Perpetual contracts offer traders the ability to hold positions indefinitely with leverage, allowing for continuous exposure to asset price movements without expiration dates. Leveraged tokens provide built-in leverage through tradable tokens, simplifying risk management by automatically rebalancing exposure without the need for margin calls. Explore the advantages and risks of perpetuities versus leveraged tokens to refine your trading strategy effectively.

Why it is important

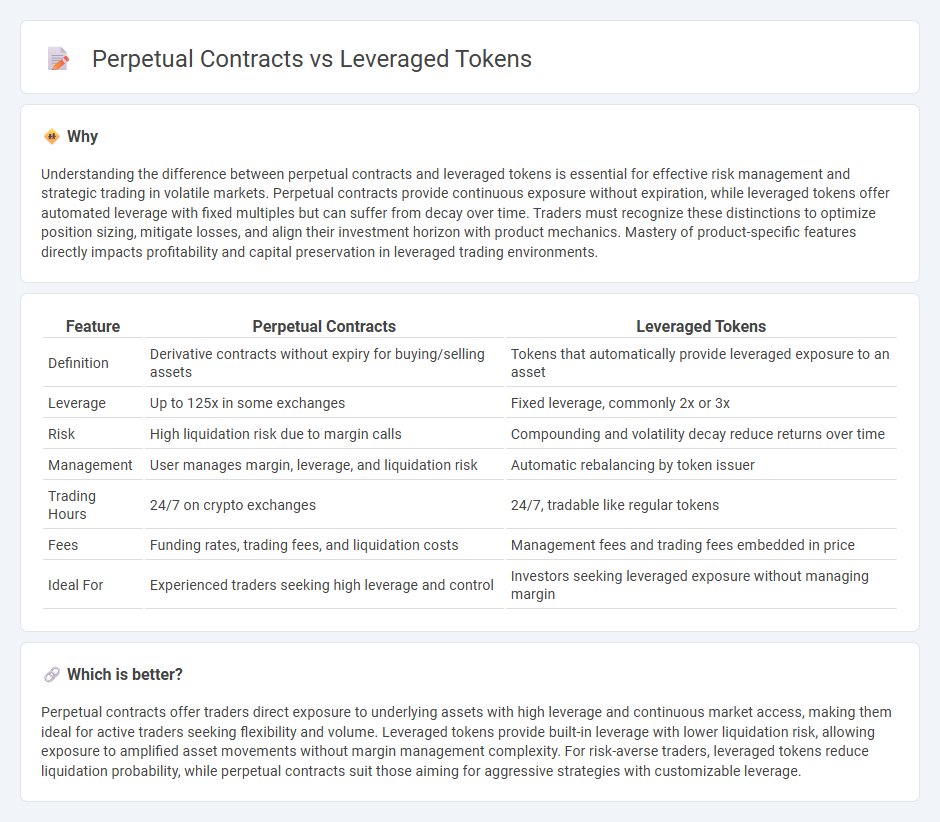

Understanding the difference between perpetual contracts and leveraged tokens is essential for effective risk management and strategic trading in volatile markets. Perpetual contracts provide continuous exposure without expiration, while leveraged tokens offer automated leverage with fixed multiples but can suffer from decay over time. Traders must recognize these distinctions to optimize position sizing, mitigate losses, and align their investment horizon with product mechanics. Mastery of product-specific features directly impacts profitability and capital preservation in leveraged trading environments.

Comparison Table

| Feature | Perpetual Contracts | Leveraged Tokens |

|---|---|---|

| Definition | Derivative contracts without expiry for buying/selling assets | Tokens that automatically provide leveraged exposure to an asset |

| Leverage | Up to 125x in some exchanges | Fixed leverage, commonly 2x or 3x |

| Risk | High liquidation risk due to margin calls | Compounding and volatility decay reduce returns over time |

| Management | User manages margin, leverage, and liquidation risk | Automatic rebalancing by token issuer |

| Trading Hours | 24/7 on crypto exchanges | 24/7, tradable like regular tokens |

| Fees | Funding rates, trading fees, and liquidation costs | Management fees and trading fees embedded in price |

| Ideal For | Experienced traders seeking high leverage and control | Investors seeking leveraged exposure without managing margin |

Which is better?

Perpetual contracts offer traders direct exposure to underlying assets with high leverage and continuous market access, making them ideal for active traders seeking flexibility and volume. Leveraged tokens provide built-in leverage with lower liquidation risk, allowing exposure to amplified asset movements without margin management complexity. For risk-averse traders, leveraged tokens reduce liquidation probability, while perpetual contracts suit those aiming for aggressive strategies with customizable leverage.

Connection

Perpetual contracts and leveraged tokens both enable traders to amplify exposure to asset price movements without owning the underlying assets, utilizing leverage to maximize potential returns. Perpetual contracts offer the ability to hold positions indefinitely with funding fees maintaining price alignment to spot markets, while leveraged tokens automatically adjust leverage to maintain a target ratio. Together, they provide flexible, high-leverage trading instruments widely used in cryptocurrency markets for speculative and hedging purposes.

Key Terms

Leverage

Leveraged tokens provide a fixed leverage ratio, usually ranging from 2x to 3x, allowing traders to gain amplified exposure to an asset without managing margin or liquidation risks directly. Perpetual contracts offer flexible and adjustable leverage, often up to 125x, enabling traders to scale their positions dynamically but requiring constant risk management due to potential liquidation. Explore the key differences in leverage mechanics and risk profiles to determine which instrument suits your trading strategy best.

Liquidation

Leveraged tokens offer built-in risk management by automatically rebalancing exposure to avoid liquidation, while perpetual contracts require margin maintenance and face liquidation if margin falls below a threshold. Liquidation in perpetual contracts often leads to forced position closures and potential losses beyond initial margin, making risk management critical for traders. Explore the key differences in liquidation mechanisms and risk controls between leveraged tokens and perpetual contracts.

Expiry

Leveraged tokens provide exposure to leveraged positions without the need for manual liquidation, as they reset daily and avoid expiry, unlike perpetual contracts that have no fixed expiry but can face funding rate changes and liquidation risks. Perpetual contracts allow indefinite holding but require active margin management and monitoring of funding payments to maintain positions. Explore detailed comparisons to understand which instrument suits your trading strategy best.

Source and External Links

Leveraged Tokens Meaning in Crypto - Leveraged tokens are ERC-20 tokens that provide investors with a leveraged position in futures markets, automatically rebalanced to maintain a fixed leverage ratio (e.g., 2x, 3x), allowing exposure to amplified gains or losses without direct margin trading complexities.

What is a Leveraged Token? - Leveraged tokens have built-in leverage (like 3x), represent perpetual contract positions of underlying assets, eliminate liquidation risk by never reaching zero value, and can be traded or redeemed freely without margin payments.

Leverage Tokens Overview - Leveraged tokens provide amplified exposure with automated rebalancing and risk management, dynamically adjusting leverage to enhance gains in favorable moves while reducing liquidation risk by lowering leverage when the market moves against the position.

dowidth.com

dowidth.com