Tape reading focuses on analyzing real-time order flow and volume to anticipate short-term price movements, providing traders with immediate insights into market sentiment. Market profile organizes price and volume data over time into a distribution curve, revealing key levels of support and resistance based on market activity patterns. Explore the differences and advantages of tape reading versus market profile to refine your trading strategy.

Why it is important

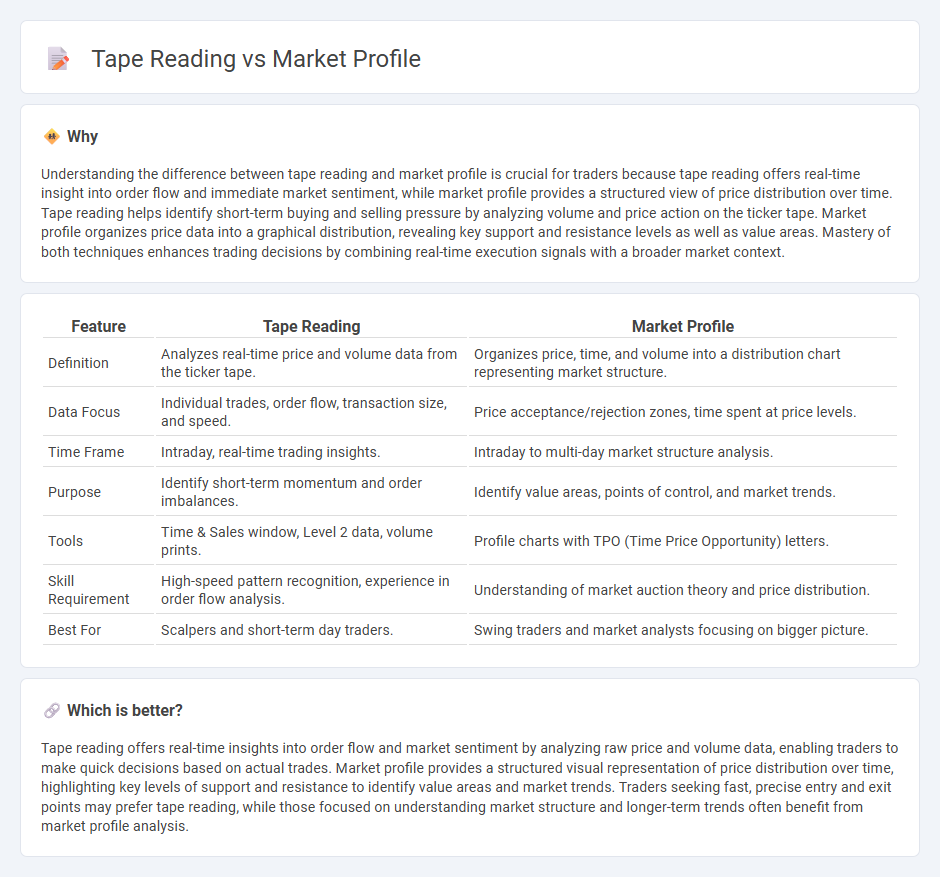

Understanding the difference between tape reading and market profile is crucial for traders because tape reading offers real-time insight into order flow and immediate market sentiment, while market profile provides a structured view of price distribution over time. Tape reading helps identify short-term buying and selling pressure by analyzing volume and price action on the ticker tape. Market profile organizes price data into a graphical distribution, revealing key support and resistance levels as well as value areas. Mastery of both techniques enhances trading decisions by combining real-time execution signals with a broader market context.

Comparison Table

| Feature | Tape Reading | Market Profile |

|---|---|---|

| Definition | Analyzes real-time price and volume data from the ticker tape. | Organizes price, time, and volume into a distribution chart representing market structure. |

| Data Focus | Individual trades, order flow, transaction size, and speed. | Price acceptance/rejection zones, time spent at price levels. |

| Time Frame | Intraday, real-time trading insights. | Intraday to multi-day market structure analysis. |

| Purpose | Identify short-term momentum and order imbalances. | Identify value areas, points of control, and market trends. |

| Tools | Time & Sales window, Level 2 data, volume prints. | Profile charts with TPO (Time Price Opportunity) letters. |

| Skill Requirement | High-speed pattern recognition, experience in order flow analysis. | Understanding of market auction theory and price distribution. |

| Best For | Scalpers and short-term day traders. | Swing traders and market analysts focusing on bigger picture. |

Which is better?

Tape reading offers real-time insights into order flow and market sentiment by analyzing raw price and volume data, enabling traders to make quick decisions based on actual trades. Market profile provides a structured visual representation of price distribution over time, highlighting key levels of support and resistance to identify value areas and market trends. Traders seeking fast, precise entry and exit points may prefer tape reading, while those focused on understanding market structure and longer-term trends often benefit from market profile analysis.

Connection

Tape reading provides real-time analysis of order flow and volume at specific price levels, offering insights into market sentiment. Market profile organizes this data over time, highlighting price acceptance and rejection zones through volume distribution. Together, they enable traders to identify key support and resistance levels while understanding market dynamics for more informed decision-making.

Key Terms

**Market Profile:**

Market Profile organizes price and volume data into a distribution curve, revealing key levels such as value areas, points of control, and range extremes to identify market sentiment and potential support or resistance zones. It provides a structured framework to analyze price behavior over time, offering traders insights into market balance and imbalance. Explore how Market Profile can enhance your trading strategy with detailed volume distribution analysis.

Value Area

Market profile centers on Value Area, identifying the price range where 70% of trading volume occurs, offering traders insight into market sentiment and fair value. Tape reading emphasizes real-time order flow and transaction details, helping traders gauge buying and selling pressure within the Value Area context. Explore how these techniques complement each other to enhance trading strategies.

Point of Control (POC)

The Point of Control (POC) in market profile represents the price level with the highest traded volume, offering crucial insights into market sentiment and value areas. Tape reading complements this by providing real-time order flow analysis, enabling traders to detect momentum shifts and liquidity dynamics around the POC. Explore how integrating market profile's POC with tape reading strategies can enhance trading precision and decision-making.

Source and External Links

What is the Market Profile? - Jim Dalton Trading - The Market Profile is a unique charting tool that reveals the two-way auction process of price over time by organizing auction data into a time-price opportunity format, allowing traders to observe market movement patterns and herd behavior.

Market Profile Trading: Understanding its Power and Impact - Market Profile trading offers a graphical view of price distribution over time and volume, helping traders identify key market structure and activity to improve trading decisions and risk management.

Market profile - Wikipedia - Market Profile is an intra-day charting technique developed by J. Peter Steidlmayer that plots price vertically against time/activity horizontally to display market value distribution as a bell-shaped curve for evaluating price behavior during a trading day.

dowidth.com

dowidth.com