Bid-ask spread capture focuses on profiting from the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. Order matching involves pairing buy and sell orders to facilitate transactions at mutually agreed prices, ensuring market liquidity and price discovery. Explore how these strategies impact trading efficiency and profitability.

Why it is important

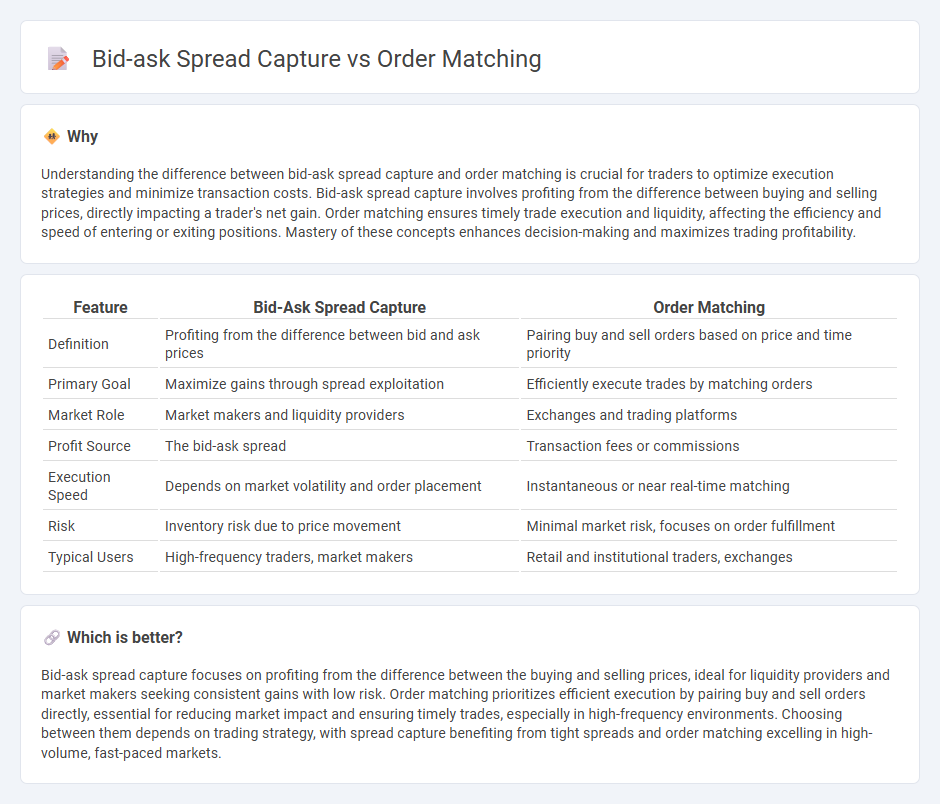

Understanding the difference between bid-ask spread capture and order matching is crucial for traders to optimize execution strategies and minimize transaction costs. Bid-ask spread capture involves profiting from the difference between buying and selling prices, directly impacting a trader's net gain. Order matching ensures timely trade execution and liquidity, affecting the efficiency and speed of entering or exiting positions. Mastery of these concepts enhances decision-making and maximizes trading profitability.

Comparison Table

| Feature | Bid-Ask Spread Capture | Order Matching |

|---|---|---|

| Definition | Profiting from the difference between bid and ask prices | Pairing buy and sell orders based on price and time priority |

| Primary Goal | Maximize gains through spread exploitation | Efficiently execute trades by matching orders |

| Market Role | Market makers and liquidity providers | Exchanges and trading platforms |

| Profit Source | The bid-ask spread | Transaction fees or commissions |

| Execution Speed | Depends on market volatility and order placement | Instantaneous or near real-time matching |

| Risk | Inventory risk due to price movement | Minimal market risk, focuses on order fulfillment |

| Typical Users | High-frequency traders, market makers | Retail and institutional traders, exchanges |

Which is better?

Bid-ask spread capture focuses on profiting from the difference between the buying and selling prices, ideal for liquidity providers and market makers seeking consistent gains with low risk. Order matching prioritizes efficient execution by pairing buy and sell orders directly, essential for reducing market impact and ensuring timely trades, especially in high-frequency environments. Choosing between them depends on trading strategy, with spread capture benefiting from tight spreads and order matching excelling in high-volume, fast-paced markets.

Connection

Bid-ask spread capture directly impacts order matching by determining the price differential between buy and sell orders that facilitates trades execution. Narrower spreads enhance liquidity, increasing the likelihood of order matching at optimal prices and reducing transaction costs for traders. Efficient order matching algorithms leverage bid-ask spreads to optimize trade allocation and minimize market impact.

Key Terms

Order Matching:

Order matching efficiently pairs buy and sell orders based on price and time priority, reducing market latency and enhancing liquidity in trading platforms. This process ensures that traders receive optimal execution prices by matching compatible orders directly within the order book, minimizing reliance on external market makers. Explore how advanced algorithms and order matching systems drive faster, more transparent trade execution in modern financial markets.

Limit Order Book

Order matching in a Limit Order Book (LOB) involves pairing buy and sell limit orders based on price-time priority, ensuring efficient execution at specified prices. Bid-ask spread capture occurs when traders place limit orders within the spread, earning the spread difference by providing liquidity rather than consuming it. Explore deeper insights into how order matching algorithms and spread strategies optimize trading performance in electronic markets.

Matching Engine

The Matching Engine plays a critical role in order matching by efficiently pairing buy and sell orders to ensure market liquidity and price discovery. It contrasts with bid-ask spread capture strategies, which aim to profit from the difference between bid and ask prices rather than facilitating trades. Explore how Matching Engine technology enhances market efficiency and trading strategies.

Source and External Links

Order matching system: Explained - TIOmarkets - An order matching system is a digital platform that pairs buy and sell orders using algorithms like price-time priority, which prioritizes orders by best price and earliest time, and pro-rata, which prioritizes by order size to ensure efficient and fair trade execution.

Electronic Trading and Order Matching System Basics - Strike - Order matching in electronic trading involves eight key steps from order placement to settlement, prioritizing orders primarily by price and time to maintain fair and efficient markets, as exemplified by systems like the NSE's price-time priority algorithm.

Order matching system - Wikipedia - An order matching system is an electronic mechanism at financial exchanges that matches buy and sell orders based on algorithms ensuring best execution, operating in continuous trading or auction states as part of a broader electronic trading ecosystem.

dowidth.com

dowidth.com