Flash loans provide instant, uncollateralized borrowing opportunities within decentralized finance platforms, enabling users to execute complex trades or arbitrage without upfront capital. Copy trading allows investors to replicate the strategies of experienced traders automatically, aligning portfolio performance without deep market analysis. Explore more to understand which trading method suits your investment goals.

Why it is important

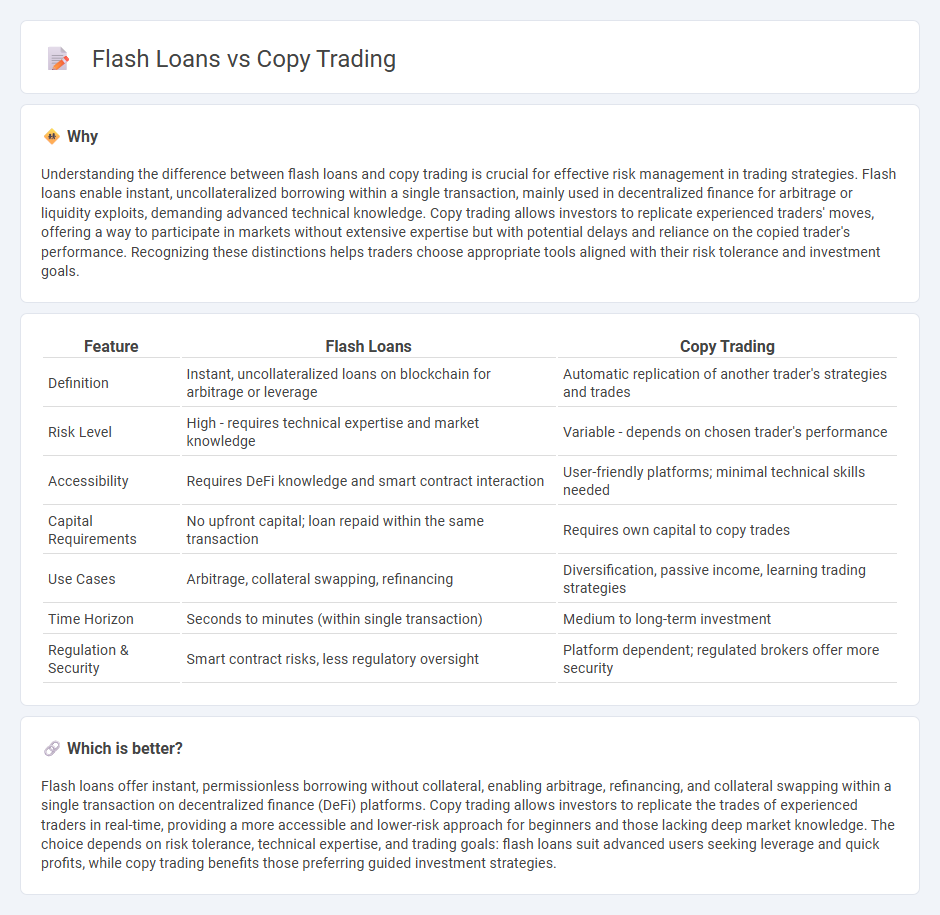

Understanding the difference between flash loans and copy trading is crucial for effective risk management in trading strategies. Flash loans enable instant, uncollateralized borrowing within a single transaction, mainly used in decentralized finance for arbitrage or liquidity exploits, demanding advanced technical knowledge. Copy trading allows investors to replicate experienced traders' moves, offering a way to participate in markets without extensive expertise but with potential delays and reliance on the copied trader's performance. Recognizing these distinctions helps traders choose appropriate tools aligned with their risk tolerance and investment goals.

Comparison Table

| Feature | Flash Loans | Copy Trading |

|---|---|---|

| Definition | Instant, uncollateralized loans on blockchain for arbitrage or leverage | Automatic replication of another trader's strategies and trades |

| Risk Level | High - requires technical expertise and market knowledge | Variable - depends on chosen trader's performance |

| Accessibility | Requires DeFi knowledge and smart contract interaction | User-friendly platforms; minimal technical skills needed |

| Capital Requirements | No upfront capital; loan repaid within the same transaction | Requires own capital to copy trades |

| Use Cases | Arbitrage, collateral swapping, refinancing | Diversification, passive income, learning trading strategies |

| Time Horizon | Seconds to minutes (within single transaction) | Medium to long-term investment |

| Regulation & Security | Smart contract risks, less regulatory oversight | Platform dependent; regulated brokers offer more security |

Which is better?

Flash loans offer instant, permissionless borrowing without collateral, enabling arbitrage, refinancing, and collateral swapping within a single transaction on decentralized finance (DeFi) platforms. Copy trading allows investors to replicate the trades of experienced traders in real-time, providing a more accessible and lower-risk approach for beginners and those lacking deep market knowledge. The choice depends on risk tolerance, technical expertise, and trading goals: flash loans suit advanced users seeking leverage and quick profits, while copy trading benefits those preferring guided investment strategies.

Connection

Flash loans enable traders to borrow substantial capital instantly without collateral, facilitating rapid execution of arbitrage and other high-frequency strategies. Copy trading leverages these instant capital opportunities by allowing less experienced traders to mimic expert strategies, optimizing profits through real-time synchronized transactions. Both mechanisms enhance market liquidity and accessibility, driving innovation in decentralized finance and algorithmic trading platforms.

Key Terms

Signal Provider (Copy Trading)

Signal providers in copy trading offer curated trading strategies based on market analysis, enabling followers to replicate trades automatically with minimal effort. Unlike flash loans, which provide instant, non-collateralized loans for arbitrage or liquidity purposes, signal providers focus on delivering actionable insights and trade signals to maximize portfolio growth. Explore how partnering with expert signal providers can elevate your copy trading success.

Smart Contract (Flash Loans)

Flash loans leverage smart contracts to enable instant, unsecured borrowing of cryptocurrency within a single transaction, allowing users to execute complex arbitrage or liquidation strategies without upfront capital. Unlike copy trading, which replicates trades from experienced investors, flash loans depend on automated contract execution to ensure loan repayment before transaction completion, minimizing risk for lenders. Explore how smart contracts power flash loans to understand their transformative impact on decentralized finance.

Liquidation (Flash Loans)

Flash loan liquidation leverages instant, uncollateralized loans to capitalize on under-collateralized positions in decentralized finance (DeFi) lending protocols, enabling the borrower to repay debt and seize collateral in a single transaction. Copy trading involves mirroring the portfolio actions of experienced traders, focusing on market trends rather than rapid opportunistic liquidations characteristic of flash loans. Explore the mechanics of flash loan liquidations and their impact on DeFi liquidity to learn more.

Source and External Links

Copy trading - Wikipedia - Copy trading allows individuals to automatically replicate the positions opened and managed by selected investors, creating "People-Based Portfolios" where followers' funds are indirectly managed by copied traders known as signal providers or leaders.

Copy Trading | Copy the Best Traders in 2025 | AvaTrade - Copy trading lets less experienced traders automatically copy the trades of experienced traders, offering a hands-off way to invest by selecting traders based on performance, risk, and style, differing from social and mirror trading in customization and automation.

What is Copy Trading, How Does it Work and How to ... - PrimeXBT - Copy trading involves choosing profitable traders on platforms to automatically copy their trades in real-time, with the ability to allocate capital and control risk per trade, simplifying market investment without needing personal analysis.

dowidth.com

dowidth.com