Tokenized assets represent digital ownership of real-world commodities, enabling fractional investment and enhanced liquidity compared to traditional precious metals like gold and silver. These blockchain-based tokens offer transparency, faster transactions, and reduced custody risks, contrasting with the physical storage and insurance challenges of metals. Explore how tokenized assets are transforming trading strategies and investment portfolios.

Why it is important

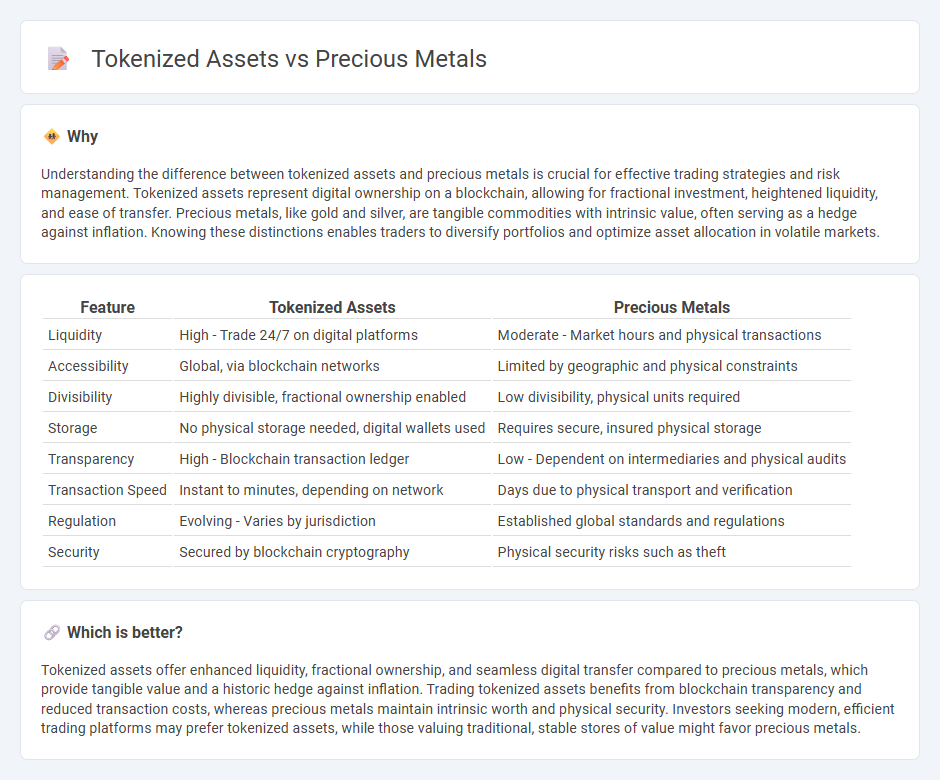

Understanding the difference between tokenized assets and precious metals is crucial for effective trading strategies and risk management. Tokenized assets represent digital ownership on a blockchain, allowing for fractional investment, heightened liquidity, and ease of transfer. Precious metals, like gold and silver, are tangible commodities with intrinsic value, often serving as a hedge against inflation. Knowing these distinctions enables traders to diversify portfolios and optimize asset allocation in volatile markets.

Comparison Table

| Feature | Tokenized Assets | Precious Metals |

|---|---|---|

| Liquidity | High - Trade 24/7 on digital platforms | Moderate - Market hours and physical transactions |

| Accessibility | Global, via blockchain networks | Limited by geographic and physical constraints |

| Divisibility | Highly divisible, fractional ownership enabled | Low divisibility, physical units required |

| Storage | No physical storage needed, digital wallets used | Requires secure, insured physical storage |

| Transparency | High - Blockchain transaction ledger | Low - Dependent on intermediaries and physical audits |

| Transaction Speed | Instant to minutes, depending on network | Days due to physical transport and verification |

| Regulation | Evolving - Varies by jurisdiction | Established global standards and regulations |

| Security | Secured by blockchain cryptography | Physical security risks such as theft |

Which is better?

Tokenized assets offer enhanced liquidity, fractional ownership, and seamless digital transfer compared to precious metals, which provide tangible value and a historic hedge against inflation. Trading tokenized assets benefits from blockchain transparency and reduced transaction costs, whereas precious metals maintain intrinsic worth and physical security. Investors seeking modern, efficient trading platforms may prefer tokenized assets, while those valuing traditional, stable stores of value might favor precious metals.

Connection

Tokenized assets represent ownership of precious metals like gold and silver on blockchain platforms, enabling seamless digital trading and increased liquidity. By converting physical metals into digital tokens, investors benefit from fractional ownership and enhanced transparency through decentralized ledgers. This fusion of blockchain technology and tangible assets revolutionizes traditional trading by reducing barriers and facilitating instant transfers worldwide.

Key Terms

Liquidity

Precious metals offer tangible value but often face limited liquidity due to physical storage and transaction constraints. Tokenized assets leverage blockchain technology, enabling faster and more efficient trading with 24/7 market access and fractional ownership. Explore how tokenization transforms asset liquidity and investment opportunities by learning more.

Custody

Custody of precious metals involves secure physical storage facilities with stringent insurance and regulatory compliance, ensuring asset protection against theft or loss. Tokenized assets offer digital custody through blockchain technology, enabling transparent, programmable ownership records and easier transferability via secure wallets and custodial services. Explore the evolving custody solutions shaping the future of asset security.

Price Discovery

Price discovery for precious metals relies on global spot markets and exchanges such as the London Metal Exchange and COMEX, where supply-demand dynamics and geopolitical factors influence valuations. Tokenized assets enable real-time, transparent price discovery through blockchain technology, offering increased liquidity and fractional ownership compared to traditional metal markets. Explore the evolving dynamics of price discovery between precious metals and tokenized assets to understand the future of asset valuation.

Source and External Links

Precious metal - Precious metals are rare, naturally occurring metallic elements of high economic value, including gold, silver, platinum, and palladium, known for corrosion resistance and historically used as currency and investments.

Buy Precious Metals Online from Money Metals Exchange - Precious metals like gold, silver, platinum, and palladium are valued for their rarity and used both industrially and as investment assets to protect wealth and diversify portfolios.

A List of Precious Metals - The four primary precious metals are gold, silver, platinum, and palladium, each distinguished by factors affecting their value and rarity.

dowidth.com

dowidth.com