Tokenized assets represent digital ownership of real-world items such as real estate, art, or commodities, enabling fractional ownership and enhanced liquidity on blockchain platforms. Derivatives, including options and futures, derive their value from the price movements of underlying assets without conferring ownership, offering tools for hedging and speculation in financial markets. Explore the differences and advantages of tokenized assets versus derivatives to optimize your trading strategies.

Why it is important

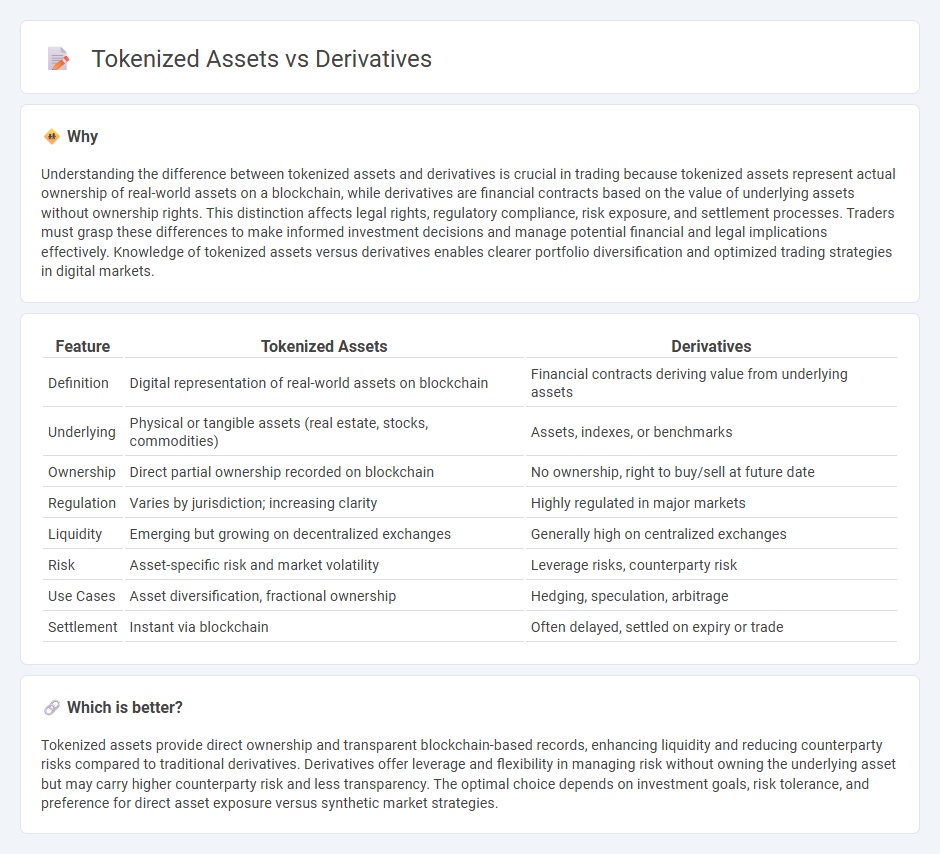

Understanding the difference between tokenized assets and derivatives is crucial in trading because tokenized assets represent actual ownership of real-world assets on a blockchain, while derivatives are financial contracts based on the value of underlying assets without ownership rights. This distinction affects legal rights, regulatory compliance, risk exposure, and settlement processes. Traders must grasp these differences to make informed investment decisions and manage potential financial and legal implications effectively. Knowledge of tokenized assets versus derivatives enables clearer portfolio diversification and optimized trading strategies in digital markets.

Comparison Table

| Feature | Tokenized Assets | Derivatives |

|---|---|---|

| Definition | Digital representation of real-world assets on blockchain | Financial contracts deriving value from underlying assets |

| Underlying | Physical or tangible assets (real estate, stocks, commodities) | Assets, indexes, or benchmarks |

| Ownership | Direct partial ownership recorded on blockchain | No ownership, right to buy/sell at future date |

| Regulation | Varies by jurisdiction; increasing clarity | Highly regulated in major markets |

| Liquidity | Emerging but growing on decentralized exchanges | Generally high on centralized exchanges |

| Risk | Asset-specific risk and market volatility | Leverage risks, counterparty risk |

| Use Cases | Asset diversification, fractional ownership | Hedging, speculation, arbitrage |

| Settlement | Instant via blockchain | Often delayed, settled on expiry or trade |

Which is better?

Tokenized assets provide direct ownership and transparent blockchain-based records, enhancing liquidity and reducing counterparty risks compared to traditional derivatives. Derivatives offer leverage and flexibility in managing risk without owning the underlying asset but may carry higher counterparty risk and less transparency. The optimal choice depends on investment goals, risk tolerance, and preference for direct asset exposure versus synthetic market strategies.

Connection

Tokenized assets represent real-world financial instruments on blockchain platforms, enabling fractional ownership and increased liquidity. Derivatives based on these tokenized assets allow traders to speculate on price movements without owning the underlying tokens directly. The integration of tokenization and derivatives trading enhances market accessibility, transparency, and efficiency across digital asset markets.

Key Terms

Underlying Asset

Derivatives derive their value from an underlying asset, such as stocks, commodities, or currencies, without granting ownership of the asset itself. Tokenized assets represent actual ownership or a fraction of the underlying asset, recorded on a blockchain, providing increased transparency and liquidity. Explore how underlying asset treatment impacts investment strategies and risk management in both markets.

Smart Contracts

Derivatives are financial contracts whose value depends on an underlying asset, enabling hedging and speculative strategies, while tokenized assets represent actual ownership or fractional interests in physical or digital assets recorded on a blockchain. Smart contracts automate execution by enforcing pre-coded rules, reducing intermediaries and increasing transparency in both derivatives and tokenized asset transactions. Explore the evolving role of smart contracts in transforming traditional finance into a more efficient, decentralized ecosystem.

Leverage

Derivatives enable traders to gain significant leverage by controlling large positions with relatively small capital, amplifying both potential gains and losses without owning the underlying asset. Tokenized assets offer fractional ownership and native liquidity on blockchain platforms, but typically involve direct asset exposure rather than leverage-driven speculation. Explore the advantages and risks of leverage in derivatives compared to tokenized asset investment strategies.

Source and External Links

Derivative - In mathematics, the derivative measures the sensitivity of a function's output relative to changes in its input and can be extended to higher-order derivatives representing rates of change like velocity and acceleration in physics.

Derivative (finance) - In finance, a derivative is a contract between buyer and seller whose value is based on underlying assets such as commodities, stocks, or interest rates, allowing risk management and speculation without owning the underlying asset.

Introduction to Derivatives - Derivatives can be understood as the instantaneous rate of change or slope of a function, found by taking the limit of the average rate of change as the interval approaches zero, with common notation being d/dx.

dowidth.com

dowidth.com