Flash loans offer instant, permissionless borrowing without collateral by leveraging smart contract execution within a single transaction, enabling arbitrage and refinancing opportunities. Collateralized lending requires borrowers to provide assets as security, mitigating lender risk but limiting liquidity and borrowing capacity. Discover how these innovative financial mechanisms reshape trading strategies and asset management.

Why it is important

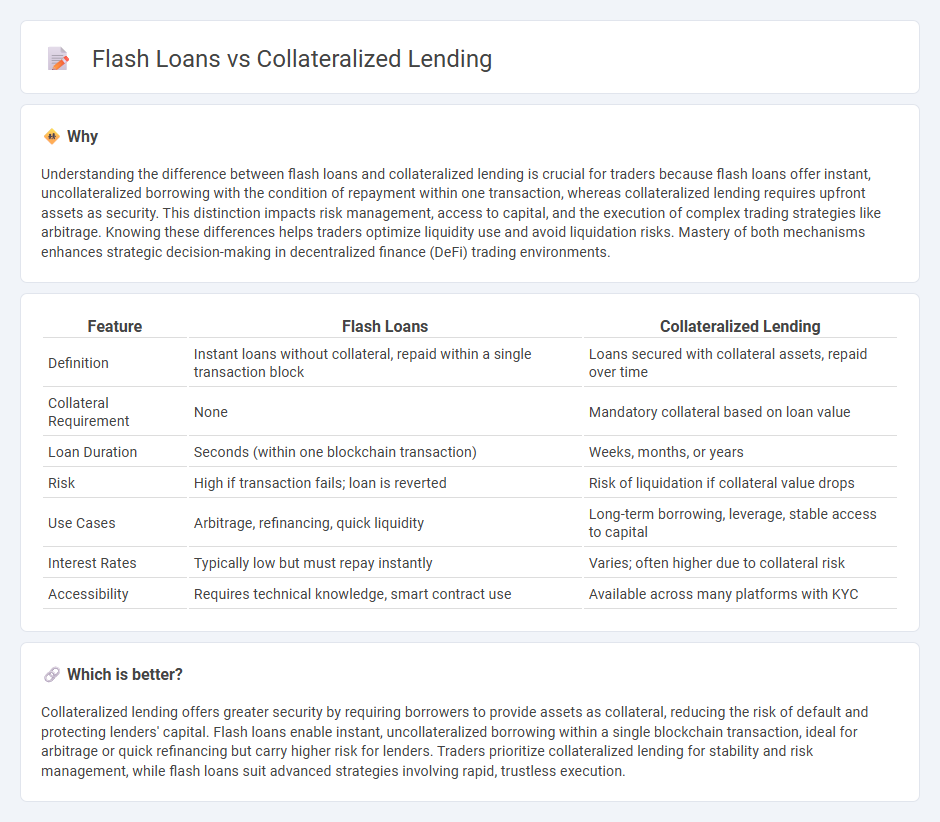

Understanding the difference between flash loans and collateralized lending is crucial for traders because flash loans offer instant, uncollateralized borrowing with the condition of repayment within one transaction, whereas collateralized lending requires upfront assets as security. This distinction impacts risk management, access to capital, and the execution of complex trading strategies like arbitrage. Knowing these differences helps traders optimize liquidity use and avoid liquidation risks. Mastery of both mechanisms enhances strategic decision-making in decentralized finance (DeFi) trading environments.

Comparison Table

| Feature | Flash Loans | Collateralized Lending |

|---|---|---|

| Definition | Instant loans without collateral, repaid within a single transaction block | Loans secured with collateral assets, repaid over time |

| Collateral Requirement | None | Mandatory collateral based on loan value |

| Loan Duration | Seconds (within one blockchain transaction) | Weeks, months, or years |

| Risk | High if transaction fails; loan is reverted | Risk of liquidation if collateral value drops |

| Use Cases | Arbitrage, refinancing, quick liquidity | Long-term borrowing, leverage, stable access to capital |

| Interest Rates | Typically low but must repay instantly | Varies; often higher due to collateral risk |

| Accessibility | Requires technical knowledge, smart contract use | Available across many platforms with KYC |

Which is better?

Collateralized lending offers greater security by requiring borrowers to provide assets as collateral, reducing the risk of default and protecting lenders' capital. Flash loans enable instant, uncollateralized borrowing within a single blockchain transaction, ideal for arbitrage or quick refinancing but carry higher risk for lenders. Traders prioritize collateralized lending for stability and risk management, while flash loans suit advanced strategies involving rapid, trustless execution.

Connection

Flash loans and collateralized lending are connected through their use in decentralized finance (DeFi) platforms, where both enable users to access liquidity without traditional credit checks. Flash loans provide instant, uncollateralized loans that must be repaid within a single transaction, often leveraging collateralized assets to execute arbitrage or refinancing strategies. Collateralized lending secures loans with digital assets, which can be utilized or swapped during flash loan transactions to optimize capital efficiency and reduce risk.

Key Terms

**Collateralized Lending:**

Collateralized lending requires borrowers to provide assets as security, reducing lender risk and enabling larger loan amounts with lower interest rates. Common collateral includes real estate, securities, or cryptocurrency, ensuring repayment through asset liquidation if defaults occur. Explore in-depth insights on collateralized lending's mechanisms and benefits.

Collateral

Collateralized lending requires borrowers to provide assets as security, minimizing lender risk by ensuring the loan is backed by tangible value. Flash loans, however, do not require collateral and rely on the transaction being completed within a single blockchain block to ensure repayment. Explore more about how collateral impacts risk management and loan accessibility in decentralized finance.

Loan-to-Value (LTV) Ratio

Collateralized lending requires borrowers to provide assets as collateral, ensuring the Loan-to-Value (LTV) ratio is maintained below a specific threshold to minimize lender risk, often ranging between 50-80%. Flash loans, by contrast, require no collateral and utilize smart contracts to ensure instant repayment within the same transaction, effectively rendering the LTV ratio irrelevant. Explore the mechanisms and risk profiles behind these lending models to understand their applications in decentralized finance.

Source and External Links

What Are Collateral Loans and How Do They Work? - A collateralized loan is a secured loan backed by an asset the borrower owns, which the lender can seize if the loan isn't repaid; it typically offers lower interest rates and larger loan amounts but carries the risk of losing the collateral.

What is a Collateralized Loan? - Collateralized loans are business or personal loans backed by assets like real estate or equipment, reducing lender risk and enabling lower interest rates compared to unsecured loans.

What is a Collateral (or Collateralized) Loan - A collateralized loan is secured by pledging an asset such as property or vehicles, offering generally more favorable loan terms, but with the risk of losing the asset upon default.

dowidth.com

dowidth.com