Trade journaling software allows traders to systematically record and review their trades, capturing details such as entry and exit points, trade rationale, and emotional context to improve decision-making. Trade analytics platforms provide advanced data analysis tools that visualize performance metrics, identify patterns, and generate insights from large datasets to optimize trading strategies. Explore the key differences and benefits of each to enhance your trading performance effectively.

Why it is important

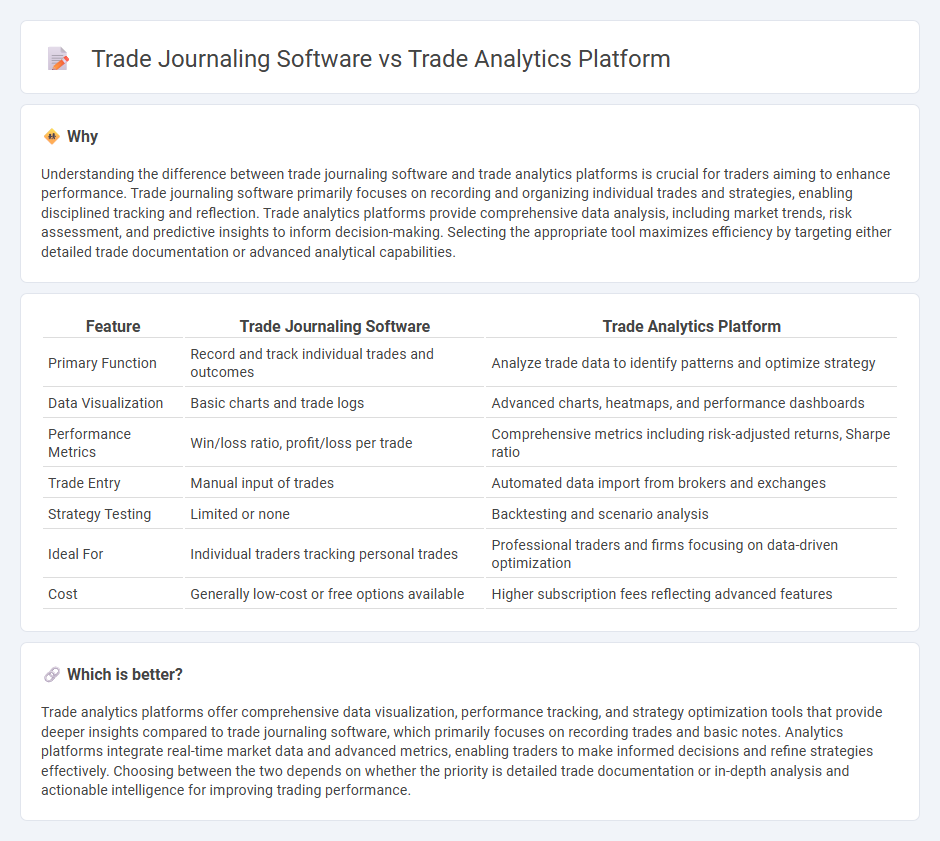

Understanding the difference between trade journaling software and trade analytics platforms is crucial for traders aiming to enhance performance. Trade journaling software primarily focuses on recording and organizing individual trades and strategies, enabling disciplined tracking and reflection. Trade analytics platforms provide comprehensive data analysis, including market trends, risk assessment, and predictive insights to inform decision-making. Selecting the appropriate tool maximizes efficiency by targeting either detailed trade documentation or advanced analytical capabilities.

Comparison Table

| Feature | Trade Journaling Software | Trade Analytics Platform |

|---|---|---|

| Primary Function | Record and track individual trades and outcomes | Analyze trade data to identify patterns and optimize strategy |

| Data Visualization | Basic charts and trade logs | Advanced charts, heatmaps, and performance dashboards |

| Performance Metrics | Win/loss ratio, profit/loss per trade | Comprehensive metrics including risk-adjusted returns, Sharpe ratio |

| Trade Entry | Manual input of trades | Automated data import from brokers and exchanges |

| Strategy Testing | Limited or none | Backtesting and scenario analysis |

| Ideal For | Individual traders tracking personal trades | Professional traders and firms focusing on data-driven optimization |

| Cost | Generally low-cost or free options available | Higher subscription fees reflecting advanced features |

Which is better?

Trade analytics platforms offer comprehensive data visualization, performance tracking, and strategy optimization tools that provide deeper insights compared to trade journaling software, which primarily focuses on recording trades and basic notes. Analytics platforms integrate real-time market data and advanced metrics, enabling traders to make informed decisions and refine strategies effectively. Choosing between the two depends on whether the priority is detailed trade documentation or in-depth analysis and actionable intelligence for improving trading performance.

Connection

Trade journaling software and trade analytics platforms are integral components of modern trading strategies, allowing traders to systematically record, review, and analyze their trades to optimize performance. By integrating trade journaling data with advanced analytics tools, traders gain actionable insights into market patterns, risk management, and behavioral biases, enhancing decision-making accuracy. This seamless connection facilitates continuous improvement through detailed performance metrics, helping traders refine strategies and improve profitability over time.

Key Terms

**Trade Analytics Platform:**

Trade analytics platforms provide comprehensive data analysis, visualization, and performance metrics, enabling traders to make data-driven decisions by examining market trends, risk factors, and asset correlations. Unlike basic trade journaling software that primarily records trades, trade analytics platforms integrate advanced algorithms and real-time data feeds for predictive insights and portfolio optimization. Explore the full potential of trade analytics platforms to elevate your trading strategy and outcomes.

Performance Metrics

Trade analytics platforms provide in-depth performance metrics, including real-time trade execution data, risk-adjusted returns, and advanced statistical analysis tools that enhance decision-making for traders. Trade journaling software primarily focuses on recording and organizing individual trades, offering basic performance summaries and behavioral insights rather than comprehensive analytics. Explore how each solution can optimize your trading strategy by delving deeper into their performance metric capabilities.

Data Visualization

Trade analytics platforms offer advanced data visualization tools that transform raw trading data into interactive charts, heatmaps, and performance dashboards, enabling traders to identify patterns and optimize strategies effectively. Trade journaling software typically provides basic visual summaries of trades, focusing on record-keeping rather than deep analytical insights. Explore the key differences in data visualization capabilities to select the right tool for your trading analysis needs.

Source and External Links

TradesViz - A versatile, feature-packed platform offering advanced trade analytics, AI-powered trade journaling, broker integration, and customizable dashboards to analyze every trade aspect deeply and visually.

IG Trade Analytics Tool - A tool that provides personal trading performance insights, helping traders understand their successes and mistakes through detailed trade data analysis and educational resources.

Tradervue Trading Analysis - Software focused on improving trading performance objectively with advanced, customizable reports including risk analysis, tag reports, and liquidity breakdowns for detailed trade review.

dowidth.com

dowidth.com