Trade journaling software enhances individual traders' performance by providing detailed analytics, customizable reports, and real-time tracking of trades, enabling precise strategy refinement. Social trading networks facilitate collaboration by allowing users to follow, copy, and interact with experienced traders, fostering communal learning and diversified investment exposure. Explore how integrating both platforms can elevate your trading experience and decision-making efficiency.

Why it is important

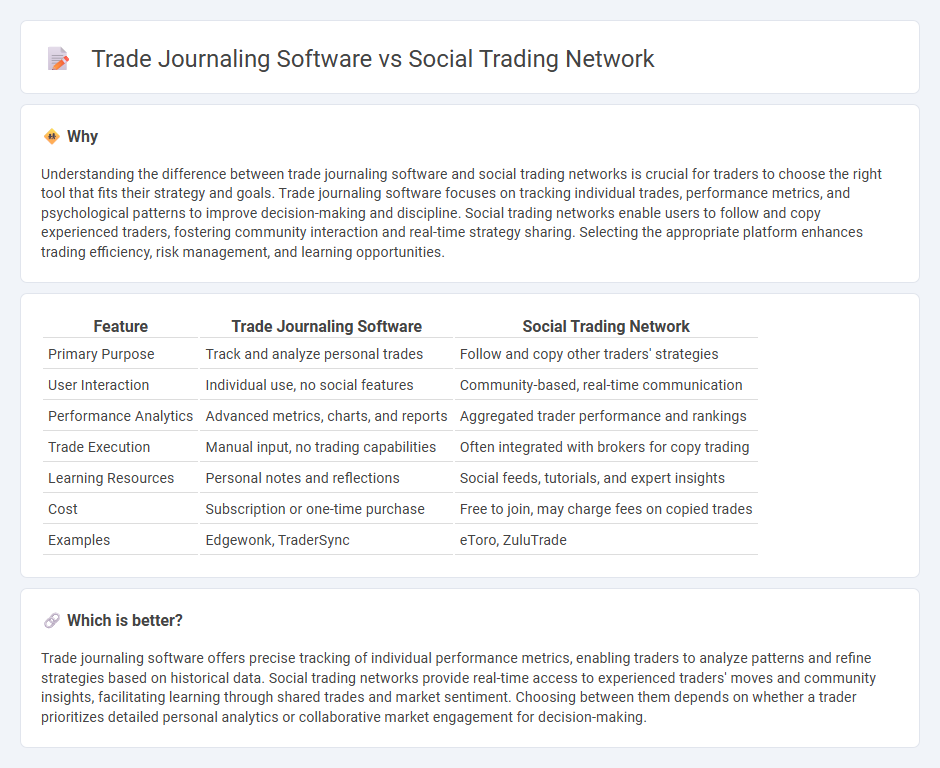

Understanding the difference between trade journaling software and social trading networks is crucial for traders to choose the right tool that fits their strategy and goals. Trade journaling software focuses on tracking individual trades, performance metrics, and psychological patterns to improve decision-making and discipline. Social trading networks enable users to follow and copy experienced traders, fostering community interaction and real-time strategy sharing. Selecting the appropriate platform enhances trading efficiency, risk management, and learning opportunities.

Comparison Table

| Feature | Trade Journaling Software | Social Trading Network |

|---|---|---|

| Primary Purpose | Track and analyze personal trades | Follow and copy other traders' strategies |

| User Interaction | Individual use, no social features | Community-based, real-time communication |

| Performance Analytics | Advanced metrics, charts, and reports | Aggregated trader performance and rankings |

| Trade Execution | Manual input, no trading capabilities | Often integrated with brokers for copy trading |

| Learning Resources | Personal notes and reflections | Social feeds, tutorials, and expert insights |

| Cost | Subscription or one-time purchase | Free to join, may charge fees on copied trades |

| Examples | Edgewonk, TraderSync | eToro, ZuluTrade |

Which is better?

Trade journaling software offers precise tracking of individual performance metrics, enabling traders to analyze patterns and refine strategies based on historical data. Social trading networks provide real-time access to experienced traders' moves and community insights, facilitating learning through shared trades and market sentiment. Choosing between them depends on whether a trader prioritizes detailed personal analytics or collaborative market engagement for decision-making.

Connection

Trade journaling software enhances decision-making by systematically recording and analyzing trading activities, while social trading networks provide real-time strategies and performance insights from a community of traders. Integration of these tools allows traders to compare personal performance data with peer benchmarks, fostering more informed adjustments and strategy refinement. The synergy between detailed trade logs and communal feedback accelerates learning and improves overall trading outcomes.

Key Terms

**Social Trading Network:**

Social trading networks enable investors to follow, copy, and interact with experienced traders, leveraging collective market insights to enhance decision-making and reduce individual risk. These platforms provide real-time data sharing, performance tracking, and community-driven strategies, fostering a collaborative trading environment. Explore how social trading networks can transform your investment approach by learning more about their features and benefits.

Copy Trading

Social trading networks enable traders to copy successful investors' trades in real-time, leveraging collective market insights to optimize performance. Trade journaling software focuses on tracking and analyzing personal trading activities to improve individual strategies through detailed performance metrics. Discover how copy trading can transform your investment approach by exploring the advantages of social trading networks.

Social Feed

Social trading networks provide real-time social feeds that enable traders to share insights, strategies, and market trends with a broad community, fostering collaborative decision-making and collective learning. Trade journaling software primarily focuses on tracking individual trade performance, offering detailed analytics and personalized feedback without real-time peer interaction. Explore the benefits of integrating social feeds to enhance your trading strategy and community engagement.

Source and External Links

Social Trading Networks: Your Guide to Smart Investing - TradeFundrr - A social trading network is a digital platform that connects investors to share and replicate trading strategies in real-time, combining traditional trading tools with social media features like live chat, performance tracking, and copy trading functionality to create an interactive community-based investing experience.

Social trading - Wikipedia - Social trading allows investors to observe and copy the trades of peers or experts, enabling collaborative investment decisions and learning through mechanisms like copy trade and mirror trade, integrating social networking concepts into financial markets.

10 Best Social Trading Platforms - Extrapolate - Social trading platforms, such as eToro and Zingeroo, allow novice and experienced investors to follow and copy strategies from successful traders, with the market projected to grow significantly and offering features like trading competitions and consolidated market access.

dowidth.com

dowidth.com