Flash loans provide instant, unsecured borrowing within decentralized finance, enabling arbitrage and capital-efficient strategies without upfront collateral. Futures contracts offer derivative trading by locking in asset prices for future settlement, allowing hedging and speculation on price movements. Explore the nuances between flash loans and futures contracts to optimize your trading strategies.

Why it is important

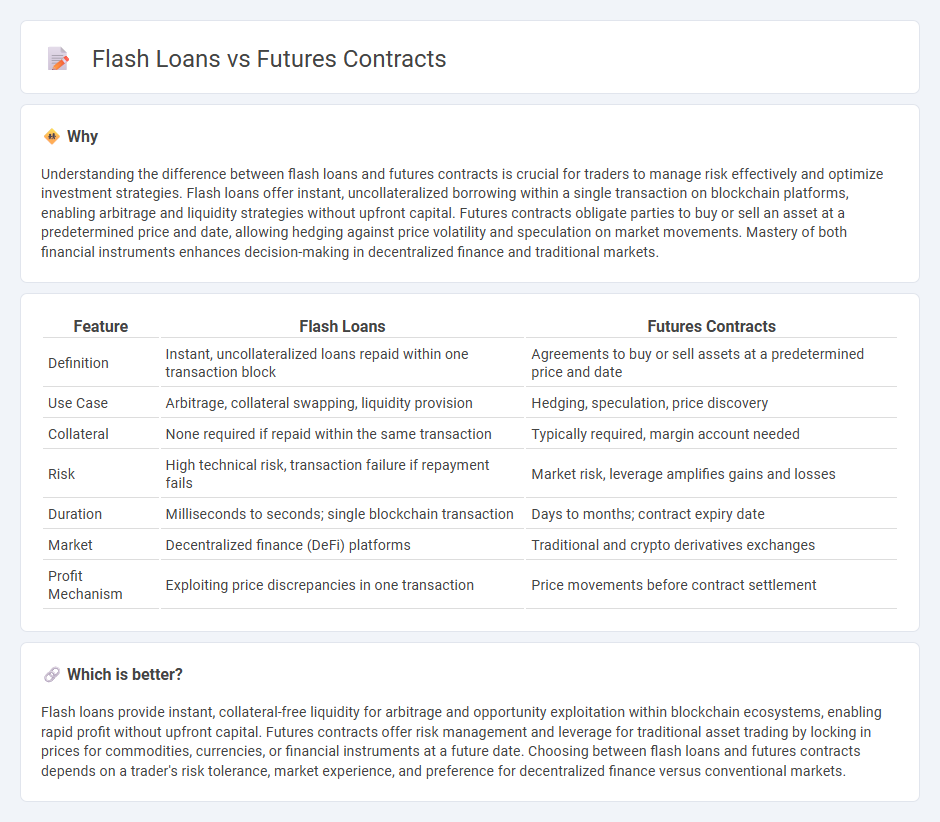

Understanding the difference between flash loans and futures contracts is crucial for traders to manage risk effectively and optimize investment strategies. Flash loans offer instant, uncollateralized borrowing within a single transaction on blockchain platforms, enabling arbitrage and liquidity strategies without upfront capital. Futures contracts obligate parties to buy or sell an asset at a predetermined price and date, allowing hedging against price volatility and speculation on market movements. Mastery of both financial instruments enhances decision-making in decentralized finance and traditional markets.

Comparison Table

| Feature | Flash Loans | Futures Contracts |

|---|---|---|

| Definition | Instant, uncollateralized loans repaid within one transaction block | Agreements to buy or sell assets at a predetermined price and date |

| Use Case | Arbitrage, collateral swapping, liquidity provision | Hedging, speculation, price discovery |

| Collateral | None required if repaid within the same transaction | Typically required, margin account needed |

| Risk | High technical risk, transaction failure if repayment fails | Market risk, leverage amplifies gains and losses |

| Duration | Milliseconds to seconds; single blockchain transaction | Days to months; contract expiry date |

| Market | Decentralized finance (DeFi) platforms | Traditional and crypto derivatives exchanges |

| Profit Mechanism | Exploiting price discrepancies in one transaction | Price movements before contract settlement |

Which is better?

Flash loans provide instant, collateral-free liquidity for arbitrage and opportunity exploitation within blockchain ecosystems, enabling rapid profit without upfront capital. Futures contracts offer risk management and leverage for traditional asset trading by locking in prices for commodities, currencies, or financial instruments at a future date. Choosing between flash loans and futures contracts depends on a trader's risk tolerance, market experience, and preference for decentralized finance versus conventional markets.

Connection

Flash loans enable instant, uncollateralized borrowing that can be leveraged to execute arbitrage opportunities within decentralized finance (DeFi) platforms, often involving futures contracts. Futures contracts allow traders to speculate on the price movement of assets, and when combined with flash loans, they facilitate highly efficient, low-risk arbitrage strategies by quickly capitalizing on price discrepancies across markets. This synergy between flash loans and futures contracts enhances liquidity and market efficiency in crypto trading ecosystems.

Key Terms

Margin

Futures contracts require margin deposits to maintain a leveraged position, ensuring traders meet potential losses and market fluctuations. Flash loans, primarily used in decentralized finance (DeFi), do not involve margin but require the loan to be repaid within a single transaction block, minimizing risk exposure. Explore the nuances of margin requirements and risk management in both futures and flash loans for deeper understanding.

Leverage

Futures contracts offer leverage by allowing traders to control large positions with a relatively small margin, amplifying both potential gains and risks in traditional markets. Flash loans provide instant, permissionless leverage in DeFi, enabling users to borrow vast amounts without collateral for atomic transactions within a single block. Discover how leverage mechanisms in futures contracts and flash loans transform trading strategies and risk management.

Settlement

Futures contracts involve a legally binding agreement to buy or sell an asset at a predetermined price on a future date, with settlement typically conducted in cash or through asset delivery. Flash loans, unique to decentralized finance (DeFi), offer instant, uncollateralized loans that must be repaid within the same blockchain transaction, eliminating traditional settlement delays. Explore how these settlement mechanisms impact risk and liquidity by learning more about their operational nuances.

Source and External Links

Definition of a Futures Contract - CME Group - A futures contract is a legally binding, standardized agreement to buy or sell a specific asset at a set price on a set date or during a set month, traded on futures exchanges with standardized quality, quantity, and delivery terms allowing for easy transfer of ownership, where price is the main variable discovered by bidding.

Futures Contract | Definition + Examples - Wall Street Prep - Futures contracts are financial derivatives obliging counterparties to exchange an asset at a pre-agreed price by a specific date; they differ from forward contracts by being exchange-traded, standardized, and regulated, with a clearinghouse managing counterparty risks.

Futures contract - Wikipedia - Futures contracts help mitigate default risk by requiring margin deposits and marking to market daily, ensuring that gains and losses are settled progressively until delivery when the actual spot price is exchanged, with this standardized legal mechanism assuring contract performance.

dowidth.com

dowidth.com