Order book imbalance measures the difference between buy and sell orders at various price levels, revealing market sentiment and potential price movements. Volume profile analyzes the distribution of trading volume over price ranges, highlighting key support and resistance zones critical for informed decision-making. Explore how combining order book imbalance and volume profile enhances trading strategies and market insights.

Why it is important

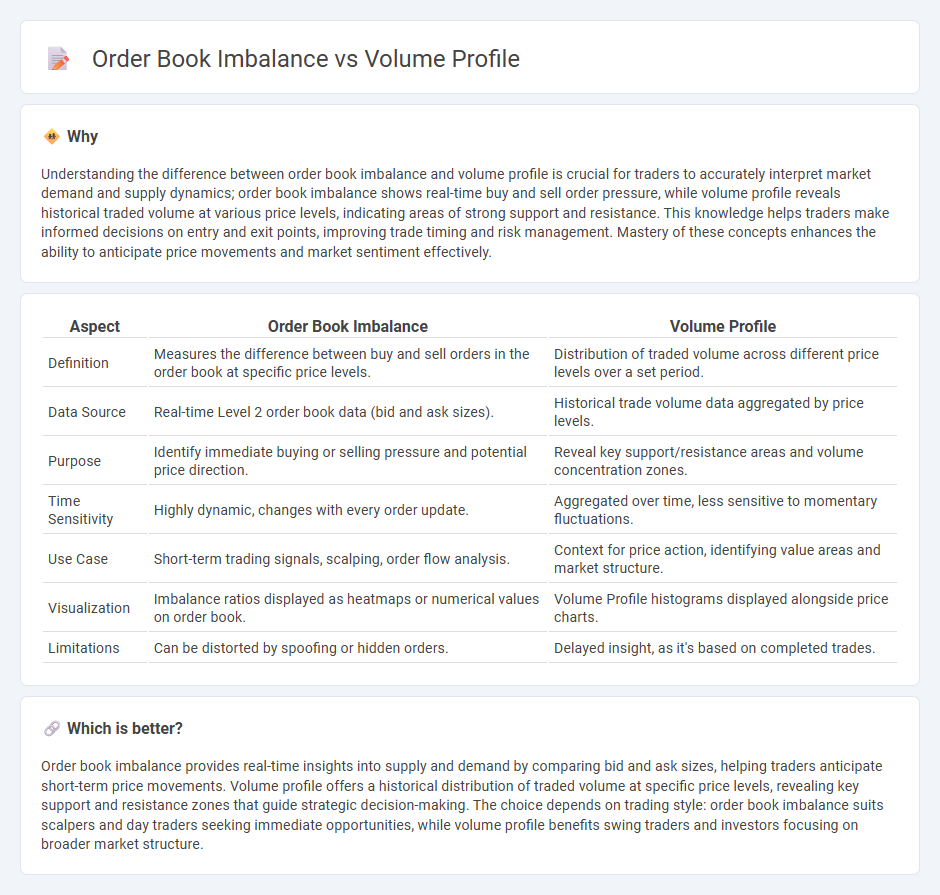

Understanding the difference between order book imbalance and volume profile is crucial for traders to accurately interpret market demand and supply dynamics; order book imbalance shows real-time buy and sell order pressure, while volume profile reveals historical traded volume at various price levels, indicating areas of strong support and resistance. This knowledge helps traders make informed decisions on entry and exit points, improving trade timing and risk management. Mastery of these concepts enhances the ability to anticipate price movements and market sentiment effectively.

Comparison Table

| Aspect | Order Book Imbalance | Volume Profile |

|---|---|---|

| Definition | Measures the difference between buy and sell orders in the order book at specific price levels. | Distribution of traded volume across different price levels over a set period. |

| Data Source | Real-time Level 2 order book data (bid and ask sizes). | Historical trade volume data aggregated by price levels. |

| Purpose | Identify immediate buying or selling pressure and potential price direction. | Reveal key support/resistance areas and volume concentration zones. |

| Time Sensitivity | Highly dynamic, changes with every order update. | Aggregated over time, less sensitive to momentary fluctuations. |

| Use Case | Short-term trading signals, scalping, order flow analysis. | Context for price action, identifying value areas and market structure. |

| Visualization | Imbalance ratios displayed as heatmaps or numerical values on order book. | Volume Profile histograms displayed alongside price charts. |

| Limitations | Can be distorted by spoofing or hidden orders. | Delayed insight, as it's based on completed trades. |

Which is better?

Order book imbalance provides real-time insights into supply and demand by comparing bid and ask sizes, helping traders anticipate short-term price movements. Volume profile offers a historical distribution of traded volume at specific price levels, revealing key support and resistance zones that guide strategic decision-making. The choice depends on trading style: order book imbalance suits scalpers and day traders seeking immediate opportunities, while volume profile benefits swing traders and investors focusing on broader market structure.

Connection

Order book imbalance reflects the difference between buy and sell orders at various price levels, providing key insights into market sentiment. Volume profile complements this by mapping the traded volume distribution over price levels, highlighting areas of high liquidity and support or resistance zones. Together, they enable traders to identify potential price movements by analyzing where supply and demand converge or diverge.

Key Terms

Price Levels

Volume profile highlights the trading activity distribution across price levels, revealing key support and resistance zones through aggregated volume data. Order book imbalance measures the difference between buy and sell orders at specific price points, indicating potential shifts in market sentiment and liquidity. Explore deeper insights on how these tools optimize trading strategies and price action analysis.

Trade Volume

Volume Profile analyzes historical trade volume at specific price levels to identify support and resistance zones, highlighting areas of high liquidity where significant trading occurred. Order Book Imbalance reflects the real-time difference between buy and sell orders, providing insight into market sentiment and potential price movements based on current supply and demand dynamics. Explore detailed comparisons to understand how trade volume impacts both tools for effective market analysis.

Bid-Ask Pressure

Volume profile reveals the distribution of traded volume across different price levels, highlighting key support and resistance zones where market participants show strong interest. Order book imbalance measures the quantitative difference between bid and ask orders, providing real-time insight into bid-ask pressure that reflects potential price direction or short-term momentum shifts. Explore deeper to understand how integrating volume profile with order book imbalance enhances trading decisions based on dynamic market liquidity and directional bias.

Source and External Links

Advanced Day Trading Strategies Using Volume Profile - Volume Profile is a volume-by-price indicator showing total trading volume at each price level over a specified time, helping traders visualize significant price levels through a histogram on the price chart.

Volume profile indicators: basic concepts - Volume Profile charts the volume traded at specific price levels during a set period, dividing volume into up and down volume to reveal dominant price levels and assist in trading decisions.

Understanding Volume Profile: A Powerful Tool for Traders - Volume Profile plots trading volume against price instead of time, identifying key support and resistance zones by highlighting price levels with significant trading activity.

dowidth.com

dowidth.com