Flash loans enable traders to borrow large sums of cryptocurrency instantly without collateral, executing complex arbitrage or liquidation strategies within a single transaction. Leveraged tokens offer built-in leverage by providing exposure to amplified asset movements without the need for margin maintenance or liquidation risks. Discover more about how these innovative trading tools can optimize your investment strategies.

Why it is important

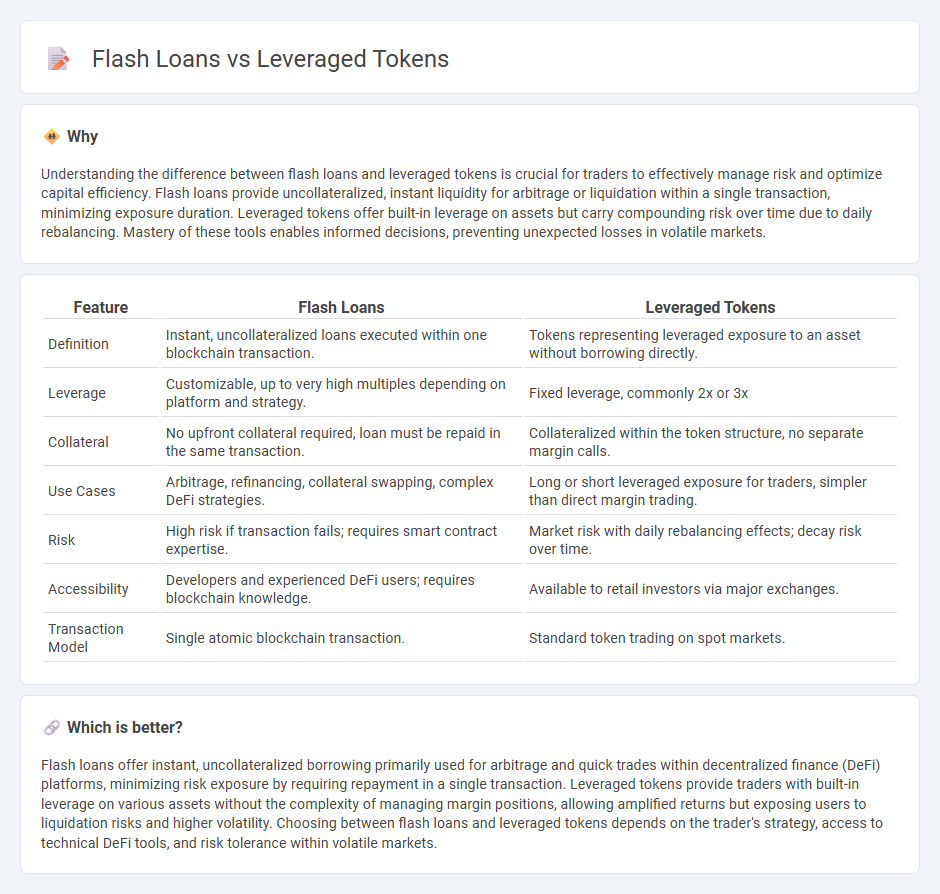

Understanding the difference between flash loans and leveraged tokens is crucial for traders to effectively manage risk and optimize capital efficiency. Flash loans provide uncollateralized, instant liquidity for arbitrage or liquidation within a single transaction, minimizing exposure duration. Leveraged tokens offer built-in leverage on assets but carry compounding risk over time due to daily rebalancing. Mastery of these tools enables informed decisions, preventing unexpected losses in volatile markets.

Comparison Table

| Feature | Flash Loans | Leveraged Tokens |

|---|---|---|

| Definition | Instant, uncollateralized loans executed within one blockchain transaction. | Tokens representing leveraged exposure to an asset without borrowing directly. |

| Leverage | Customizable, up to very high multiples depending on platform and strategy. | Fixed leverage, commonly 2x or 3x |

| Collateral | No upfront collateral required, loan must be repaid in the same transaction. | Collateralized within the token structure, no separate margin calls. |

| Use Cases | Arbitrage, refinancing, collateral swapping, complex DeFi strategies. | Long or short leveraged exposure for traders, simpler than direct margin trading. |

| Risk | High risk if transaction fails; requires smart contract expertise. | Market risk with daily rebalancing effects; decay risk over time. |

| Accessibility | Developers and experienced DeFi users; requires blockchain knowledge. | Available to retail investors via major exchanges. |

| Transaction Model | Single atomic blockchain transaction. | Standard token trading on spot markets. |

Which is better?

Flash loans offer instant, uncollateralized borrowing primarily used for arbitrage and quick trades within decentralized finance (DeFi) platforms, minimizing risk exposure by requiring repayment in a single transaction. Leveraged tokens provide traders with built-in leverage on various assets without the complexity of managing margin positions, allowing amplified returns but exposing users to liquidation risks and higher volatility. Choosing between flash loans and leveraged tokens depends on the trader's strategy, access to technical DeFi tools, and risk tolerance within volatile markets.

Connection

Flash loans enable traders to borrow large sums of capital instantly without collateral, facilitating arbitrage opportunities and complex trading strategies. Leveraged tokens represent a fixed leverage exposure to underlying assets, amplifying potential returns or losses without requiring margin management. Combining flash loans with leveraged tokens allows traders to maximize capital efficiency and execute highly leveraged positions quickly within decentralized finance (DeFi) ecosystems.

Key Terms

Margin

Leveraged tokens provide traders exposure to margin trading without managing collateral or liquidation risks, as they automatically adjust positions to maintain target leverage. Flash loans offer instant, uncollateralized credit primarily used for arbitrage or refinancing within a single transaction, requiring technical expertise and blockchain interaction. Explore the distinctions between these tools to optimize margin strategies effectively.

Liquidation

Leveraged tokens allow traders to gain amplified exposure to an asset without managing collateral or margin, reducing the risk of liquidation compared to flash loans, which involve borrowing large amounts instantly but require repayment within one transaction block to avoid liquidation risks. Flash loans are primarily used for arbitrage, refinance, or liquidation opportunities due to their atomic nature, whereas leveraged tokens inherently contain built-in risk management to maintain target leverage levels, minimizing liquidation events. Explore further to understand how these financial instruments impact DeFi liquidation strategies and risk profiles.

Arbitrage

Leveraged tokens provide traders with exposure to amplified asset movements without managing collateral or margin calls, while flash loans enable borrowing large sums instantly within one transaction to exploit arbitrage opportunities. Arbitrageurs use flash loans to capitalize on price discrepancies across decentralized exchanges, executing profitable trades without upfront capital, whereas leveraged tokens offer a simplified way to gain leveraged exposure with built-in risk management. Discover how these tools transform arbitrage strategies by exploring their mechanisms and benefits in decentralized finance.

Source and External Links

What is a Leveraged Token? - Coincall - Leveraged tokens are crypto derivatives with built-in leverage, representing positions in an underlying asset with a fixed leverage ratio, allowing amplified returns without margin requirements or liquidation risk, and can be traded like regular tokens.

Leveraged Tokens Explained: A Comprehensive Guide for Crypto Trading - KuCoin - Leveraged tokens are financial products offering amplified exposure to cryptocurrencies without margin trading complexities, internally managing leverage and liquidation risk through a basket of perpetual contracts.

Leverage Tokens Overview - Toros Finance - Leveraged tokens provide automated leverage that dynamically adjusts exposure to blockchain assets, preventing forced liquidations by reducing leverage when the market moves against the position and increasing leverage when it moves favorably.

dowidth.com

dowidth.com