Options flow reveals real-time market sentiment by tracking the buying and selling of options contracts, offering insights into potential price movements and trader expectations. Volume profile displays the distribution of trading volume over price levels, highlighting key support and resistance zones that guide strategic entry and exit points. Explore how combining options flow and volume profile can enhance your trading decisions and market analysis.

Why it is important

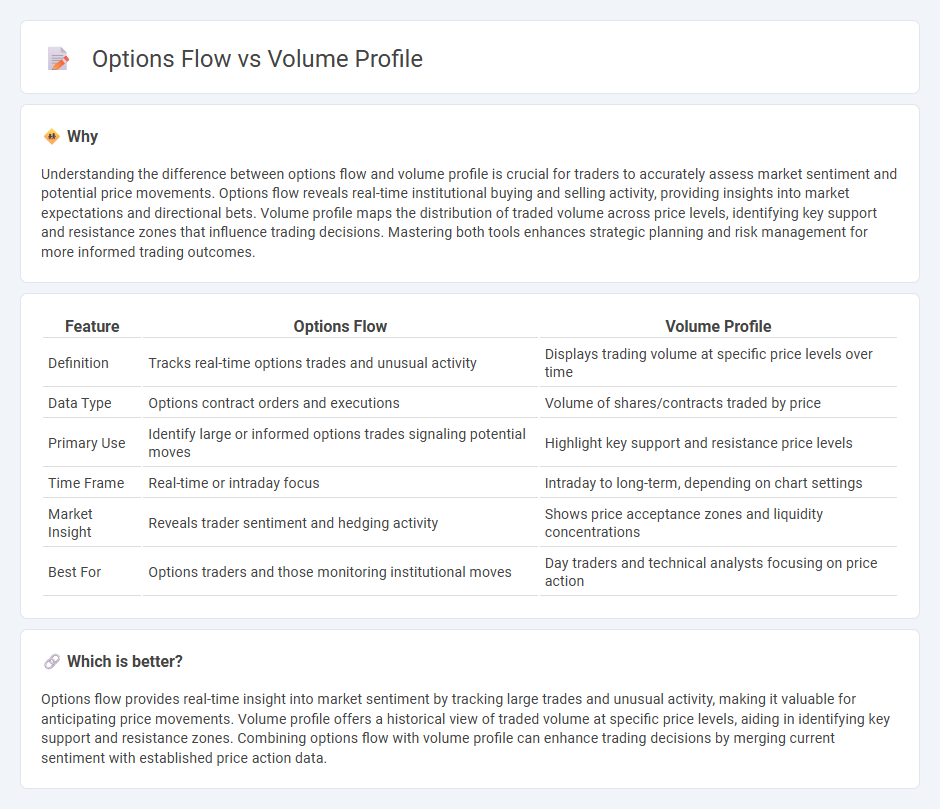

Understanding the difference between options flow and volume profile is crucial for traders to accurately assess market sentiment and potential price movements. Options flow reveals real-time institutional buying and selling activity, providing insights into market expectations and directional bets. Volume profile maps the distribution of traded volume across price levels, identifying key support and resistance zones that influence trading decisions. Mastering both tools enhances strategic planning and risk management for more informed trading outcomes.

Comparison Table

| Feature | Options Flow | Volume Profile |

|---|---|---|

| Definition | Tracks real-time options trades and unusual activity | Displays trading volume at specific price levels over time |

| Data Type | Options contract orders and executions | Volume of shares/contracts traded by price |

| Primary Use | Identify large or informed options trades signaling potential moves | Highlight key support and resistance price levels |

| Time Frame | Real-time or intraday focus | Intraday to long-term, depending on chart settings |

| Market Insight | Reveals trader sentiment and hedging activity | Shows price acceptance zones and liquidity concentrations |

| Best For | Options traders and those monitoring institutional moves | Day traders and technical analysts focusing on price action |

Which is better?

Options flow provides real-time insight into market sentiment by tracking large trades and unusual activity, making it valuable for anticipating price movements. Volume profile offers a historical view of traded volume at specific price levels, aiding in identifying key support and resistance zones. Combining options flow with volume profile can enhance trading decisions by merging current sentiment with established price action data.

Connection

Options flow provides real-time insights into market sentiment by tracking large trades and unusual activity, which directly influences the volume profile by highlighting price levels with significant trading interest. The volume profile visually represents the distribution of traded volume at specific price points, enabling traders to identify key support and resistance zones driven by options market dynamics. Analyzing options flow alongside the volume profile enhances decision-making by revealing where institutional investors are concentrating their positions and how these affect price structure.

Key Terms

Price Levels

Volume profile highlights the distribution of traded volumes at specific price levels, identifying key support and resistance zones critical for market analysis. Options flow tracks real-time options market activity, revealing trader sentiment and potential price movements based on option volume and open interest at different strike prices. Explore deeper insights into how these tools complement each other for precision trading strategies.

Open Interest

Volume profile provides a comprehensive visualization of traded volumes at specific price levels, highlighting market support and resistance zones. Options flow tracks real-time options trades and changes in Open Interest, revealing trader sentiment and potential price movements based on options market activity. Explore how integrating volume profile and options flow analysis can enhance your trading strategy by deepening insight into Open Interest dynamics.

Trade Imbalance

Trade imbalance in volume profile highlights significant buying or selling activity at specific price levels, revealing key support and resistance zones driven by institutional traders. Options flow tracks the real-time buying and selling of options contracts, providing insights into market sentiment and potential large trades impacting price movements. Explore detailed strategies integrating trade imbalance data with options flow to enhance trading decisions and market timing.

Source and External Links

Advanced Day Trading Strategies Using Volume Profile - TradingSim - Volume Profile is a volume-by-price indicator showing total trading volume at each price level over a given period, helping traders identify significant price levels via a histogram plotted on the price chart.

Volume profile indicators: basic concepts - TradingView - Volume Profile is an advanced charting tool that displays trading activity at specified price levels and periods, dividing total volume into up volume and down volume to visualize dominant price levels.

Using the Volume Profile Indicator - Charles Schwab - The Volume Profile indicator helps traders identify price levels where demand concentrates, showing balanced or imbalanced market conditions that can indicate potential trading strategies based on the Point of Control (POC) and value areas.

dowidth.com

dowidth.com