Options flow reveals real-time trading activity and sentiment by tracking the volume and direction of option contracts being bought or sold, providing insights into market momentum and potential price movements. Open interest indicates the total number of outstanding option contracts that remain open, reflecting market liquidity and investor commitment over time. Explore the nuances of options flow and open interest to enhance your trading strategy and market analysis.

Why it is important

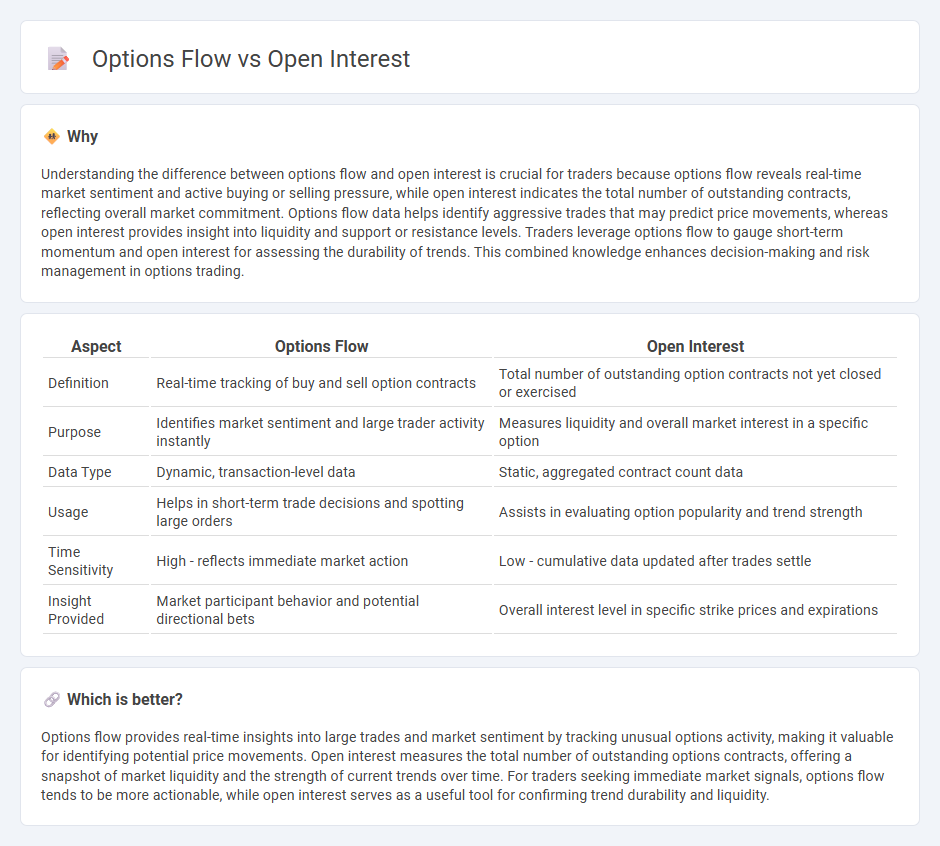

Understanding the difference between options flow and open interest is crucial for traders because options flow reveals real-time market sentiment and active buying or selling pressure, while open interest indicates the total number of outstanding contracts, reflecting overall market commitment. Options flow data helps identify aggressive trades that may predict price movements, whereas open interest provides insight into liquidity and support or resistance levels. Traders leverage options flow to gauge short-term momentum and open interest for assessing the durability of trends. This combined knowledge enhances decision-making and risk management in options trading.

Comparison Table

| Aspect | Options Flow | Open Interest |

|---|---|---|

| Definition | Real-time tracking of buy and sell option contracts | Total number of outstanding option contracts not yet closed or exercised |

| Purpose | Identifies market sentiment and large trader activity instantly | Measures liquidity and overall market interest in a specific option |

| Data Type | Dynamic, transaction-level data | Static, aggregated contract count data |

| Usage | Helps in short-term trade decisions and spotting large orders | Assists in evaluating option popularity and trend strength |

| Time Sensitivity | High - reflects immediate market action | Low - cumulative data updated after trades settle |

| Insight Provided | Market participant behavior and potential directional bets | Overall interest level in specific strike prices and expirations |

Which is better?

Options flow provides real-time insights into large trades and market sentiment by tracking unusual options activity, making it valuable for identifying potential price movements. Open interest measures the total number of outstanding options contracts, offering a snapshot of market liquidity and the strength of current trends over time. For traders seeking immediate market signals, options flow tends to be more actionable, while open interest serves as a useful tool for confirming trend durability and liquidity.

Connection

Options flow reveals real-time trading activity and investor sentiment, directly influencing open interest, which represents the total number of outstanding option contracts. A surge in options flow, particularly in buying activity, typically leads to an increase in open interest as new contracts are created. Monitoring both metrics allows traders to gauge market momentum and potential price movements more accurately.

Key Terms

Contracts

Open interest represents the total number of outstanding options contracts that remain unexercised or unsettled in the market, serving as a key indicator of market liquidity. Options flow tracks real-time trading activity by showing the volume and price of new contracts being bought or sold, revealing trader sentiment and potential market moves. Explore further to understand how analyzing both open interest and options flow can enhance your trading strategy and decision-making.

Volume

Open interest represents the total number of outstanding options contracts that have not been settled, providing insight into market liquidity and participant commitment. Options flow specifically tracks real-time trading volume and order activity, revealing immediate market sentiment and directional bias. Explore deeper analyses of volume metrics to enhance your options trading strategies.

Market sentiment

Open interest represents the total number of outstanding options contracts, providing insight into the strength of market sentiment and potential price trends. Options flow tracks real-time options trading activity, revealing traders' immediate expectations and shifts in bullish or bearish sentiment. Explore how combining open interest and options flow offers a comprehensive view of market sentiment and trading dynamics.

Source and External Links

Open Interest - CME Group - Open interest is the total number of futures contracts held by market participants at the end of the trading day, reflecting the number of contracts that remain open and serving as an indicator of market sentiment and price trend strength.

Open interest - Wikipedia - Open interest refers to the total number of outstanding derivative contracts that have not been settled, providing insight into market liquidity and used as a technical indicator to confirm market trends.

Open Interest | Learn Options Trading - Market Chameleon - Open interest is the total number of option contracts currently open and not yet liquidated, important for traders to analyze market positions, liquidity, and potential price movements around specific option strikes.

dowidth.com

dowidth.com