Paper trading competitions simulate real-market strategies without financial risk, allowing traders to refine skills and test hypotheses in a controlled environment. Algorithmic trading tournaments emphasize automated systems and quantitative models, challenging participants to develop optimized algorithms for speed, accuracy, and profitability under live-market conditions. Explore detailed comparisons to understand which format aligns best with your trading goals and expertise.

Why it is important

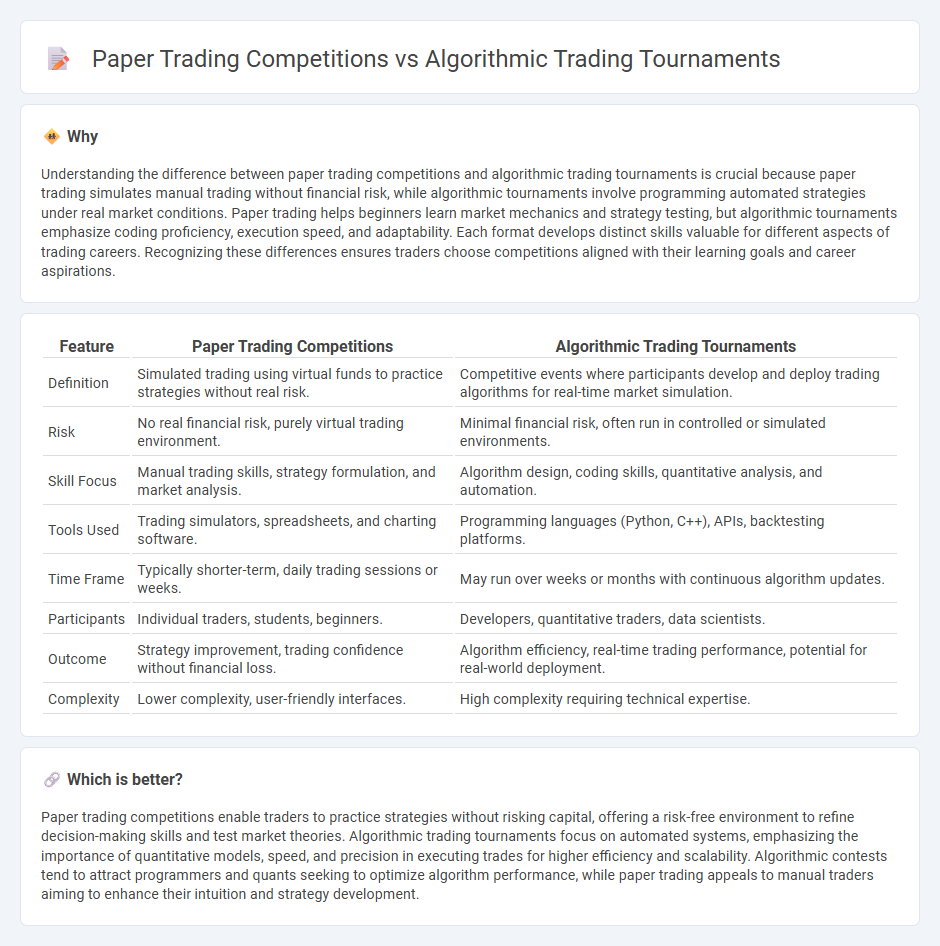

Understanding the difference between paper trading competitions and algorithmic trading tournaments is crucial because paper trading simulates manual trading without financial risk, while algorithmic tournaments involve programming automated strategies under real market conditions. Paper trading helps beginners learn market mechanics and strategy testing, but algorithmic tournaments emphasize coding proficiency, execution speed, and adaptability. Each format develops distinct skills valuable for different aspects of trading careers. Recognizing these differences ensures traders choose competitions aligned with their learning goals and career aspirations.

Comparison Table

| Feature | Paper Trading Competitions | Algorithmic Trading Tournaments |

|---|---|---|

| Definition | Simulated trading using virtual funds to practice strategies without real risk. | Competitive events where participants develop and deploy trading algorithms for real-time market simulation. |

| Risk | No real financial risk, purely virtual trading environment. | Minimal financial risk, often run in controlled or simulated environments. |

| Skill Focus | Manual trading skills, strategy formulation, and market analysis. | Algorithm design, coding skills, quantitative analysis, and automation. |

| Tools Used | Trading simulators, spreadsheets, and charting software. | Programming languages (Python, C++), APIs, backtesting platforms. |

| Time Frame | Typically shorter-term, daily trading sessions or weeks. | May run over weeks or months with continuous algorithm updates. |

| Participants | Individual traders, students, beginners. | Developers, quantitative traders, data scientists. |

| Outcome | Strategy improvement, trading confidence without financial loss. | Algorithm efficiency, real-time trading performance, potential for real-world deployment. |

| Complexity | Lower complexity, user-friendly interfaces. | High complexity requiring technical expertise. |

Which is better?

Paper trading competitions enable traders to practice strategies without risking capital, offering a risk-free environment to refine decision-making skills and test market theories. Algorithmic trading tournaments focus on automated systems, emphasizing the importance of quantitative models, speed, and precision in executing trades for higher efficiency and scalability. Algorithmic contests tend to attract programmers and quants seeking to optimize algorithm performance, while paper trading appeals to manual traders aiming to enhance their intuition and strategy development.

Connection

Paper trading competitions simulate real-market conditions without financial risk, allowing participants to test and refine algorithmic trading strategies in a controlled environment. Algorithmic trading tournaments leverage these simulations to benchmark automated systems based on performance metrics such as profit factor, drawdown, and execution speed. This connection fosters innovation in systematic trading approaches and enhances strategy robustness before deployment in live markets.

Key Terms

**Algorithmic Trading Tournaments:**

Algorithmic trading tournaments challenge participants to develop and deploy real-time trading algorithms in live markets, emphasizing performance under actual market conditions with real financial risk. These tournaments provide valuable experience in strategy optimization, risk management, and adapting to market volatility, often involving substantial prize pools and recognition within the trading community. Explore the dynamics and benefits of algorithmic trading tournaments to elevate your trading skills and competitive edge.

Backtesting

Algorithmic trading tournaments emphasize real-time strategy performance in live markets, whereas paper trading competitions concentrate on simulated environments using historical data. Backtesting plays a critical role in paper trading by validating algorithms against past market conditions to optimize robustness and profitability. Explore further to understand the impact of backtesting methodologies on trading success.

Execution Algorithms

Algorithmic trading tournaments test execution algorithms in real-time, live market conditions, providing direct insights into order routing, slippage, and latency impacts. Paper trading competitions simulate these strategies without financial risk, offering a risk-free environment to refine execution logic but lacking realistic market friction and dynamic responses. Explore deeper distinctions and optimization strategies for execution algorithms in both formats.

Source and External Links

Learning from the Best: Algo Trading Competitions - Algorithmic trading competitions offer simulated markets for testing strategies, winning prizes, and networking, with top platforms like Quantiacs and WorldQuant providing large prize pools and resources for skill development.

Algo Trading Challenge 2023/24 - This public competition invites teams to code and test algorithms in back-testing and live paper trading rounds, awarding cash prizes and merchandise in equity and crypto streams.

UChicago Trading Competition | The University of Chicago - A premier university-level algorithmic trading competition featuring topics like market making, options trading, and time series analysis, open to students nationwide and held annually.

dowidth.com

dowidth.com