Funding rate arbitrage exploits discrepancies in perpetual swap funding fees between exchanges, enabling traders to profit from interest rate imbalances without directional market risk. Volatility arbitrage focuses on capitalizing on differences between implied and realized volatility through options trading strategies, aiming to benefit from price fluctuations regardless of market direction. Explore these distinct arbitrage techniques to enhance your trading strategy and risk management understanding.

Why it is important

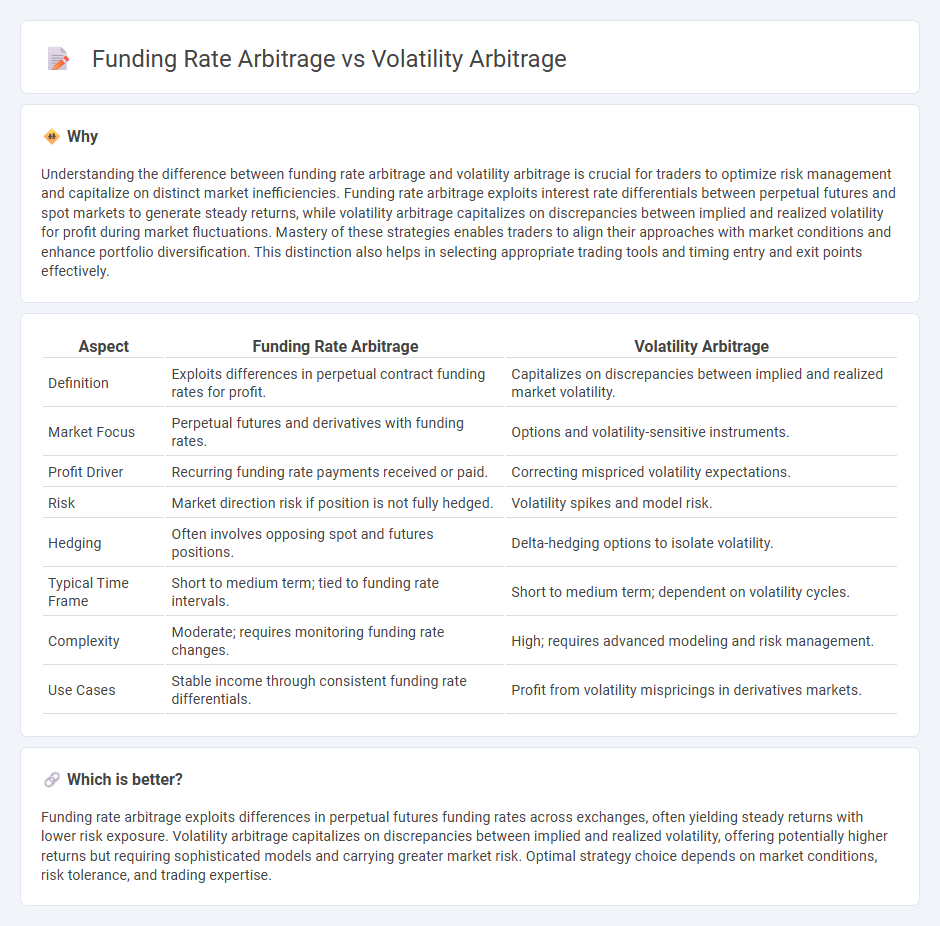

Understanding the difference between funding rate arbitrage and volatility arbitrage is crucial for traders to optimize risk management and capitalize on distinct market inefficiencies. Funding rate arbitrage exploits interest rate differentials between perpetual futures and spot markets to generate steady returns, while volatility arbitrage capitalizes on discrepancies between implied and realized volatility for profit during market fluctuations. Mastery of these strategies enables traders to align their approaches with market conditions and enhance portfolio diversification. This distinction also helps in selecting appropriate trading tools and timing entry and exit points effectively.

Comparison Table

| Aspect | Funding Rate Arbitrage | Volatility Arbitrage |

|---|---|---|

| Definition | Exploits differences in perpetual contract funding rates for profit. | Capitalizes on discrepancies between implied and realized market volatility. |

| Market Focus | Perpetual futures and derivatives with funding rates. | Options and volatility-sensitive instruments. |

| Profit Driver | Recurring funding rate payments received or paid. | Correcting mispriced volatility expectations. |

| Risk | Market direction risk if position is not fully hedged. | Volatility spikes and model risk. |

| Hedging | Often involves opposing spot and futures positions. | Delta-hedging options to isolate volatility. |

| Typical Time Frame | Short to medium term; tied to funding rate intervals. | Short to medium term; dependent on volatility cycles. |

| Complexity | Moderate; requires monitoring funding rate changes. | High; requires advanced modeling and risk management. |

| Use Cases | Stable income through consistent funding rate differentials. | Profit from volatility mispricings in derivatives markets. |

Which is better?

Funding rate arbitrage exploits differences in perpetual futures funding rates across exchanges, often yielding steady returns with lower risk exposure. Volatility arbitrage capitalizes on discrepancies between implied and realized volatility, offering potentially higher returns but requiring sophisticated models and carrying greater market risk. Optimal strategy choice depends on market conditions, risk tolerance, and trading expertise.

Connection

Funding rate arbitrage exploits differences in funding fees between perpetual futures and spot markets, while volatility arbitrage capitalizes on discrepancies between implied and realized volatility. Both strategies rely on identifying pricing inefficiencies in derivative instruments to generate risk-adjusted profits. By combining insights from funding rates and volatility patterns, traders can enhance arbitrage opportunities across crypto and traditional asset markets.

Key Terms

**Volatility Arbitrage:**

Volatility arbitrage exploits differences between implied and realized volatility in options markets to generate risk-adjusted profits by taking offsetting positions in options and underlying assets. This strategy relies heavily on accurate volatility forecasting and advanced statistical models to identify mispriced options and hedge exposure dynamically. Explore deeper insights into volatility arbitrage techniques and its practical applications in sophisticated trading environments.

Implied Volatility

Volatility arbitrage exploits discrepancies between implied volatility and realized volatility in option pricing, aiming to capitalize on mispriced volatility premiums. Funding rate arbitrage involves profiting from differences in interest or lending rates between platforms, often focusing less on implied volatility and more on interest rate differentials. Explore detailed strategies and risk factors behind implied volatility in these arbitrage methods to enhance trading performance.

Delta-Hedging

Volatility arbitrage leverages discrepancies between implied and realized volatility through continuous delta-hedging of options to capture risk-neutral volatility premiums. Funding rate arbitrage exploits differences in lending and borrowing rates within derivatives markets, often involving stablecoin swaps or perpetual futures with minimal delta exposure. Explore deeper insights into delta-hedging techniques and their strategic applications in these arbitrage models.

Source and External Links

Volatility arbitrage - Wikipedia - Volatility arbitrage is a financial strategy that exploits the difference between implied volatility of options and the forecasted future realized volatility of the underlying asset, typically implemented via delta-neutral portfolios to bet on volatility rather than price direction.

Volatility Arbitrage - Overview, How it Works, and Concerns - Corporate Finance Institute - This strategy profits from differences between implied option volatility and forecasted underlying asset volatility by maintaining a delta-neutral portfolio that requires frequent rebalancing to remain neutral as deltas shift.

Volatility arbitrage indices - S&P Global - Volatility arbitrage involves trading strategies that target the gap between forecasted and implied volatility of assets, often through delta-neutral portfolios combining options and their underlying assets to isolate returns driven by volatility changes rather than price moves.

dowidth.com

dowidth.com