine learning models recognize patterns to make predictions and are built by training algorithms on data, using classification algorithms like logistic regression and decision trees or regression algorithms like linear regression and neural networks.

Machine Learning Models - Machine learning models include supervised (classification and regression), unsupervised, semi-supervised, and reinforcement learning models, used for categorizing or predicting outcomes based on labeled or unlabeled data.

dowidth.com

dowidth.com