Airdrop farming involves collecting free cryptocurrency tokens distributed by projects as rewards or promotions, leveraging strategic participation in multiple airdrops to maximize gains. Scalping in trading focuses on executing rapid, small trades to capitalize on minor price fluctuations within short timeframes, requiring precise timing and technical analysis. Explore detailed strategies and pros and cons of each approach to enhance your trading portfolio effectively.

Why it is important

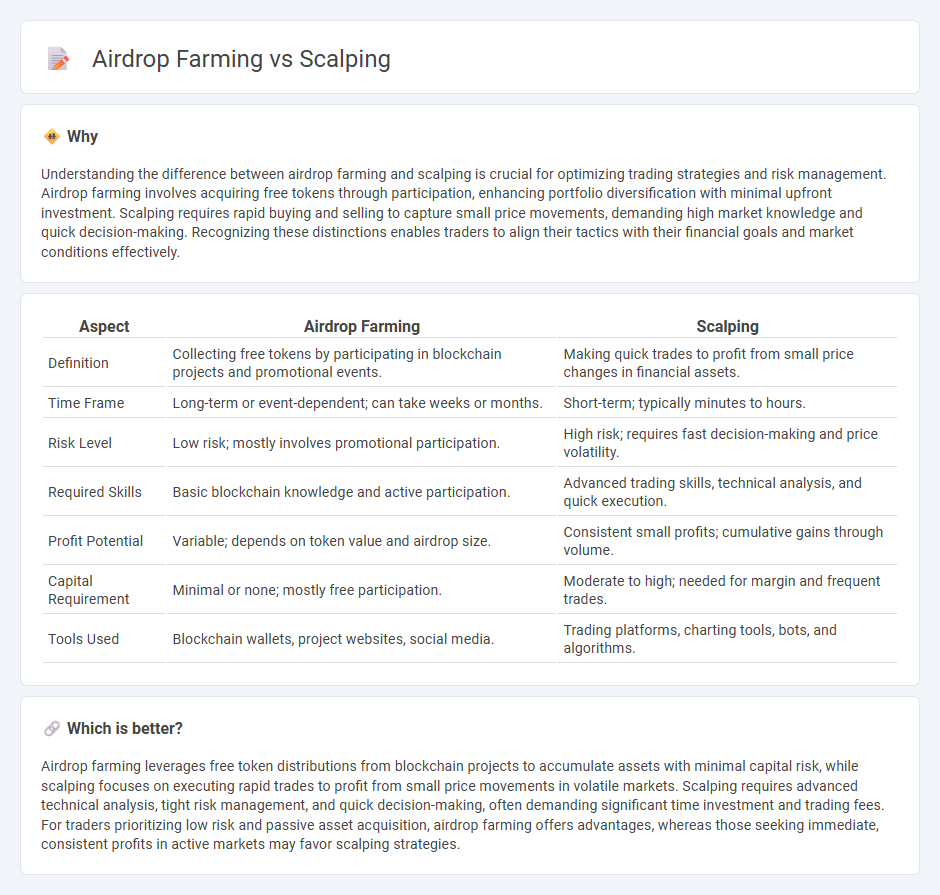

Understanding the difference between airdrop farming and scalping is crucial for optimizing trading strategies and risk management. Airdrop farming involves acquiring free tokens through participation, enhancing portfolio diversification with minimal upfront investment. Scalping requires rapid buying and selling to capture small price movements, demanding high market knowledge and quick decision-making. Recognizing these distinctions enables traders to align their tactics with their financial goals and market conditions effectively.

Comparison Table

| Aspect | Airdrop Farming | Scalping |

|---|---|---|

| Definition | Collecting free tokens by participating in blockchain projects and promotional events. | Making quick trades to profit from small price changes in financial assets. |

| Time Frame | Long-term or event-dependent; can take weeks or months. | Short-term; typically minutes to hours. |

| Risk Level | Low risk; mostly involves promotional participation. | High risk; requires fast decision-making and price volatility. |

| Required Skills | Basic blockchain knowledge and active participation. | Advanced trading skills, technical analysis, and quick execution. |

| Profit Potential | Variable; depends on token value and airdrop size. | Consistent small profits; cumulative gains through volume. |

| Capital Requirement | Minimal or none; mostly free participation. | Moderate to high; needed for margin and frequent trades. |

| Tools Used | Blockchain wallets, project websites, social media. | Trading platforms, charting tools, bots, and algorithms. |

Which is better?

Airdrop farming leverages free token distributions from blockchain projects to accumulate assets with minimal capital risk, while scalping focuses on executing rapid trades to profit from small price movements in volatile markets. Scalping requires advanced technical analysis, tight risk management, and quick decision-making, often demanding significant time investment and trading fees. For traders prioritizing low risk and passive asset acquisition, airdrop farming offers advantages, whereas those seeking immediate, consistent profits in active markets may favor scalping strategies.

Connection

Airdrop farming and scalping share a common strategy of leveraging short-term opportunities within the crypto market to maximize profits. Both approaches require close market monitoring, rapid execution, and an understanding of token distribution events and price volatility. Skilled traders use airdrop farming to acquire tokens early, then apply scalping techniques to sell quickly for incremental gains.

Key Terms

**Scalping:**

Scalping involves making quick trades to capitalize on small price fluctuations in cryptocurrency markets, often executed multiple times a day to maximize profits. This strategy requires high market liquidity, quick decision-making, and real-time data analysis to effectively enter and exit positions within seconds or minutes. Explore deeper insights into scalping techniques and the tools used by professional traders to enhance your trading strategy.

Spread

Scalping in cryptocurrency trading aims at profiting from small price spreads through rapid buying and selling, often exploiting market inefficiencies. Airdrop farming involves accumulating tokens from blockchain projects distributing free tokens, focusing less on spread and more on quantity obtained during promotional events. Explore the nuances of how spreads impact profitability in these strategies to optimize your crypto investment approach.

Liquidity

Scalping in cryptocurrency trading involves quick, short-term trades to profit from small price movements, often relying on high liquidity for rapid entry and exit. Airdrop farming focuses on accumulating free tokens distributed by projects, where liquidity plays a crucial role in token value realization and trading opportunities. Explore more about how liquidity impacts these strategies and which suits your trading style best.

Source and External Links

Scalping (Day Trading Technique) - Corporate Finance Institute - Scalping is a day trading method where an investor buys and sells stocks multiple times within the same day, aiming for small profits with each trade by exploiting short-term stock movements, often in highly volatile securities.

Scalping (trading) - Wikipedia - Scalping in trading refers to rapidly opening and closing positions to profit from small price changes or bid-ask spreads, typically done within seconds or minutes, and can be either a legitimate arbitrage method or a form of market manipulation.

What is a scalping strategy in the stock market and how does it work? - Scalping is a fast-paced trading strategy relying on technical indicators like moving averages and RSI to buy and sell securities quickly for small gains, suitable for traders who can execute rapid trades and analysis under pressure.

dowidth.com

dowidth.com