Airdrop farming involves collecting free cryptocurrency tokens by engaging with various blockchain projects, allowing users to accumulate assets with minimal upfront investment. Token launchpad participation requires purchasing tokens during new project sales, offering early access to potentially high-growth investments but often with higher risk. Explore these strategies in detail to determine which method aligns with your trading goals.

Why it is important

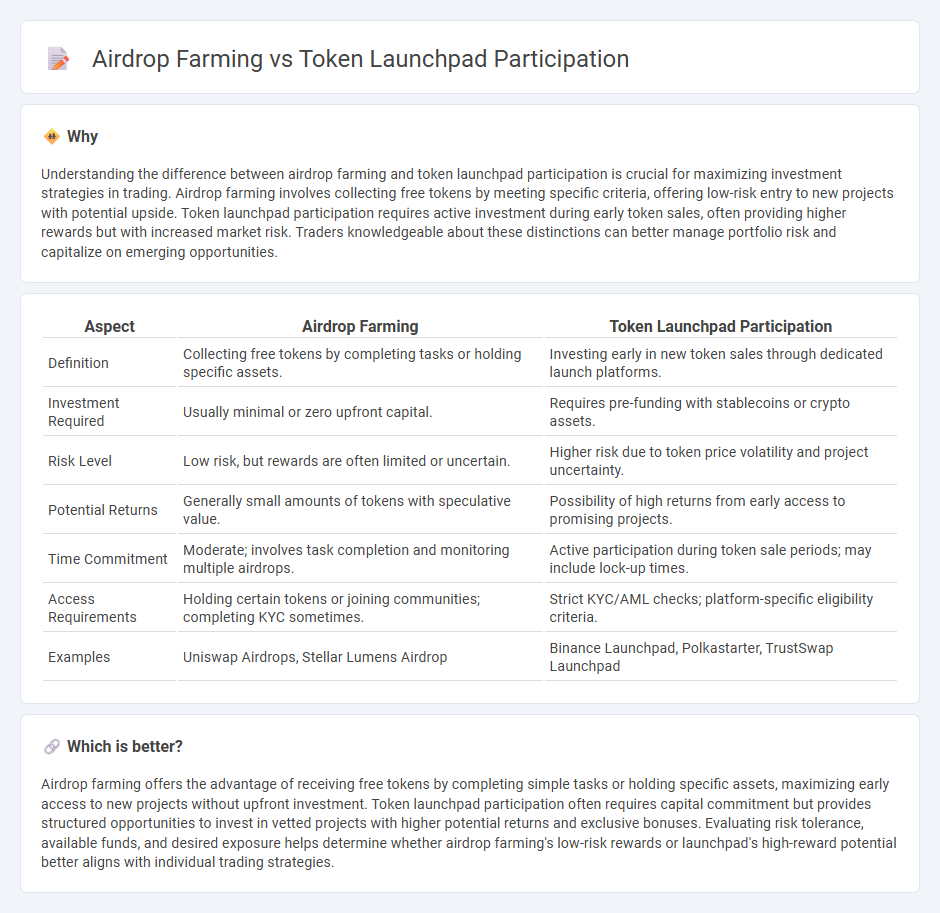

Understanding the difference between airdrop farming and token launchpad participation is crucial for maximizing investment strategies in trading. Airdrop farming involves collecting free tokens by meeting specific criteria, offering low-risk entry to new projects with potential upside. Token launchpad participation requires active investment during early token sales, often providing higher rewards but with increased market risk. Traders knowledgeable about these distinctions can better manage portfolio risk and capitalize on emerging opportunities.

Comparison Table

| Aspect | Airdrop Farming | Token Launchpad Participation |

|---|---|---|

| Definition | Collecting free tokens by completing tasks or holding specific assets. | Investing early in new token sales through dedicated launch platforms. |

| Investment Required | Usually minimal or zero upfront capital. | Requires pre-funding with stablecoins or crypto assets. |

| Risk Level | Low risk, but rewards are often limited or uncertain. | Higher risk due to token price volatility and project uncertainty. |

| Potential Returns | Generally small amounts of tokens with speculative value. | Possibility of high returns from early access to promising projects. |

| Time Commitment | Moderate; involves task completion and monitoring multiple airdrops. | Active participation during token sale periods; may include lock-up times. |

| Access Requirements | Holding certain tokens or joining communities; completing KYC sometimes. | Strict KYC/AML checks; platform-specific eligibility criteria. |

| Examples | Uniswap Airdrops, Stellar Lumens Airdrop | Binance Launchpad, Polkastarter, TrustSwap Launchpad |

Which is better?

Airdrop farming offers the advantage of receiving free tokens by completing simple tasks or holding specific assets, maximizing early access to new projects without upfront investment. Token launchpad participation often requires capital commitment but provides structured opportunities to invest in vetted projects with higher potential returns and exclusive bonuses. Evaluating risk tolerance, available funds, and desired exposure helps determine whether airdrop farming's low-risk rewards or launchpad's high-reward potential better aligns with individual trading strategies.

Connection

Airdrop farming involves collecting free tokens distributed by blockchain projects to increase wallet holdings and potential returns. Token launchpads provide early access to new cryptocurrency projects, often rewarding participants with exclusive tokens that can be farmed or traded. Engaging in both strategies allows traders to maximize exposure to emerging digital assets and capitalize on initial market opportunities.

Key Terms

**Token Launchpad Participation:**

Token launchpad participation allows investors to acquire tokens at an early stage through a structured sale, often requiring staking or meeting specific criteria, which can lead to higher-quality token distributions and potential long-term value. This method contrasts with airdrop farming, where users perform tasks primarily to collect free tokens, sometimes resulting in less committed community engagement. Explore more about how token launchpads enhance strategic investment opportunities and project growth.

Allocation

Token launchpad participation offers a structured allocation process where projects distribute tokens proportionally based on contribution tiers or staking amounts, ensuring committed community involvement. In contrast, airdrop farming often results in uneven token distribution as participants leverage multiple wallets or engage in low-effort actions to maximize rewards without true project engagement. Explore deeper insights to understand how allocation impacts long-term token value and participant commitment.

Whitelisting

Token launchpad participation requires rigorous whitelisting processes to ensure genuine project supporters have access to early token sales, significantly reducing the risk of bots and sybil attacks compared to airdrop farming. Airdrop farming often exploits loopholes in whitelisting to accumulate free tokens without long-term commitment, impacting token distribution fairness. Explore more about optimizing whitelist strategies to enhance project integrity and participant quality.

Source and External Links

Best Crypto Launchpads in 2025 | IDO Platforms - ICO Bench - Crypto launchpads allow users to participate in early token purchases of vetted projects through a process involving project evaluation, marketing, and scheduled token claim periods, offering opportunities similar to presales but with risks due to crypto volatility.

Launchpad: What It Is and How to Join Token Sales - TradeLink Pro - Launchpads bridge investors and new crypto projects by vetting projects, implementing KYC, and providing early access to token sales where users can buy tokens before public trading, aiming to reduce risks and increase investment opportunity.

What Is Gate Launchpad and How to Participate? - Gate Launchpad allows users to stake tokens to gain early purchase rights for new tokens at discounted rates, facilitating early-stage investment with an efficient, secure crowdfunding model, while emphasizing the need to assess risks and project backgrounds carefully.

dowidth.com

dowidth.com