Statistical arbitrage exploits pricing inefficiencies between correlated securities using quantitative models, while merger arbitrage focuses on profiting from price discrepancies arising during corporate merger and acquisition deals. Statistical arbitrage strategies rely heavily on historical price patterns and high-frequency trading, whereas merger arbitrage involves assessing deal completion risks and regulatory approval. Discover more about how these arbitrage strategies can enhance portfolio diversification and risk management.

Why it is important

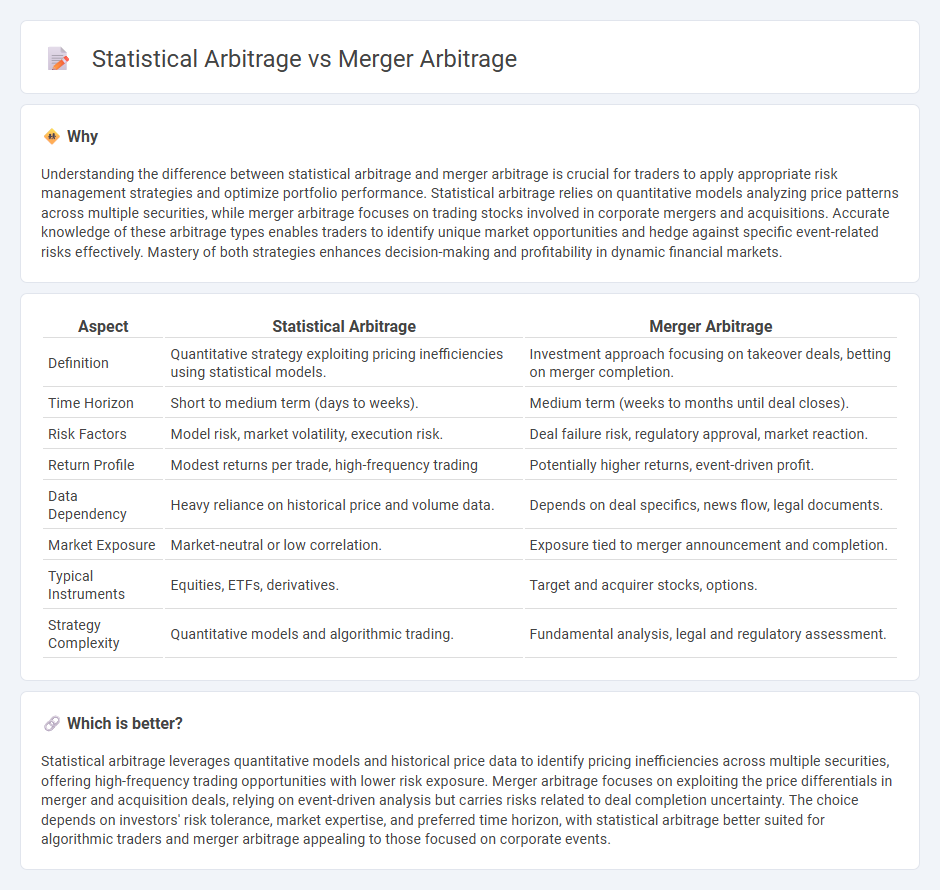

Understanding the difference between statistical arbitrage and merger arbitrage is crucial for traders to apply appropriate risk management strategies and optimize portfolio performance. Statistical arbitrage relies on quantitative models analyzing price patterns across multiple securities, while merger arbitrage focuses on trading stocks involved in corporate mergers and acquisitions. Accurate knowledge of these arbitrage types enables traders to identify unique market opportunities and hedge against specific event-related risks effectively. Mastery of both strategies enhances decision-making and profitability in dynamic financial markets.

Comparison Table

| Aspect | Statistical Arbitrage | Merger Arbitrage |

|---|---|---|

| Definition | Quantitative strategy exploiting pricing inefficiencies using statistical models. | Investment approach focusing on takeover deals, betting on merger completion. |

| Time Horizon | Short to medium term (days to weeks). | Medium term (weeks to months until deal closes). |

| Risk Factors | Model risk, market volatility, execution risk. | Deal failure risk, regulatory approval, market reaction. |

| Return Profile | Modest returns per trade, high-frequency trading | Potentially higher returns, event-driven profit. |

| Data Dependency | Heavy reliance on historical price and volume data. | Depends on deal specifics, news flow, legal documents. |

| Market Exposure | Market-neutral or low correlation. | Exposure tied to merger announcement and completion. |

| Typical Instruments | Equities, ETFs, derivatives. | Target and acquirer stocks, options. |

| Strategy Complexity | Quantitative models and algorithmic trading. | Fundamental analysis, legal and regulatory assessment. |

Which is better?

Statistical arbitrage leverages quantitative models and historical price data to identify pricing inefficiencies across multiple securities, offering high-frequency trading opportunities with lower risk exposure. Merger arbitrage focuses on exploiting the price differentials in merger and acquisition deals, relying on event-driven analysis but carries risks related to deal completion uncertainty. The choice depends on investors' risk tolerance, market expertise, and preferred time horizon, with statistical arbitrage better suited for algorithmic traders and merger arbitrage appealing to those focused on corporate events.

Connection

Statistical arbitrage and merger arbitrage both exploit pricing inefficiencies in financial markets but differ in their approaches. Statistical arbitrage uses quantitative models and historical price data to identify temporary mispricings across a large universe of securities. Merger arbitrage focuses specifically on price discrepancies in target and acquiring companies during announced mergers or acquisitions, capturing profit from the expected deal completion.

Key Terms

**Merger Arbitrage:**

Merger arbitrage involves capitalizing on the price discrepancies between the current market price of a target company's stock and the acquisition price proposed in a merger or takeover, typically yielding profits when the deal closes successfully. This strategy requires in-depth analysis of deal terms, regulatory approvals, and the likelihood of deal completion to mitigate risks such as deal failure or regulatory intervention. Explore deeper insights into merger arbitrage strategies and risk management techniques to enhance your investment approach.

Acquisition Premium

Merger arbitrage strategies capitalize on acquisition premiums by exploiting the price difference between a target company's current stock price and the offer price set by the acquiring firm, reflecting the risk and expected completion of the deal. Statistical arbitrage, in contrast, relies on quantitative models to identify mispricings and mean-reversion patterns in large baskets of securities, with less direct emphasis on acquisition premiums. Explore our detailed analysis to better understand how acquisition premiums influence arbitrage opportunities and optimize your investment strategies.

Deal Spread

Merger arbitrage targets profits from the deal spread, the price difference between a target company's current stock price and the acquisition offer, capitalizing on merger completion probabilities. Statistical arbitrage relies on quantitative models to exploit price inefficiencies across large portfolios, without direct dependence on deal spreads. Explore detailed strategies and risk profiles of merger arbitrage versus statistical arbitrage to deepen your understanding.

Source and External Links

Merger arbitrage: Process, examples, types, and risks - Merger arbitrage is an event-driven investing strategy focusing on buying the target company's stock below its expected post-merger value, involving research, analysis of merger agreements, risk assessment, and monitoring, with risks including deal failure or regulatory issues.

An Introduction to Merger Arbitrage - Merger arbitrage involves investing in companies undergoing mergers or acquisitions, profiting from the spread between the acquisition offer and the current trading price, with principal merger types being stock-for-stock, cash, and mixed consideration mergers.

Risk arbitrage - Risk or merger arbitrage speculates on the successful completion of mergers by buying the target's stock (and sometimes shorting the acquirer's stock in stock mergers), profiting as the stock price approaches the offer price upon deal completion.

dowidth.com

dowidth.com