Copy trading enables investors to replicate the exact trades of expert traders in real-time, offering a hands-on approach for those seeking direct exposure. Mirror trading automatically executes trades based on a predefined algorithm or strategy, allowing for systematic and emotion-free investment decisions. Explore the nuances of copy trading and mirror trading to determine which best aligns with your financial goals.

Why it is important

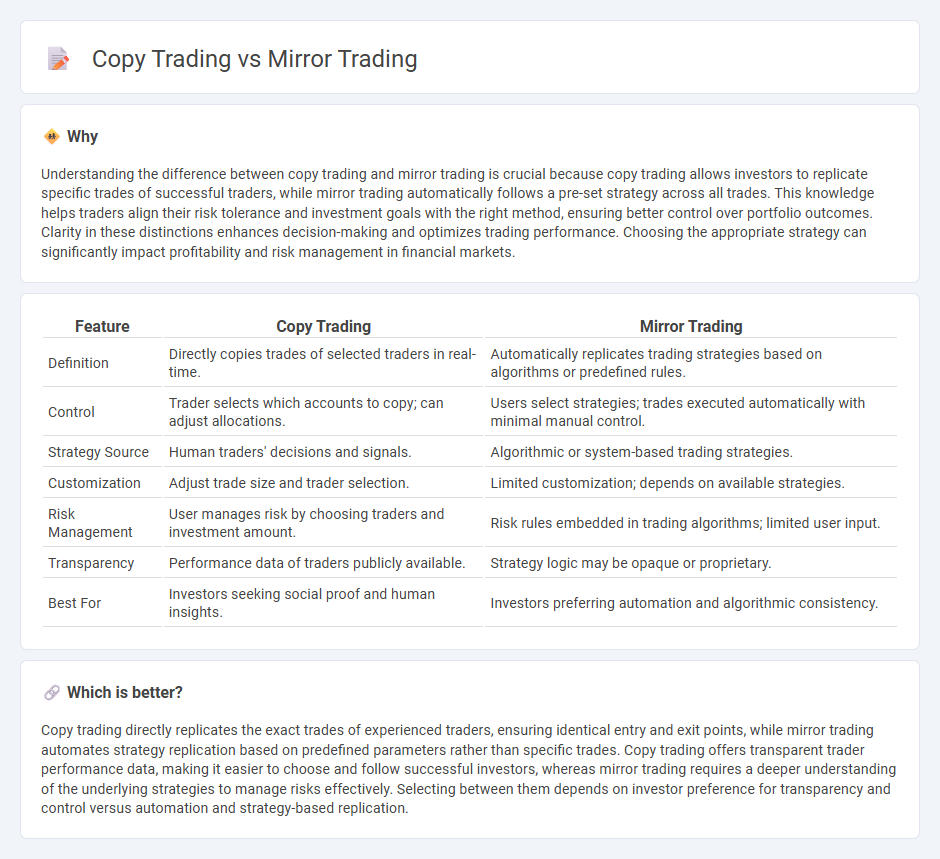

Understanding the difference between copy trading and mirror trading is crucial because copy trading allows investors to replicate specific trades of successful traders, while mirror trading automatically follows a pre-set strategy across all trades. This knowledge helps traders align their risk tolerance and investment goals with the right method, ensuring better control over portfolio outcomes. Clarity in these distinctions enhances decision-making and optimizes trading performance. Choosing the appropriate strategy can significantly impact profitability and risk management in financial markets.

Comparison Table

| Feature | Copy Trading | Mirror Trading |

|---|---|---|

| Definition | Directly copies trades of selected traders in real-time. | Automatically replicates trading strategies based on algorithms or predefined rules. |

| Control | Trader selects which accounts to copy; can adjust allocations. | Users select strategies; trades executed automatically with minimal manual control. |

| Strategy Source | Human traders' decisions and signals. | Algorithmic or system-based trading strategies. |

| Customization | Adjust trade size and trader selection. | Limited customization; depends on available strategies. |

| Risk Management | User manages risk by choosing traders and investment amount. | Risk rules embedded in trading algorithms; limited user input. |

| Transparency | Performance data of traders publicly available. | Strategy logic may be opaque or proprietary. |

| Best For | Investors seeking social proof and human insights. | Investors preferring automation and algorithmic consistency. |

Which is better?

Copy trading directly replicates the exact trades of experienced traders, ensuring identical entry and exit points, while mirror trading automates strategy replication based on predefined parameters rather than specific trades. Copy trading offers transparent trader performance data, making it easier to choose and follow successful investors, whereas mirror trading requires a deeper understanding of the underlying strategies to manage risks effectively. Selecting between them depends on investor preference for transparency and control versus automation and strategy-based replication.

Connection

Copy trading and mirror trading both enable traders to replicate the strategies of experienced investors to potentially enhance their own trading performance. Copy trading involves automatically copying specific trades made by a selected trader, while mirror trading replicates entire trading strategies or systems across portfolios in real-time. Both approaches leverage social trading platforms and algorithmic tools to facilitate seamless strategy execution and risk management.

Key Terms

Strategy Provider

Strategy providers in mirror trading develop algorithmic models that automatically execute trades on behalf of investors, ensuring consistent adherence to specific trading rules. In contrast, copy trading's strategy providers are individual traders whose actions are directly replicated by followers, often reflecting personal discretion and style. Explore deeper insights into how these providers impact risk management and performance outcomes.

Automated Execution

Mirror trading enables investors to replicate entire trading strategies automatically by copying the exact trades of experienced traders, ensuring seamless and real-time execution. Copy trading allows followers to select individual traders to mimic their specific trade actions, offering a more personalized yet automated trading experience. Explore the differences in automation and strategy replication to determine which method suits your trading goals best.

Signal Duplication

Mirror trading replicates entire trading strategies by automatically copying all trades from a professional trader's account, ensuring precise signal duplication and execution. Copy trading allows users to selectively follow individual trades or traders, providing more control but less exact signal duplication. Explore the nuances of signal duplication to understand which method suits your investment goals best.

Source and External Links

Mirror trading - Wikipedia - Mirror trading is a method in which traders automatically copy or "mirror" the trades executed by selected strategies or experienced traders in their brokerage accounts, commonly used in forex and stock markets to diversify risk and save time without manual intervention.

What is Mirror Trading? | NICE Actimize - Mirror trading allows investors to replicate the real-time trades of seasoned traders using automated platforms, offering access to professional expertise, diversification, and emotion-free investing for novice traders.

Guide To Mirror Trading Platforms & Software - DayTrading.com - Mirror trading enables beginners to copy the positions of experienced traders automatically or via trading bots (Expert Advisors), regulated by authorities, and designed to help traders with limited time benefit from expert strategies in real-time.

dowidth.com

dowidth.com