Smart Money Concepts focus on understanding market movements driven by informed traders with significant capital, revealing patterns that predict price action. Institutional Order Flow analysis examines large-scale transactions to identify entry and exit points used by major financial entities, providing insight into market sentiment. Explore deeper to discover how these strategies can enhance your trading precision and profitability.

Why it is important

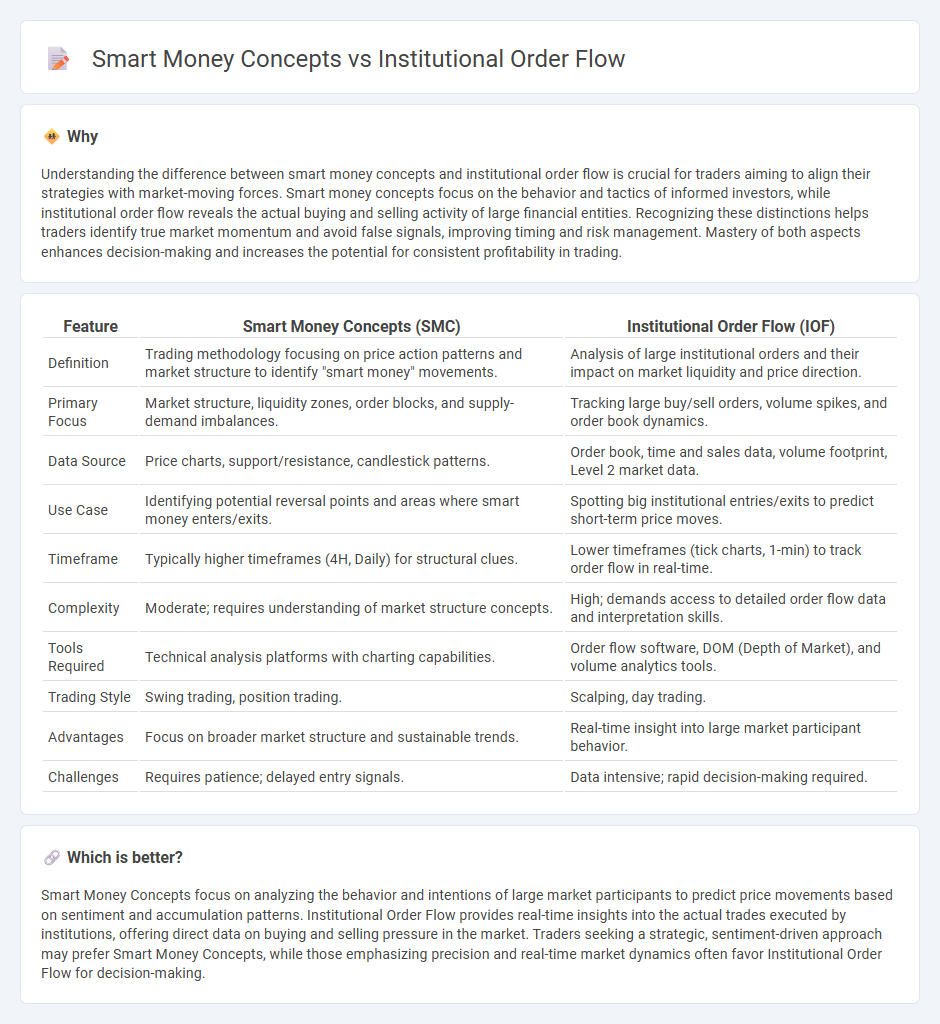

Understanding the difference between smart money concepts and institutional order flow is crucial for traders aiming to align their strategies with market-moving forces. Smart money concepts focus on the behavior and tactics of informed investors, while institutional order flow reveals the actual buying and selling activity of large financial entities. Recognizing these distinctions helps traders identify true market momentum and avoid false signals, improving timing and risk management. Mastery of both aspects enhances decision-making and increases the potential for consistent profitability in trading.

