Funded account programs offer traders the opportunity to manage capital provided by proprietary firms, allowing them to trade with reduced personal financial risk, while hedge funds pool investments from accredited investors to implement diverse strategies for broader market exposure and potential high returns. These programs often emphasize performance-based scaling and stricter risk management tailored for individual traders, contrasting with hedge funds' formal structure, regulatory compliance, and institutional investor focus. Explore the differences and benefits of each to determine the best fit for your trading goals.

Why it is important

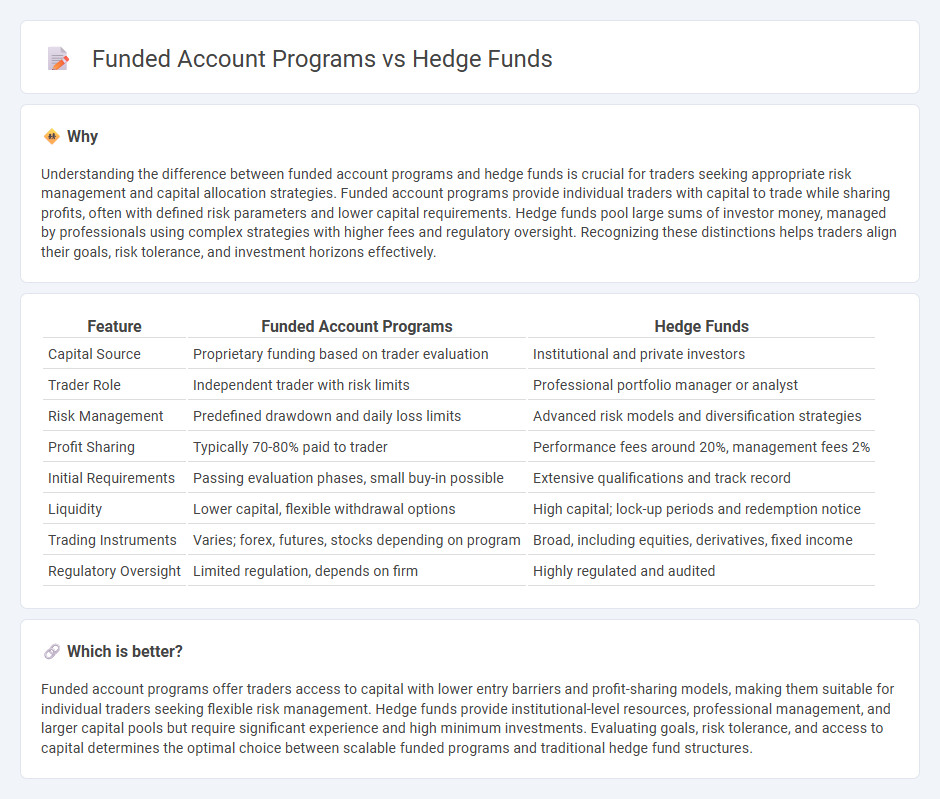

Understanding the difference between funded account programs and hedge funds is crucial for traders seeking appropriate risk management and capital allocation strategies. Funded account programs provide individual traders with capital to trade while sharing profits, often with defined risk parameters and lower capital requirements. Hedge funds pool large sums of investor money, managed by professionals using complex strategies with higher fees and regulatory oversight. Recognizing these distinctions helps traders align their goals, risk tolerance, and investment horizons effectively.

Comparison Table

| Feature | Funded Account Programs | Hedge Funds |

|---|---|---|

| Capital Source | Proprietary funding based on trader evaluation | Institutional and private investors |

| Trader Role | Independent trader with risk limits | Professional portfolio manager or analyst |

| Risk Management | Predefined drawdown and daily loss limits | Advanced risk models and diversification strategies |

| Profit Sharing | Typically 70-80% paid to trader | Performance fees around 20%, management fees 2% |

| Initial Requirements | Passing evaluation phases, small buy-in possible | Extensive qualifications and track record |

| Liquidity | Lower capital, flexible withdrawal options | High capital; lock-up periods and redemption notice |

| Trading Instruments | Varies; forex, futures, stocks depending on program | Broad, including equities, derivatives, fixed income |

| Regulatory Oversight | Limited regulation, depends on firm | Highly regulated and audited |

Which is better?

Funded account programs offer traders access to capital with lower entry barriers and profit-sharing models, making them suitable for individual traders seeking flexible risk management. Hedge funds provide institutional-level resources, professional management, and larger capital pools but require significant experience and high minimum investments. Evaluating goals, risk tolerance, and access to capital determines the optimal choice between scalable funded programs and traditional hedge fund structures.

Connection

Funded account programs provide traders with capital to trade without risking personal funds, resembling the capital allocation model used by hedge funds where portfolio managers trade using pooled investor assets. Both structures prioritize risk management, performance evaluation, and profit sharing, aligning trader incentives with capital providers. This connection enables skilled traders in funded programs to gain experience and potentially transition to managing or collaborating with hedge funds.

Key Terms

Leverage

Hedge funds typically utilize moderate leverage ratios, often between 2:1 and 3:1, to amplify returns while managing risk through diversified portfolios and professional management. Funded account programs, in contrast, can offer significantly higher leverage, sometimes exceeding 10:1, allowing traders to maximize capital efficiency but with increased exposure to market volatility. Explore the advantages and risks of leverage in hedge funds versus funded accounts to optimize your investment strategy.

Capital Allocation

Hedge funds pool capital from multiple investors to allocate across diverse asset classes, leveraging expert management to optimize returns while maintaining stringent regulatory compliance. Funded account programs provide traders with capital to trade on behalf of the firm, sharing profits based on performance without requiring personal investment, emphasizing risk management and scalability. Explore the nuances of capital allocation and risk strategies to determine the best approach for your financial goals.

Risk Management

Hedge funds employ sophisticated risk management strategies, including diversification, derivatives hedging, and strict regulatory compliance to mitigate market volatility and protect investor capital. Funded account programs often provide traders with capital while enforcing stringent risk controls through daily drawdown limits and real-time monitoring to manage exposure. Explore how these approaches differ in balancing returns and risk to optimize investment outcomes.

Source and External Links

Hedge Funds: Overview, Recruitment, Careers & Salaries - A hedge fund is an investment firm that raises money from institutional and accredited investors, using diverse strategies like short-selling and derivatives to seek absolute returns and reduce risks, unlike mutual funds that target relative returns.

Hedge Funds | Investor.gov - Hedge funds are private, unregistered investment funds that pool money mostly from sophisticated investors and use flexible investment strategies not available to mutual funds, often carrying higher risk and fewer regulatory protections.

Hedge fund - Wikipedia - Hedge funds are pooled investment funds employing complex trading and risk techniques, charging management and performance fees, and using strategies originally aimed at hedging but now covering a broad range of approaches potentially contributing to market risks.

dowidth.com

dowidth.com