Statistical arbitrage involves leveraging quantitative models to identify pricing inefficiencies between related financial instruments, enabling traders to capitalize on temporary mispricings. Market making focuses on providing liquidity by continuously quoting buy and sell prices, profiting from the bid-ask spread while managing inventory risk. Explore deeper insights into these trading strategies to enhance portfolio optimization and risk management.

Why it is important

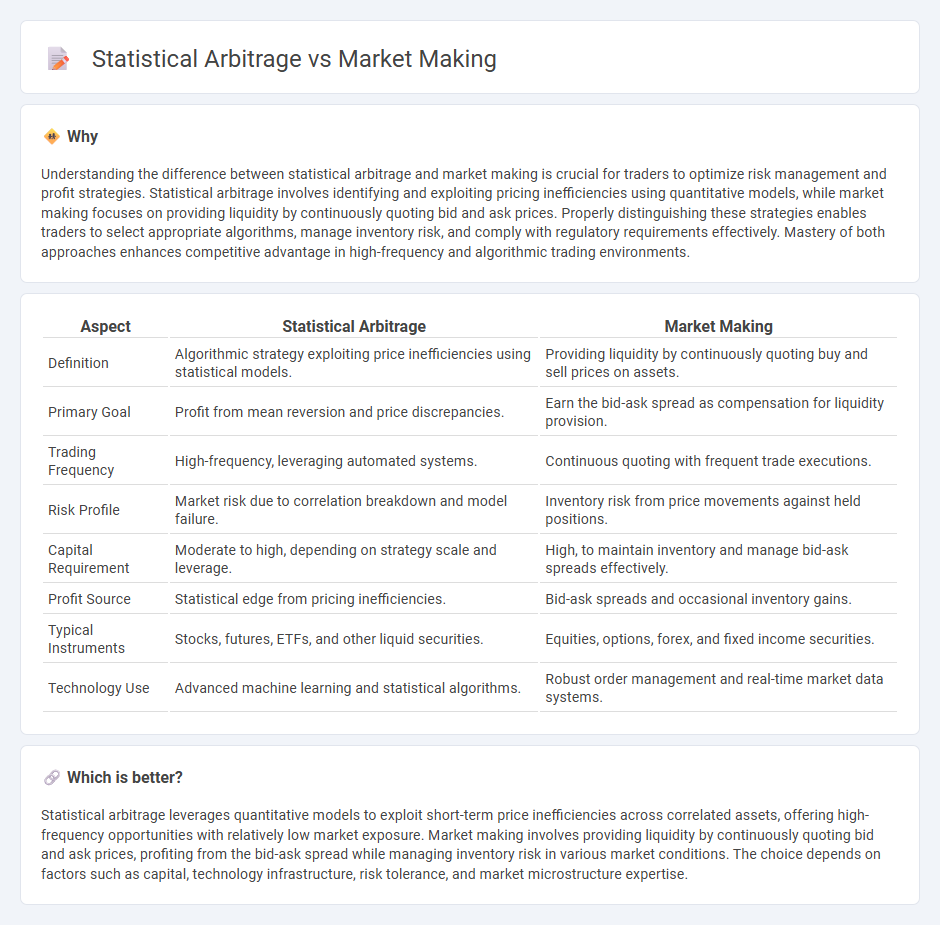

Understanding the difference between statistical arbitrage and market making is crucial for traders to optimize risk management and profit strategies. Statistical arbitrage involves identifying and exploiting pricing inefficiencies using quantitative models, while market making focuses on providing liquidity by continuously quoting bid and ask prices. Properly distinguishing these strategies enables traders to select appropriate algorithms, manage inventory risk, and comply with regulatory requirements effectively. Mastery of both approaches enhances competitive advantage in high-frequency and algorithmic trading environments.

Comparison Table

| Aspect | Statistical Arbitrage | Market Making |

|---|---|---|

| Definition | Algorithmic strategy exploiting price inefficiencies using statistical models. | Providing liquidity by continuously quoting buy and sell prices on assets. |

| Primary Goal | Profit from mean reversion and price discrepancies. | Earn the bid-ask spread as compensation for liquidity provision. |

| Trading Frequency | High-frequency, leveraging automated systems. | Continuous quoting with frequent trade executions. |

| Risk Profile | Market risk due to correlation breakdown and model failure. | Inventory risk from price movements against held positions. |

| Capital Requirement | Moderate to high, depending on strategy scale and leverage. | High, to maintain inventory and manage bid-ask spreads effectively. |

| Profit Source | Statistical edge from pricing inefficiencies. | Bid-ask spreads and occasional inventory gains. |

| Typical Instruments | Stocks, futures, ETFs, and other liquid securities. | Equities, options, forex, and fixed income securities. |

| Technology Use | Advanced machine learning and statistical algorithms. | Robust order management and real-time market data systems. |

Which is better?

Statistical arbitrage leverages quantitative models to exploit short-term price inefficiencies across correlated assets, offering high-frequency opportunities with relatively low market exposure. Market making involves providing liquidity by continuously quoting bid and ask prices, profiting from the bid-ask spread while managing inventory risk in various market conditions. The choice depends on factors such as capital, technology infrastructure, risk tolerance, and market microstructure expertise.

Connection

Statistical arbitrage and market making both rely on exploiting price inefficiencies in financial markets through quantitative models and real-time data analysis. Market makers provide liquidity and stabilize prices by continuously quoting bid and ask prices, while statistical arbitrage uses statistical methods to identify and capitalize on temporary price deviations between correlated assets. Together, these strategies enhance market efficiency by narrowing spreads and correcting mispricings.

Key Terms

Bid-Ask Spread

Market making involves continuously providing buy and sell quotes to capture the bid-ask spread, profiting from the difference between these prices in highly liquid markets. Statistical arbitrage, by contrast, exploits price inefficiencies and patterns across securities, often employing complex models without solely relying on the bid-ask spread. Explore detailed strategies behind market making and statistical arbitrage to uncover how each leverages price movements in financial markets.

Liquidity Provision

Market making focuses on liquidity provision by continuously quoting bid and ask prices to facilitate trading and narrow spreads. Statistical arbitrage exploits price discrepancies across related assets using quantitative models, indirectly impacting liquidity by executing trades based on statistical signals. Explore deeper insights into how liquidity provision differentiates these strategies and enhances market efficiency.

Mean Reversion

Market making involves continuously quoting buy and sell prices to capture the bid-ask spread, often relying on mean reversion to manage inventory risk by predicting that price deviations from the fair value will revert. Statistical arbitrage, particularly mean reversion strategies, exploits temporary price inefficiencies by identifying assets whose prices deviate from historical averages, anticipating a return to equilibrium. Explore the nuances of mean reversion in these strategies to optimize trading performance and risk management.

Source and External Links

Mastering the Market Maker Trading Strategy | EPAM SolutionsHub - Market making is a trading strategy where market makers profit by buying securities at a bid price and selling at a higher ask price, managing inventory risk and analyzing order flow to provide liquidity while earning from the bid-ask spread.

Market maker: What it is, importance, benefits & examples - StoneX - A market maker continually quotes both buy and sell prices for securities, facilitating immediate trade execution, profiting from the bid-ask spread, and managing inventory to balance risk and liquidity provision.

Market Maker - Definition, Role, How They Work - Market makers ensure market liquidity by simultaneously providing bids and asks, handling trades for others and themselves, and earning profits through the bid-ask spread compensating for the risk of holding inventory.

dowidth.com

dowidth.com