Paper trading platforms simulate real-market conditions allowing traders to practice strategies with virtual money, reducing risk while building experience. Desktop trading platforms offer direct market access with advanced tools, faster execution, and customizable interfaces suited for active traders requiring robust performance. Explore more to understand which platform aligns best with your trading goals and skill level.

Why it is important

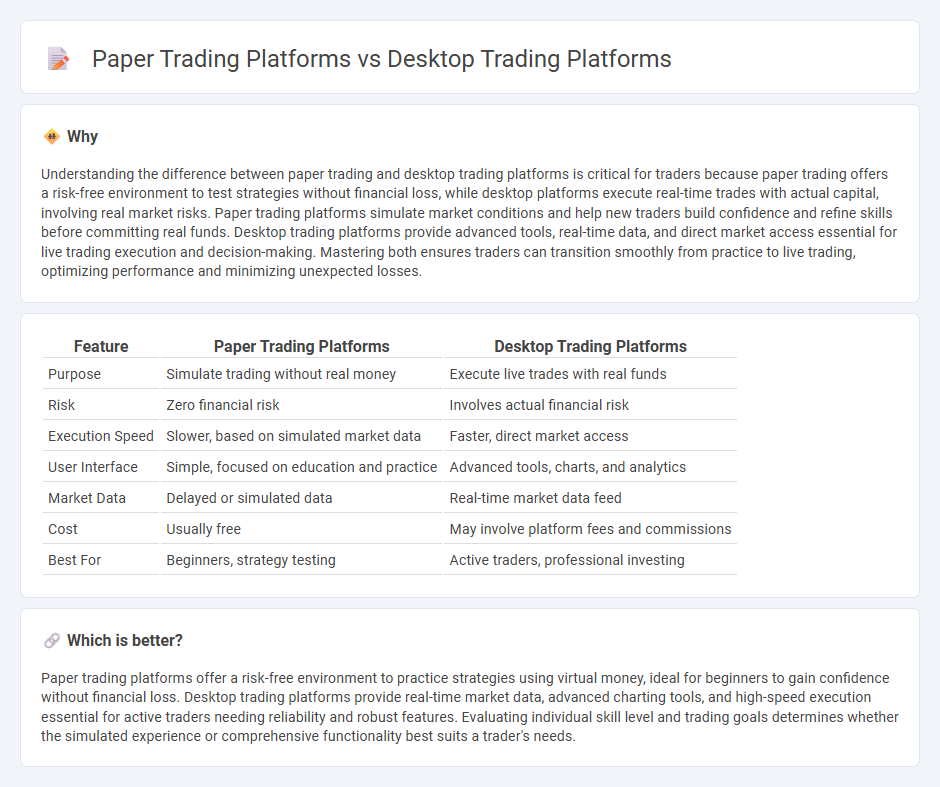

Understanding the difference between paper trading and desktop trading platforms is critical for traders because paper trading offers a risk-free environment to test strategies without financial loss, while desktop platforms execute real-time trades with actual capital, involving real market risks. Paper trading platforms simulate market conditions and help new traders build confidence and refine skills before committing real funds. Desktop trading platforms provide advanced tools, real-time data, and direct market access essential for live trading execution and decision-making. Mastering both ensures traders can transition smoothly from practice to live trading, optimizing performance and minimizing unexpected losses.

Comparison Table

| Feature | Paper Trading Platforms | Desktop Trading Platforms |

|---|---|---|

| Purpose | Simulate trading without real money | Execute live trades with real funds |

| Risk | Zero financial risk | Involves actual financial risk |

| Execution Speed | Slower, based on simulated market data | Faster, direct market access |

| User Interface | Simple, focused on education and practice | Advanced tools, charts, and analytics |

| Market Data | Delayed or simulated data | Real-time market data feed |

| Cost | Usually free | May involve platform fees and commissions |

| Best For | Beginners, strategy testing | Active traders, professional investing |

Which is better?

Paper trading platforms offer a risk-free environment to practice strategies using virtual money, ideal for beginners to gain confidence without financial loss. Desktop trading platforms provide real-time market data, advanced charting tools, and high-speed execution essential for active traders needing reliability and robust features. Evaluating individual skill level and trading goals determines whether the simulated experience or comprehensive functionality best suits a trader's needs.

Connection

Paper trading platforms simulate real market conditions allowing traders to practice strategies without financial risk, while desktop trading platforms provide direct access to live market execution and account management. Both types of platforms are interconnected through shared market data feeds and order execution protocols, enabling seamless transition from practice to live trading environments. Integration of APIs and cloud-based synchronization ensures consistency in user experience and performance tracking across paper and desktop trading setups.

Key Terms

Execution Speed

Desktop trading platforms offer superior execution speed by leveraging direct market access and powerful hardware, crucial for active traders requiring real-time order processing. Paper trading platforms simulate market conditions but typically do not match the execution speed of live desktop platforms, limiting their effectiveness for testing high-frequency strategies. Explore detailed comparisons to understand which platform suits your trading style and performance needs.

Real Money Accounts

Desktop trading platforms offer advanced tools, real-time data, and direct market access essential for managing real money accounts effectively, providing traders with faster execution and deeper customization. Paper trading platforms simulate market conditions without financial risk, ideal for strategy testing but lacking the emotional and liquidity components present in real money trading. Explore the nuances between these platforms to optimize your real money trading strategy.

Risk-Free Simulation

Desktop trading platforms provide robust tools for real-time market analysis and execution, offering experienced traders direct access to live data and advanced order types. Paper trading platforms simulate these market conditions without financial risk, enabling beginners and professionals to test strategies and build confidence in a risk-free environment. Explore how choosing the right platform can enhance your trading skills and minimize potential losses.

Source and External Links

Desktop Trading Platform - TradeStation - A customizable desktop trading platform with multi-monitor support, advanced charting, automation via proprietary programming, and support for stocks, options, futures, and futures options trading.

IBKR Desktop | Interactive Brokers LLC - A powerful, streamlined desktop trading platform offering broad technical and fundamental analysis tools, advanced order types, multi-market access, and customizable workspace with multi-monitor support.

Power E*TRADE Pro | Desktop Trading Platform - A highly customizable desktop platform featuring advanced charting, complex trading tools, multi-monitor support, real-time market depth, and live scanning for trade opportunities.

dowidth.com

dowidth.com