Comparison Table

| Feature | Smart Money Concepts (SMC) | Institutional Order Flow (IOF) |

|---|---|---|

| Definition | Trading methodology focusing on price action patterns and market structure to identify "smart money" movements. | Analysis of large institutional orders and their impact on market liquidity and price direction. |

| Primary Focus | Market structure, liquidity zones, order blocks, and supply-demand imbalances. | Tracking large buy/sell orders, volume spikes, and order book dynamics. |

| Data Source | Price charts, support/resistance, candlestick patterns. | Order book, time and sales data, volume footprint, Level 2 market data. |

| Use Case | Identifying potential reversal points and areas where smart money enters/exits. | Spotting big institutional entries/exits to predict short-term price moves. |

| Timeframe | Typically higher timeframes (4H, Daily) for structural clues. | Lower timeframes (tick charts, 1-min) to track order flow in real-time. |

| Complexity | Moderate; requires understanding of market structure concepts. | High; demands access to detailed order flow data and interpretation skills. |

| Tools Required | Technical analysis platforms with charting capabilities. | Order flow software, DOM (Depth of Market), and volume analytics tools. |

| Trading Style | Swing trading, position trading. | Scalping, day trading. |

| Advantages | Focus on broader market structure and sustainable trends. | Real-time insight into large market participant behavior. |

| Challenges | Requires patience; delayed entry signals. | Data intensive; rapid decision-making required. |

Which is better?

Smart Money Concepts focus on analyzing the behavior and intentions of large market participants to predict price movements based on sentiment and accumulation patterns. Institutional Order Flow provides real-time insights into the actual trades executed by institutions, offering direct data on buying and selling pressure in the market. Traders seeking a strategic, sentiment-driven approach may prefer Smart Money Concepts, while those emphasizing precision and real-time market dynamics often favor Institutional Order Flow for decision-making.

Connection

Smart money concepts closely align with Institutional Order Flow as both reflect the trading activities of large, influential market participants like hedge funds, banks, and asset managers. Institutional Order Flow provides valuable insights into market sentiment and liquidity, revealing where significant volume clusters and price movements occur due to smart money actions. Understanding the correlation between these concepts allows traders to anticipate market trends by analyzing large order placements and smart money behaviors that drive price dynamics.

Key Terms

Liquidity

Institutional order flow refers to the large volumes of trades executed by financial institutions that significantly impact market liquidity and price movements. Smart money concepts emphasize the behavior of informed investors who strategically seek liquidity to enter or exit positions without causing adverse price shifts, often targeting areas where institutional order flow accumulates. Discover how understanding liquidity dynamics enhances trading strategies by analyzing the interaction between institutional activities and smart money tactics.

Order Blocks

Institutional order flow represents the large-scale transactions executed by financial institutions, often leaving identifiable patterns called order blocks--price areas where significant buying or selling occurred. Smart money concepts emphasize these order blocks as critical zones of support and resistance, reflecting areas where institutional traders have accumulated or distributed positions. Explore how understanding order blocks can enhance trading strategies and provide insights into market direction.

Market Makers

Market makers act as key liquidity providers, facilitating smooth trading and often representing institutional order flow in financial markets. Their strategies involve managing bid-ask spreads and using sophisticated algorithms to anticipate market movements, distinguishing them from broader smart money concepts centered on informed trading by institutional investors. Explore the distinct roles of market makers to better understand institutional order flow dynamics and smart money influences.

Source and External Links

Unlock the Power of Institutional Order Flow - Opofinance Blog - Institutional order flow refers to the buying and selling actions of large financial institutions which influence price movements, liquidity, trends, sentiment, and volatility in the forex market, but it cannot be directly seen on typical volume or depth charts and must be inferred from price action.

Institutional Order Flow Trading - GhostTraders - Institutional order flow trading focuses on the large orders of major financial players who manipulate prices toward liquidity zones and helps traders predict market direction by following where smart money accumulates or distributes positions.

Bullish and Bearish Order Flow - SMC & ICT trading - Writo-Finance - Institutional order flow can be analyzed through the concept of order blocks, which are chart zones showing where large institutional trades shifted market momentum, offering clues to follow smart money's gradual accumulation or distribution patterns.

dowidth.com

dowidth.com