Delta hedging minimizes risk in options trading by adjusting a portfolio's position in the underlying asset to maintain a neutral delta, effectively stabilizing price sensitivity. Cross hedging involves managing exposure to price fluctuations in an asset using a related but different asset, commonly employed when direct hedges are unavailable or illiquid. Explore the nuances of delta hedging and cross hedging strategies to enhance your trading risk management.

Why it is important

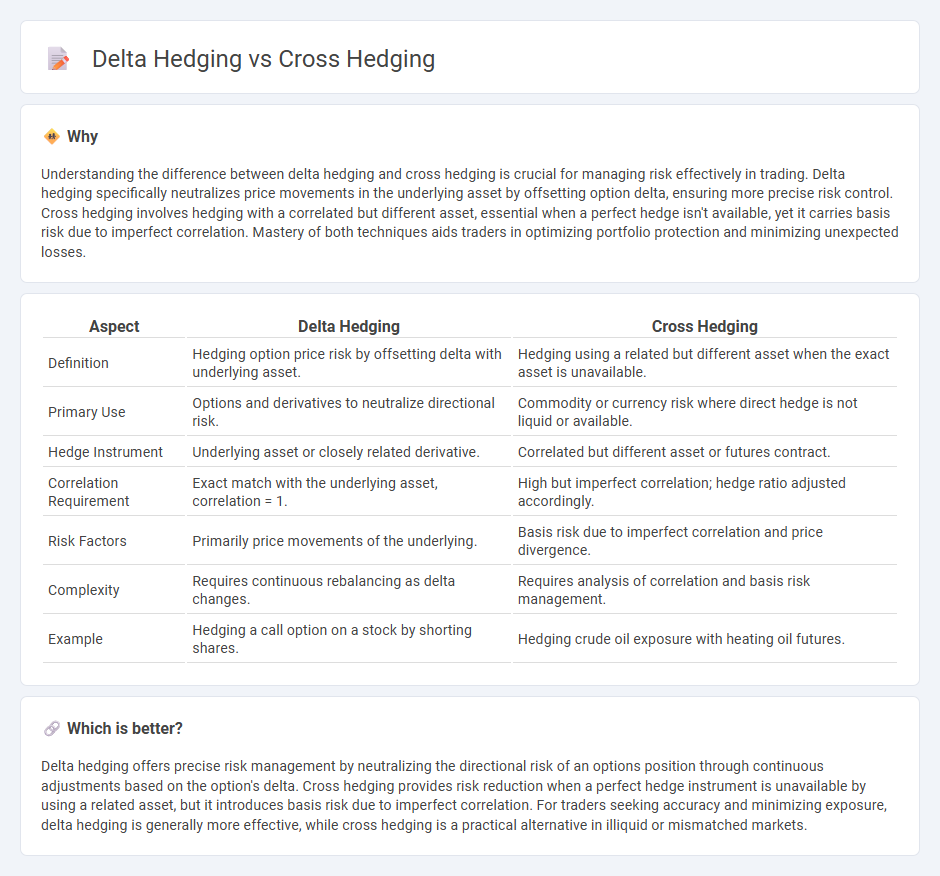

Understanding the difference between delta hedging and cross hedging is crucial for managing risk effectively in trading. Delta hedging specifically neutralizes price movements in the underlying asset by offsetting option delta, ensuring more precise risk control. Cross hedging involves hedging with a correlated but different asset, essential when a perfect hedge isn't available, yet it carries basis risk due to imperfect correlation. Mastery of both techniques aids traders in optimizing portfolio protection and minimizing unexpected losses.

Comparison Table

| Aspect | Delta Hedging | Cross Hedging |

|---|---|---|

| Definition | Hedging option price risk by offsetting delta with underlying asset. | Hedging using a related but different asset when the exact asset is unavailable. |

| Primary Use | Options and derivatives to neutralize directional risk. | Commodity or currency risk where direct hedge is not liquid or available. |

| Hedge Instrument | Underlying asset or closely related derivative. | Correlated but different asset or futures contract. |

| Correlation Requirement | Exact match with the underlying asset, correlation = 1. | High but imperfect correlation; hedge ratio adjusted accordingly. |

| Risk Factors | Primarily price movements of the underlying. | Basis risk due to imperfect correlation and price divergence. |

| Complexity | Requires continuous rebalancing as delta changes. | Requires analysis of correlation and basis risk management. |

| Example | Hedging a call option on a stock by shorting shares. | Hedging crude oil exposure with heating oil futures. |

Which is better?

Delta hedging offers precise risk management by neutralizing the directional risk of an options position through continuous adjustments based on the option's delta. Cross hedging provides risk reduction when a perfect hedge instrument is unavailable by using a related asset, but it introduces basis risk due to imperfect correlation. For traders seeking accuracy and minimizing exposure, delta hedging is generally more effective, while cross hedging is a practical alternative in illiquid or mismatched markets.

Connection

Delta hedging and cross hedging are connected through their shared goal of managing risk in trading portfolios. Delta hedging involves adjusting the positions of options and underlying assets to maintain a delta-neutral position, while cross hedging uses related but not identical assets to offset exposure when exact hedging instruments are unavailable. Both techniques aim to minimize the impact of price fluctuations and market volatility on portfolio value by dynamically managing exposure.

Key Terms

Correlation (Cross Hedging)

Cross hedging involves managing risk by taking a position in a correlated asset rather than the exact underlying asset, relying heavily on the correlation between the two assets to minimize exposure. The effectiveness of cross hedging depends on the stability and strength of the correlation coefficient, which measures how closely the price movements of the hedge asset and the underlying asset align. Explore more about how correlation impacts the choice between cross hedging and delta hedging strategies.

Underlying Asset (Delta Hedging)

Delta hedging centers on managing risk by offsetting price fluctuations in the underlying asset through options or derivatives directly linked to that asset, optimizing the delta coefficient to maintain a neutral position. Cross hedging involves using a correlated but different asset to mitigate risk when direct hedging instruments are unavailable or illiquid. Explore further to understand how underlying asset dynamics drive delta hedging strategies and their practical applications.

Hedge Ratio

Cross hedging involves using a related but not identical asset to hedge exposure, which requires careful calculation of the hedge ratio to adjust for imperfect correlation and minimize risk. Delta hedging employs options to neutralize the directional risk of an asset by continuously adjusting the hedge ratio based on the option's delta, representing sensitivity to underlying price changes. Explore detailed strategies and numerical examples to master the calculation and application of hedge ratios in both cross and delta hedging techniques.

Source and External Links

Cross Hedging: Strategy and Use Cases - Zerocap - Cross hedging is a risk management strategy where a position is taken in a related but different asset, usually positively correlated, to hedge risk when a direct hedge is unavailable.

Cross Hedging in Trading Explained -Definition and Examples - Cross hedging involves using two positively correlated assets to reduce risk, commonly applied when the desired asset is unavailable or illiquid, but carries risks if correlations fail or if over-hedging occurs.

CROSS-HEDGING - Mortgage Bankers Association - Cross-hedging in mortgage banking allows risk reduction using a correlated but more liquid or cost-effective asset when the exact hedge instrument is illiquid or expensive.

dowidth.com

dowidth.com