Delta-neutral strategies focus on minimizing exposure to directional market risk by balancing long and short positions, aiming for consistent returns regardless of price movements. Momentum strategies capitalize on existing market trends by buying assets showing upward momentum and selling those with downward momentum, seeking to profit from sustained price moves. Explore these approaches to understand how traders tailor risk and opportunity in dynamic markets.

Why it is important

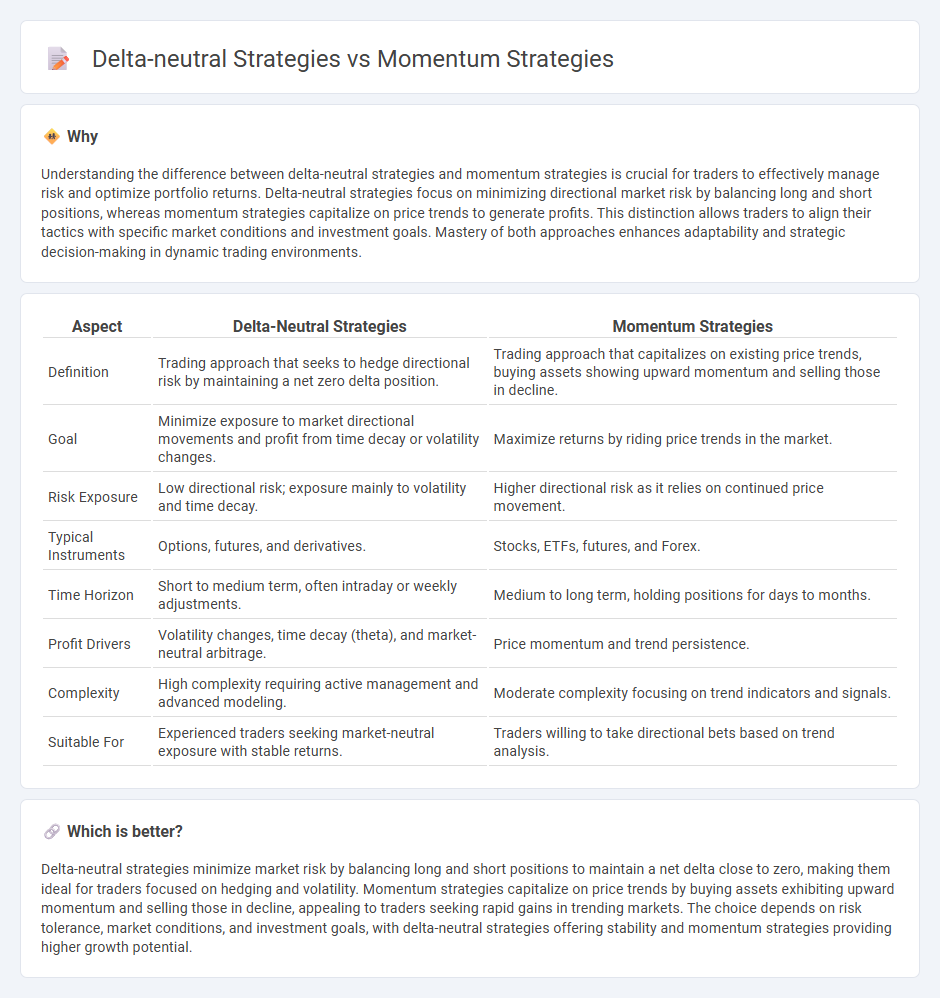

Understanding the difference between delta-neutral strategies and momentum strategies is crucial for traders to effectively manage risk and optimize portfolio returns. Delta-neutral strategies focus on minimizing directional market risk by balancing long and short positions, whereas momentum strategies capitalize on price trends to generate profits. This distinction allows traders to align their tactics with specific market conditions and investment goals. Mastery of both approaches enhances adaptability and strategic decision-making in dynamic trading environments.

Comparison Table

| Aspect | Delta-Neutral Strategies | Momentum Strategies |

|---|---|---|

| Definition | Trading approach that seeks to hedge directional risk by maintaining a net zero delta position. | Trading approach that capitalizes on existing price trends, buying assets showing upward momentum and selling those in decline. |

| Goal | Minimize exposure to market directional movements and profit from time decay or volatility changes. | Maximize returns by riding price trends in the market. |

| Risk Exposure | Low directional risk; exposure mainly to volatility and time decay. | Higher directional risk as it relies on continued price movement. |

| Typical Instruments | Options, futures, and derivatives. | Stocks, ETFs, futures, and Forex. |

| Time Horizon | Short to medium term, often intraday or weekly adjustments. | Medium to long term, holding positions for days to months. |

| Profit Drivers | Volatility changes, time decay (theta), and market-neutral arbitrage. | Price momentum and trend persistence. |

| Complexity | High complexity requiring active management and advanced modeling. | Moderate complexity focusing on trend indicators and signals. |

| Suitable For | Experienced traders seeking market-neutral exposure with stable returns. | Traders willing to take directional bets based on trend analysis. |

Which is better?

Delta-neutral strategies minimize market risk by balancing long and short positions to maintain a net delta close to zero, making them ideal for traders focused on hedging and volatility. Momentum strategies capitalize on price trends by buying assets exhibiting upward momentum and selling those in decline, appealing to traders seeking rapid gains in trending markets. The choice depends on risk tolerance, market conditions, and investment goals, with delta-neutral strategies offering stability and momentum strategies providing higher growth potential.

Connection

Delta-neutral strategies and momentum strategies are connected through their approach to managing market exposure and capturing price movements. Delta-neutral strategies seek to hedge directional risk by balancing long and short positions, while momentum strategies capitalize on trending price action, often requiring dynamic adjustments that can resemble delta-neutral hedging. Effective integration of both approaches allows traders to reduce risk while exploiting persistent market trends for enhanced returns.

Key Terms

**Momentum Strategies:**

Momentum strategies capitalize on asset price trends by buying securities showing upward momentum and selling those with downward momentum, aiming to profit from ongoing market movements. These strategies often rely on technical indicators such as moving averages, relative strength index (RSI), and volume analysis to identify and confirm trends. Discover more about how momentum strategies can be effectively implemented to enhance portfolio returns.

Trend

Momentum strategies capitalize on persistent price trends by buying assets with rising prices and selling those with falling prices, aiming to profit from market momentum. Delta-neutral strategies seek to minimize exposure to directional price movements by balancing long and short positions, focusing on capturing profits from volatility or price inefficiencies rather than trend direction. Explore the differences in risk profiles and performance metrics of these strategies to deepen your understanding.

Relative Strength

Momentum strategies leverage Relative Strength Index (RSI) to identify assets with strong upward trends, capitalizing on price momentum for potential gains. Delta-neutral strategies minimize exposure by balancing long and short positions, often incorporating Relative Strength measures to select stable, less volatile assets. Explore comprehensive analyses and case studies to understand how integrating Relative Strength enhances these trading strategies.

Source and External Links

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - This resource explains momentum trading as buying or selling assets based on recent price trends with key implementation tips such as using technical indicators, managing risk, defining clear entry/exit rules, and continuously backtesting strategies before scaling up.

Enhancing Momentum Strategies - Alpha Architect - This article discusses improved portfolio rules for momentum investing that maintain strong momentum exposure over longer periods and reduce turnover, featuring concentrated and diversified approaches based on anticipated future momentum.

Momentum Trading Strategies: Beginner's Guide | tastylive - This guide outlines common momentum trading methods like trend following, breakout trading, and relative strength, emphasizing the importance of disciplined risk management, continuous monitoring, and adjusting positions to capture profits while limiting losses.

dowidth.com

dowidth.com